Commercial & Investment Bank

When Jamie asked me to lead a new organization 12 years ago, I was thrilled. The firm was combining its traditional Investment Bank with the Treasury & Securities Services division.

The rationale was clear. The merger would create a massive franchise encompassing the industry’s most diverse and comprehensive solutions for the world’s largest and most prominent companies, governments and institutions. From capital raising and M&A advice to payments, trading and custody, the combined franchise would enable us to deliver a full range of products and solutions to clients around the world.

As others retrenched, we believed growth would come from being global and diversified, having scale and providing a complete client offering. So we merged two divisions, identified gaps and invested in global capabilities. To this day, I believe the decisions we made then set us up for the success that we’ve had for the last decade. The proof is in the revenue, returns, rankings and market share that we’ve discussed with you over the years.

This January, we announced the latest evolution of our corporate structure by merging two divisions once again: Commercial Banking (CB) with the Corporate & Investment Bank (CIB).

As we integrate these top-notch franchises, I am delighted to hand the keys of this incredible organization to Jenn Piepszak and Troy Rohrbaugh. They are exceptional leaders in every way, and I know they will continue to work hard each day, leading our employees and serving our clients with heart, integrity and excellence.

I am equally thrilled to spend more of my time in my role as President and Chief Operating Officer, helping Jamie with firmwide, strategic priorities that will provide growth and opportunities for years to come.

My focus will be on driving synergies across our lines of business, accelerating our investments in growth and innovation, and optimizing our resources across the firm. Priorities include harnessing data and modernizing our technology infrastructure so we can apply artificial intelligence (AI) to our businesses. This will help identify efficiencies and areas of opportunity. I also want to make sure we continue to manage and deploy capital in ways that best serve our clients, particularly when they need it most.

In 2023, we made significant strides in key areas:

In March, teams across our Consumer Banking, Private Banking, Commercial Banking and Investment Banking businesses joined forces to deliver the firm’s full support to the venture ecosystem in the aftermath of the regional banking turmoil. We are now exploring new ways to better serve this community, including tapping opportunities in the booming private markets so that we can compete effectively in this rapidly evolving area.

Our payments capabilities also continue to strengthen and advance as we prioritize innovation and resiliency. We are unique in that we can compete with fintechs on customer experience and digital solutions while also offering the stability, expansive network and services of a global bank.

Technology is reshaping the financial services landscape, and we are channeling its transformative power. Among our efforts, we are already using AI to onboard customers faster, combat fraud and serve up more insights to clients.

We are pushing into new markets both at home and internationally. Whether it’s growing our presence in emerging markets, deepening our relationships with multinational corporations, or expanding our U.S. branch network and wealth management business, our strategy is guided by a commitment to clients, communities and long-term value creation.

The leadership positions we have today are the result of hard work and investment over many years. We know also how hard it is to stay ahead of the pack. My promise to you, our shareholders, is that we will not be complacent. We will stay humble and hungry and strive always to be the best, most respected financial firm in the world.

Daniel E. Pinto

President and Chief Operating Officer,

JPMorgan Chase & Co.

In January 2024, we announced an exciting new chapter in our decade-long growth story.

The decision to bring together the firm’s major wholesale businesses to form the Commercial & Investment Bank continues a journey we have been on for a while as we seek to better support clients from their early stages of growth through to international expansion, acquisitions and beyond.

The new combined business has the scale, business diversity and financial firepower to offer complete solutions across banking, trading, payments and custody to middle market businesses, global companies and governments in more than 100 markets.

We are deeply indebted to Daniel Pinto, who built the Corporate & Investment Bank over the last 12 years with leadership positions across products and regionsfootnote1,footnote2. In his time as CEO, the CIB grew revenue from $34 billion in 2011 to $49 billion in 2023 and increased net income by more than 75% during the same period, and its Investment Banking and Markets businesses have been #1 franchises for over a decadefootnote1,footnote2.

It is a privilege to lead this remarkable business, and we are thrilled about the opportunities still to come. But let us first reflect on the key events and highlights of our performance in 2023.

OUR PERFORMANCE IN 2023

In 2023, the CIB generated net income of $14 billion on $49 billion in revenue, mirroring 2022’s solid performance but down from 2021’s record highs. Strong trading results and record years for our deposit-taking businesses cushioned the impact of industrywide weakness in investment banking activity, underscoring the benefits of our diversified business model.

