Asset & Wealth Management

It was an important transition year for financial markets in 2022 as the world adjusted to the move from near-zero interest rates and quantitative easing — in order to stimulate post-COVID economies — to rapid interest rate increases and global quantitative tightening. The unprecedented speed of this reset caused significant market dislocations, with higher discount rates leading to severe asset repricing. For the first time in more than 50 years, both stock and bond markets had negative returns, calling into question the diversification principles of asset allocation.

Through it all, J.P. Morgan Asset & Wealth Management (AWM) drew upon its two centuries of experience navigating global markets and providing forward-looking insights to ensure that our clients had the planning and investment advice they needed to sustain a long-term perspective. Our relentless focus on risk management and comprehensive controls over all our activities has helped us guide and support our clients throughout the years — especially during more challenging times.

As fiduciaries for millions of clients, and with more than $4 trillion of their assets, we never take for granted the trust and confidence they place in us, and we work tirelessly to re-earn it each and every day.

INVESTMENT PERFORMANCE FOR OUR CLIENTS

For many years, I have written about the importance of being an active investor, as the world is constantly evolving — yesterday’s leading opportunities are not guaranteed to be tomorrow’s. In 2022, these principles were reinforced, as actively managed portfolios — an area in which J.P. Morgan has long excelled — proved their value in delivering strong returns for clients.

AWM has one of the industry’s largest internal research budgets and employs more than 1,100 investment professionals who cover over 2,500 companies, spanning every asset class and major geography. These individuals methodically travel around the world to uncover compelling investment opportunities for our clients; last year alone, they held over 5,000 meetings with companies and management teams.