The year included central banks hiking rates at the fastest pace in decades, a second year of war in Ukraine and the outbreak of conflict in the Middle East, the collapse of several U.S. regional banks and recession in parts of Europe. Throughout, J.P. Morgan offered its expertise and balance sheet, helping companies, financial institutions and governments weather the storm.

During the regional bank turmoil and resulting economic stress, the firm helped shore up the financial system and the economy, stepping in with billions of dollars in liquidity to help banks, their clients and investors navigate the crisis. This was complemented by the firm helping to raise $155 billion for financial institutions in 2023.

Worldwide investment banking activity was hit by the uncertain economic outlook and market conditions. Industrywide fees shrank to a 10-year lowfootnote1 and dealmaking remained subdued, causing our own investment banking revenue to dip slightly, to $6.2 billion from $6.5 billion in 2022. Even so, the business maintained its #1 ranking in global investment banking fees with a wallet share of 8.8%footnote1. We also ranked #1 in debt capital markets, #2 in mergers and acquisitions (M&A), and rose to #1 in equity capital marketsfootnote1.

Our M&A franchise advised on nearly 350 deals totaling more than $700 billion in volumefootnote1, including some of the year’s largest announced transactions: the $42 billion separation of Johnson & Johnson’s consumer health business, agricultural supplier Viterra’s $17 billion merger with U.S. oilseed and grain processor Bunge, and sandwich chain Subway’s $10 billion sale to Roark Capital, one of the biggest transactions in fast food history.

A decline in M&A dealmaking and the higher interest rate environment led to subdued debt capital markets and a drop in our debt underwriting fees to $2.6 billion in 2023 compared with $2.8 billion in 2022. A standout deal was the $31 billion bond deal for Pfizer to fund its acquisition of cancer drug pioneer Seagen, in which the firm had a lead role.

In 2023, our equity underwriting fees were up 11% compared with 2022, and we gained market share year-over-yearfootnote1. While market uncertainty dented confidence in initial public offerings (IPO), the franchise led two of the year’s biggest offerings, including the $5 billion IPO of British chip designer Arm Holdings and consumer health company Kenvue’s $4 billion debut.

It was another strong year for our Markets business, which generated $28 billion in revenue. Some of the uncertainty that plagued investment banking activity kept trading desks busy as clients hedged and positioned themselves accordingly. Fixed Income Markets revenue was up 1% from 2022, driven by the Securitized Products Group and Credit, mainly offset by normalization in Currencies & Emerging Markets, while Equity Markets revenue dipped after a relatively strong performance in 2022.

Clients also voted J.P. Morgan the #1 global research firm in Institutional Investor’s annual survey for the fourth year in a row. Our analysis of economies and markets, including research on some 5,200 companies across more than 80 countries, is particularly sought after during turbulent times.

CIB Payments reported a record $9.3 billion in revenue in 2023, up from $7.6 billion in 2022, as it benefited from the higher interest rate environment.

Securities Services, our fourth major line of business in the CIB, also had a record year, reporting $4.8 billion in revenue. Sitting adjacent to the industry’s largest Markets business, it provides post-trade services to institutional asset-manager and asset-owner clients, providing safekeeping, settlement and related services for securities in approximately 100 markets around the world. Since the CIB was formed in 2012, the Securities Services business has nearly doubled assets under custody from $17 trillion at the end of 2011 to $32 trillion at the end of 2023footnote3. In recent years, investments in technology have enhanced the scale and resiliency of its platforms, enabling the business to grow revenue and secure major new mandates.

SIZING UP THE OPPORTUNITIES AHEAD

J.P. Morgan has an exceptional blend of strengths that have continued to deliver value over time. The completeness of our products and services, talent, ongoing investments in digital technology and tools, client focus and fortress balance sheet have given the CIB strong share positions across almost all areasfootnote1footnote, 2.

We are not complacent about these leadership positions. The competitive landscape for our businesses is intensifying, driven by both traditional banks as well as further growth of nonbank financial institutions. Core to our strategy is looking very closely at all areas of the business and pinpointing where there are weaknesses and opportunities to grow.

Here are some of our target areas:

The benefits of integration

This year we are integrating our major wholesale businesses Commercial Banking and the Corporate & Investment Bank. There are more connections between the two businesses than ever before. In 2023, over $3 billion in gross Investment Banking and Markets revenuefootnote6 and more than $8 billion in firmwide Payments revenue, almost half, came from Commercial Banking clientsfootnote7. With our extensive footprint in the middle market, combined with our Investment Banking franchise, we are uniquely positioned to support middle market clients as they grow in size and complexity.

At the same time, our biggest multinational and asset manager clients are navigating an increasingly complex set of challenges and need a banking partner with the scale, global reach and full-service offering to resolve them. With employees around the world supporting clients in more than 100 countries, the newly enlarged business is among the most complete institutional client franchises in the industry. Wherever companies are on their growth journey, the newly combined business will have the resources and coverage to help.

Trading at scale

Our trading business operates at huge scale.

In 2023, in the U.S. alone, it handled more than 42 billion client orders and helped investors buy and sell nearly $11 trillion in 12,000 equity securities.

Our strategy of being a complete counterparty is paying off, with our biggest institutional clients choosing to do more business with us. Accordingly, the bank’s share of the institutional client wallet has grown from 11.1% in 2018 to 13.9% in 2023footnote8.

Being there for clients in all markets and conditions, however, demands a significant amount of capital. Although this is a headwind, the business continues to provide solid returns, and we remain focused on the disciplined allocation of capital while preparing for updated U.S. capital requirements.

As assets and international trade flows increase, we are modernizing platforms by moving to the cloud and increasing automation to handle greater volumes at lower cost.

To capture market share, institutional trading needs to be easy and intuitive. We are investing to enhance the trading experience for clients across the life cycle of their trades from onboarding to pre-trade services like research, execution, post-trade settlement and data services.

We are investing heavily in the electronification of our credit business, bringing across some of the technology and approach behind our Equities business. Among other initiatives in 2023, J.P. Morgan launched a new algorithmic trading offering to U.S. Treasury investors to capture share in the world’s most important bond market.

Private capital markets

Private markets — both credit and equity — have grown significantly over the past decade. The private credit market has grown nearly fourfold over the last 10 years to more than $1.6 trillionfootnote9, while money raised in venture capital and private equity growth deals has more than doubled over the same periodfootnote10.

Our borrower and investor clients are on both sides of this growth, and we are well-positioned to serve the full range of their needs. We are growing our solution-agnostic credit strategy, deploying balance sheet where it makes sense for direct lending, in addition to our existing financing and structured solutions. We are also enhancing our offering for asset managers and financial sponsors looking to deploy capital. As the private markets continue to evolve, we will remain a significant player with a goal of providing clients with a full range of financing options.

With the acquisition of First Republic Bank and collapse of Silicon Valley Bank, we have a unique opportunity to expand our support for the Innovation Economy — the ecosystem of venture-backed companies, founders and investors, who rely on the private markets. In the past, these efforts were led largely by Commercial Banking. With our new combined franchise, we can now better serve this dynamic, fast-growing client base. We want to make clients-for-life out of the legions of tech companies and their founders by supporting them from the earliest stages of growth up to IPO and beyond.

Capital for the climate

In 2023, we continued to help clients with their sustainability goals as well as scaling green solutions. Since 2021, the CIB has financed and facilitated $230 billion for green activities toward our firmwide target of $1 trillion by 2030, primarily by supporting clients with green bond underwriting and financing for renewable and clean energy. From financing and capital raising to strategic advice, we are working closely with clients across industries as they aim to meet their own long-term sustainability targets.

Investing for the future

We are investing to scale and enhance the resiliency of our core platforms and are pioneering new technologies to move faster and improve the client experience.

Across the business we are exploring use cases for artificial intelligence. In Markets, our AI-powered Client Intelligence platform is starting to use data from across the business to create recommendations based on client interactions, and our Prime Finance team is harnessing AI to better manage the inventory of securities we have on hand for clients while optimizing our balance sheet for capital efficiency. Elsewhere, AI has improved the onboarding experience for clients, speeding up and improving the accuracy of our Know Your Customer procedures, while in Investment Banking, the technology is helping coverage teams to pinpoint when companies might need to tap the equity markets.

Our Payments business moves nearly $10 trillionfootnote13 each day, with capabilities to send payments in more than 120 currencies across 160 countries. We are future-proofing its platforms and investing to help businesses across industries such as healthcare and e-commerce accept and make payments more seamlessly. In Securities Services, an increasing focus is to provide better data services to help investor clients improve the performance of their portfolios and the operational efficiency of their businesses. In 2023, we launched the first commercial offerings on our Fusion platform, giving clients access to their custody, fund accounting and middle office data via API or the cloud. We also rolled out a tool that helps clients gather, cleanse and organize ESG data from different sources.