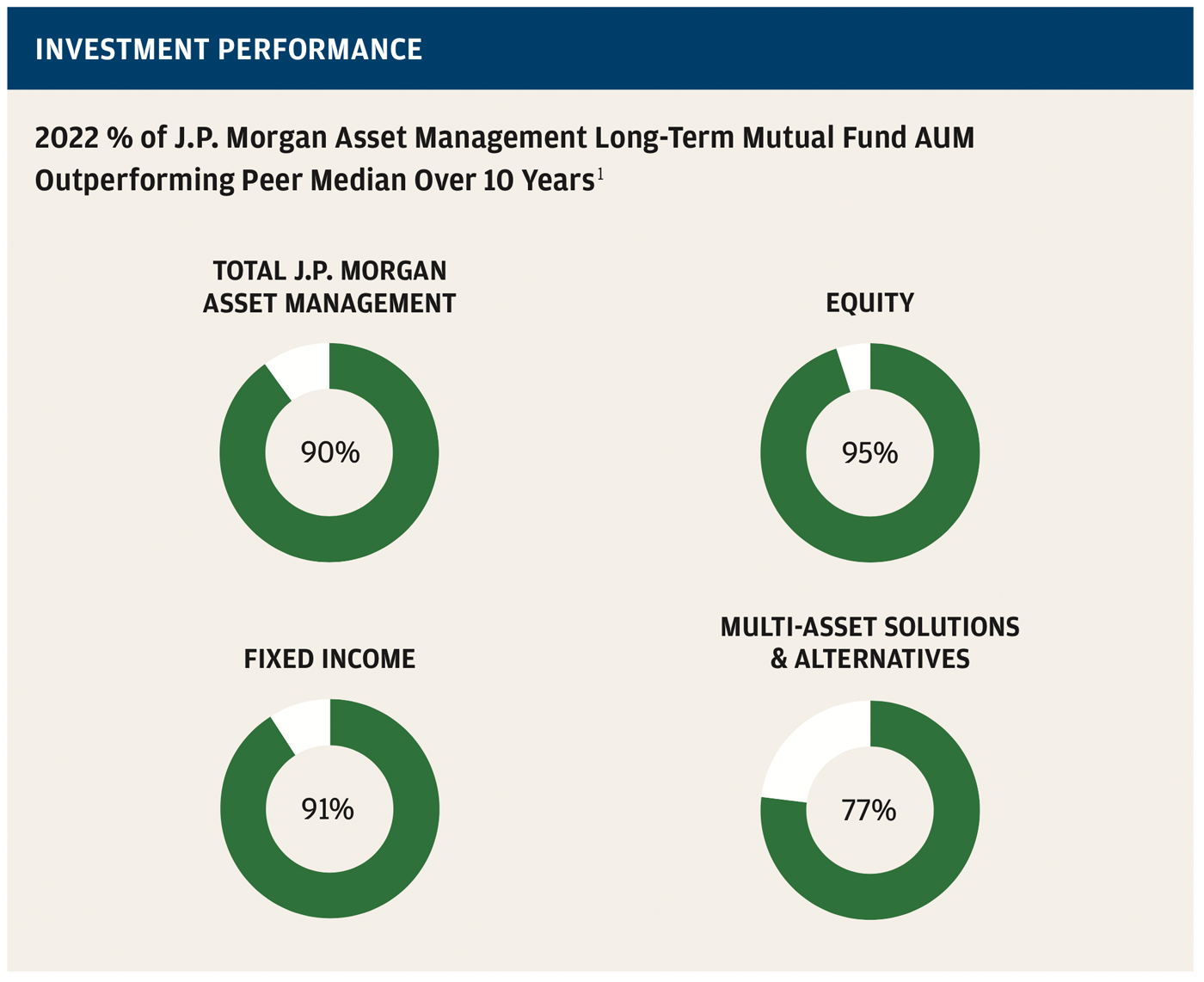

Our durable approach helped us deliver strong investment performance amid the historic levels of volatility in 2022, particularly in our Fixed Income and Equity platforms, outpacing most of our largest peers, especially those with more passive approaches to investing assets. In fact, across the three-, five- and 10-year time horizons, our investment performance in those asset classes has never been stronger. Our long-term mutual fund assets under management (AUM) outperforming the peer median over 10 years increased from a strong 86% in 2021 to an even better 90% in 2022.

Clients rewarded our consistent and strong outperformance by entrusting us with even more of their assets. AWM not only achieved its 19th consecutive year of net new inflows, but we also ranked in the top three of public peers for net client inflows over the past five years.