LOOKING AHEAD

The start of 2024 has brought some early encouraging signs for investment banking activity but a more mixed outlook for our Markets business.

Several risks remain. Economies are still adjusting to life after the pandemic and the injection of trillions of dollars in monetary and fiscal stimulus; geopolitical challenges continue to flare; and the competitive threat is intensifying. The outcome of these is inherently unknown — they could provide both headwinds and opportunities for our business.

The consistent returns created by the scale and diversity of our franchise allow us to keep investing through economic cycles. We are global with capabilities at scale, and now combined with Commercial Banking, we have the ability to become even more client-centric.

Our products, services and reach coupled with incredible people and our winning culture make us especially hopeful about the future of our business.

It is an honor for both of us to lead this world-class franchise, and we are excited for the opportunities in front of us.

Jennifer A. Piepszak

Co-CEO, Commercial & Investment Bank

Troy L. Rohrbaugh

Co-CEO, Commercial & Investment Bank

- Return to footnote reference 1

- Dealogic as of January 2, 2024

- Return to footnote reference 2

- Coalition Greenwich Competitor Analytics (preliminary for FY23). Market share is based on JPMorgan Chase’s internal business structure and revenue. Ranks are based on Coalition Index Banks.

- Return to footnote reference 3

- Represents assets held directly or indirectly on behalf of clients under safekeeping, custody and servicing arrangements.

- Return to footnote reference 4

- Revenue reflects J.P. Morgan reported revenue.

- Return to footnote reference 5

- Coalition Greenwich Competitor Analytics (preliminary for FY23). Market share is based on JPMorgan Chase’s internal business structure and revenue. Ranks are based on Coalition Index Banks for Markets.

- Return to footnote reference 6

- Includes gross revenues earned by the firm that are subject to a revenue sharing arrangement between CB and the CIB for Investment Banking and Markets products sold to CB clients. This includes revenues related to fixed income and equity markets products. Refer to page 65 of the firm’s 2023 Form 10-K for discussion of revenue sharing.

- Return to footnote reference 7

- Firmwide Payments revenues (predominantly in the CIB and CB) includes certain revenues that are reported as investment banking product revenue in CB and excludes the net impact of equity investments.

- Return to footnote reference 8

- Coalition Greenwich Institutional Client Analytics. 2023 based on 3Q23 year-to-date analysis.

- Return to footnote reference 10

- PitchBook

- Return to footnote reference 11

- 2018 firmwide Payments revenue adjusted down by $0.2 billion for data processing accounting re-class.

- Return to footnote reference 12

- 2018 Securities Services revenue adjusted down by $0.1 billion to exclude the impact of past business simplification, exit actions and accounting changes.

- Return to footnote reference 13

- Based on firmwide data using regulatory reporting guidelines prescribed by the Federal Reserve for US Title 1 planning purposes; includes internal settlements, global payments to and through third-party processors and banks, and other internal transfers.

Commercial Banking

2023 was a dynamic and complex year, marked by geopolitical tensions, stubborn inflation, rapidly rising interest rates and a regional banking crisis. Through it all, Commercial Banking (CB) served as a source of stability for our clients and communities and remained focused on executing our strategic priorities.

Amidst this market disruption, our team rose to the occasion to support thousands of new clients, expand into key markets and accelerate growth across our business. CB’s exceptional performance reflects the strength of our franchise, ongoing client focus, and sustained investments in our platforms and capabilities:

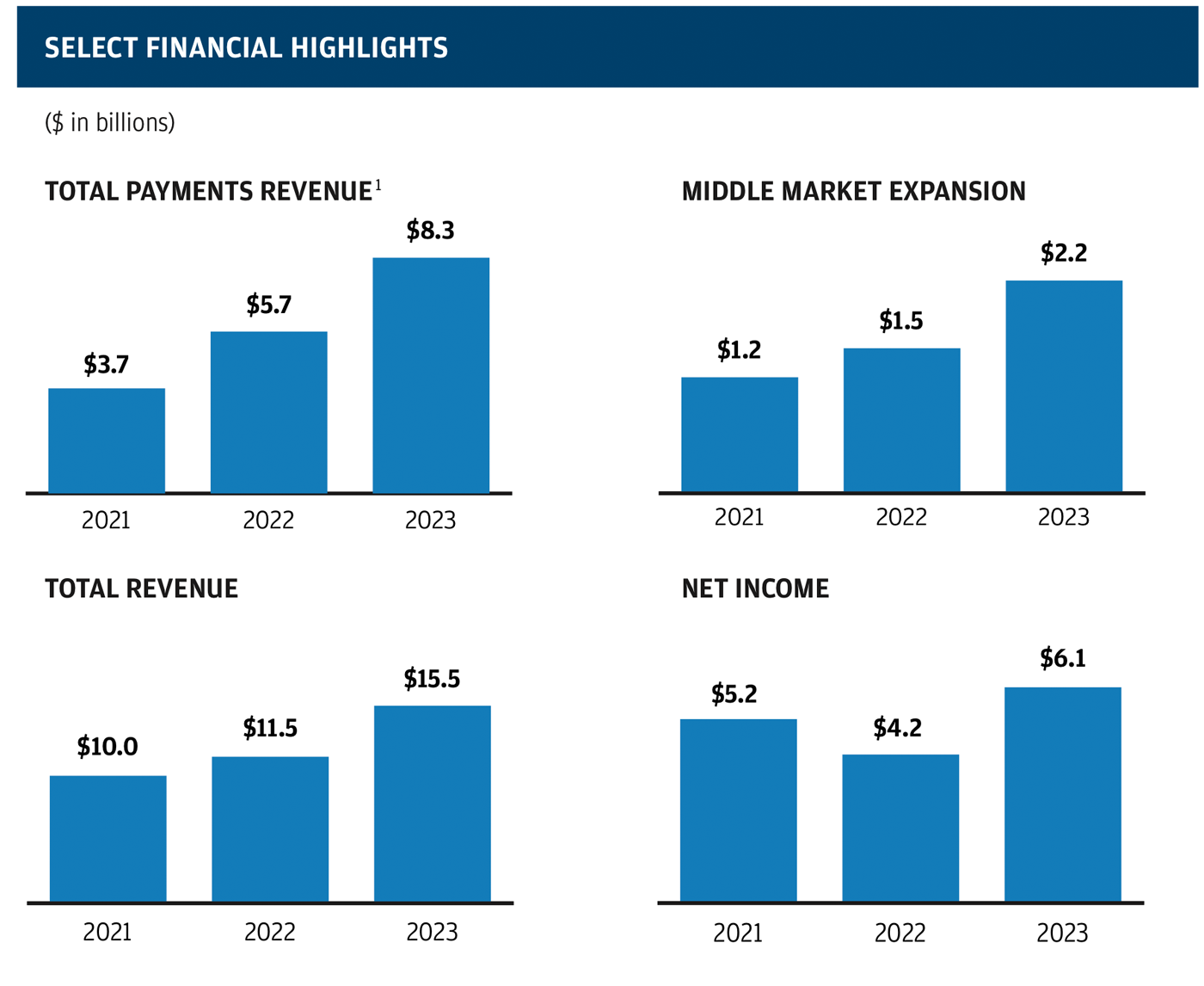

- Record revenue of $15.5 billion, up 35% year-over-year, reflecting higher net interest income, client acquisition and expansion into new markets

- Record net income of $6.1 billion, up 46% year-over-year, and a 20% return on equity

- Record Payments revenue of $8.3 billion, a 45% increase year-over-year

- Gross Investment Banking revenue of $3.4 billion, a 14% increase year-over-year

- Strong credit performance, with net charge-offs of 12 basis points

I’m incredibly proud of our outstanding operational and financial performance. Our team’s steadfast commitment, consistent investments and market discipline drove our success.

Moments that mattered

Given the challenges several key competitors faced in 2023, the banking landscape changed dramatically and greatly accelerated the expansion of our franchise.

Supporting the Innovation Economy: The collapse of Silicon Valley Bank in March of last year was a profound moment. Thousands of founders, companies and investors needed to protect their liquidity and make payroll. Many came to us, and we were ready. Because of our focus and significant investments to serve the Innovation Economy (IE) over the past decade, we were prepared.

In 2023, we accelerated our strategy to support this important segment of our economy by:

- Adding approximately two years’ worth of clients in just two months, with our team working around the clock for weeks to assist clients and open thousands of new accounts

- Hiring more than 200 experienced bankers and senior leaders across key markets

- Expanding our IE presence in eight countries, including Australia, China, Germany, Ireland, Israel, Nordics and the United Kingdom

- Establishing Startup and Climate Tech Banking teams to provide deep sector expertise

- Providing tailored capabilities, such as early-stage venture lending and capital raising

- Investing in platforms that deliver seamless digital experiences and integrated payments offerings specifically designed for startups and high-growth companies

Acquiring First Republic Bank: JPMorgan Chase’s acquisition of First Republic Bank (FRB) was another notable highlight of 2023. Given the overlap with CB, FRB offers a tremendous opportunity to deepen our presence in high-growth markets, expand our client franchise and build upon our team. CB added more than 5,000 Commercial Real Estate clients and approximately 2,000 Middle Market clients along with high-quality loans and deposits. We’re making steady progress on the integration and are excited about the synergies between our businesses and strength of our combined teams.

Executing a proven strategy

Despite these unexpected events, we made tremendous progress executing against our long-term, through-the-cycle strategy.

Building deep, enduring relationships: CB provides local expertise to nearly 70,000 clients across markets and sectors around the world. We welcomed close to 5,000footnote6 businesses last year and added roughly 500 bankers to build these relationships. In addition to supporting clients in all 50 states, we established a presence in Israel, Malaysia and Singapore, increasing our coverage of non-U.S. headquartered clients across 27 countries.

Developing powerful solutions: Our firm delivers end-to-end solutions to help our clients run their businesses more efficiently and fuel their growth. Through firmwide partnerships, CB offers customized capabilities, such as bundled services for startups and specialized payments offerings for segments like healthcare, real estate and government. These broad-based global offerings serve our clients through every stage of their life cycle.

Delivering an exceptional experience: CB is making great progress to optimize our clients’ journey across every touchpoint, including faster onboarding times, streamlined documentation and intuitive, self-service tools. As an example, we’ve been able to reduce our onboarding time to under 48 hours for a number of new clients, and we’re working to scale this experience. Informed by our clients’ needs and expectations, we’ll continue to invest in our operations and platforms to offer simple, efficient and digital-first experiences to our clients of all sizes.

Harnessing the power of our data: CB has invested in tools and capabilities to harness the full power of our data. We’ve worked to combine our proprietary data with third-party sources to form an integrated, comprehensive data asset that enables us to better understand our clients’ needs, manage risk and drive operational efficiency.

Empowering our team: One of CB’s key differentiators is – and always has been – our people. We provide our team with specialized training, collaboration and workflow tools, and content targeted to seamlessly address clients' needs. Access to personalized data and analytics helps our team develop deep sector expertise and insights to serve clients in a highly differentiated manner.

Focus on community impact

CB has played an instrumental role in supporting the neighborhoods where we live and work. Our purpose-driven business helps to create an inclusive economy, narrow the racial wealth gap and drive sustainable economic growth. We’re a pivotal part of the firm’s community impact, but our work is more than that—it’s essential to uplifting the places we call home.

In 2023 alone, CB extended more than $18 billion to help communities thrive, including:

- $6 billion to vital institutions, such as hospitals, governments and schools

- $3 billion in loans to emerging middle market businesses

- $5 billion to create and preserve over 41,000 affordable housing units

- $580 million in New Markets Tax Credit financing to support community development projects

- $240 million to community development financial institutions

Our future is bright

By all measures, 2023 was a standout year with our success driven 100% by our people. I’d like to extend my heartfelt gratitude to my extraordinary CB colleagues and partners across the firm whose unwavering commitment not only contributed to our performance but also supported our clients throughout this remarkable year.

My continued confidence in our future reflects our proven strategy, as well as our commitment to being our clients’ most important financial partner. An ambitious agenda awaits, and we’re not standing still. To build upon our strong momentum, we’ll remain disciplined as we accelerate our investments to drive our business forward.

As announced earlier this year, we’re excited to bring together the strengths and capabilities of CB and the Corporate & Investment Bank. This strategic combination further solidifies our strong partnerships across wholesale banking and creates the most global, complete and diversified Commercial & Investment Bank in the world. With an incredible team, extraordinary client franchise, iconic brand and unmatched capabilities, one thing is abundantly clear: Our future is bright.

Douglas B. Petno

Co-Head, Global Banking,

Former CEO, Commercial Banking

- 1

- In the third quarter of 2023, certain revenue from CIB Markets products was reclassified from Payments to Investment Banking. Prior period amounts have been revised to conform with current presentation.

- 2

- S&P Global Market Intelligence.

- 4

- Barlow Research Associates.

- 5

- London Stock Exchange Group.

- Return to footnote reference 6

- Excludes First Republic Bank.