FINANCIAL PERFORMANCE FOR OUR SHAREHOLDERS

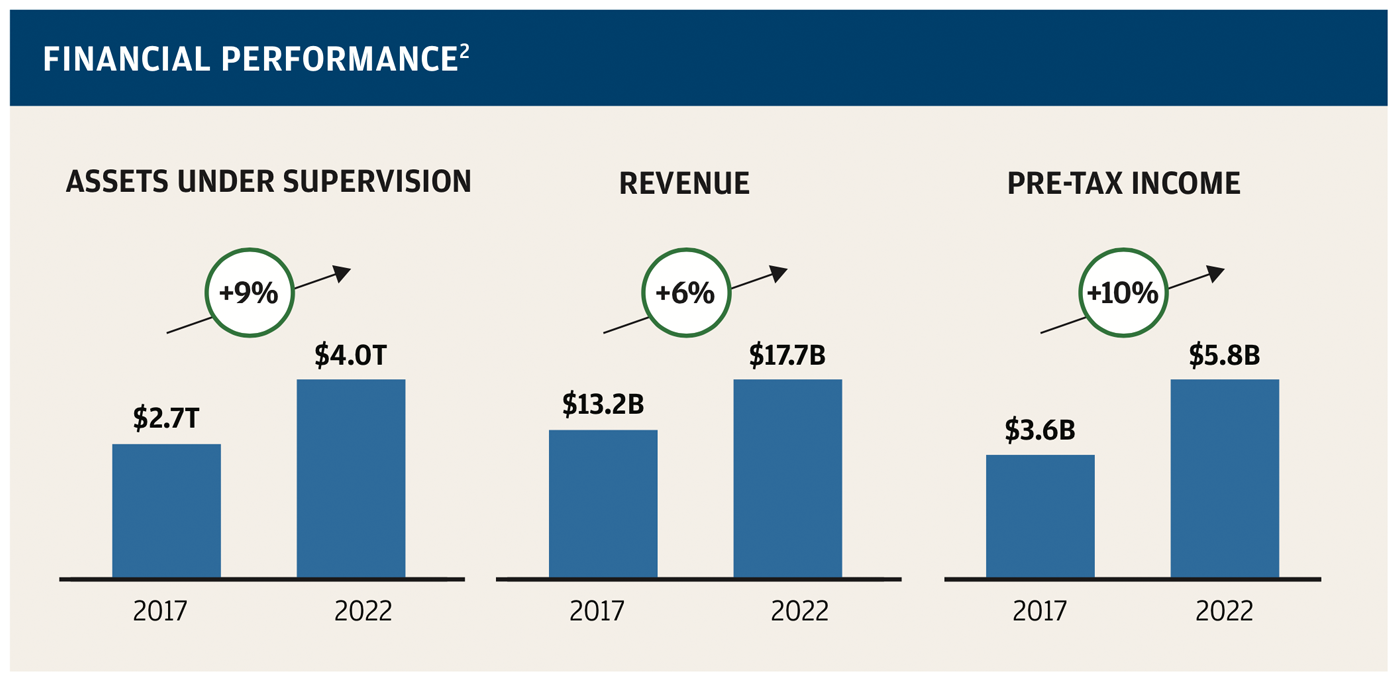

With delivering superior investment performance as our guiding principle, our revenue grew by 5% to reach a record level. Our results were strong across regions and channels and benefited from our fortress balance sheet, the Global Private Bank’s (GPB) robust deposit franchise, J.P. Morgan Asset Management’s (JPMAM) investment prowess, and a sizable number of new clients turning to J.P. Morgan for advice and guidance.

While pre-tax income was lower in 2022 than the previous year, it reflected our purposeful investments in our world-class talent, cutting-edge technologies and superior client coverage. With a healthy pre-tax margin of 33% that is among the industry’s highest, AWM has continued to deliver operating leverage to our shareholders over the past five years.

INVESTING IN THE FUTURE OF OUR FRANCHISE

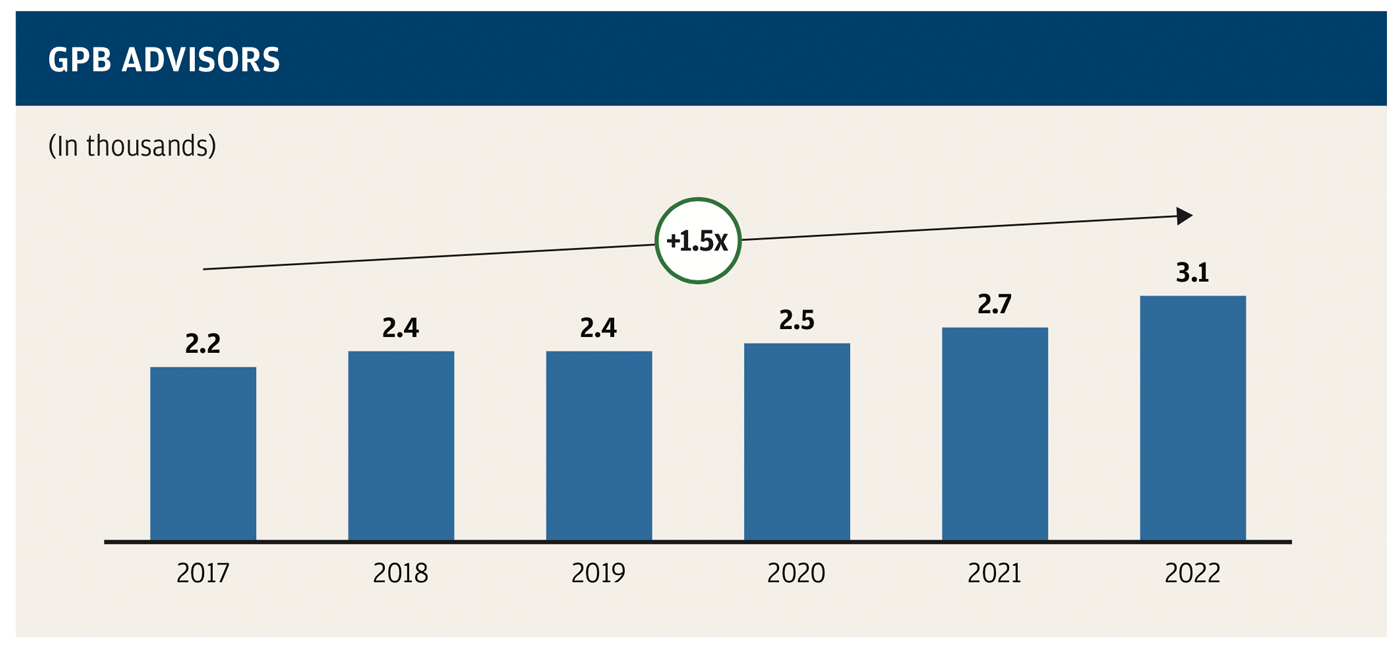

One of our most significant investments has been in our effort to increase our roster of high-quality GPB advisors. Our commitment in this area yielded results, and in 2022, for the first time, we surpassed 3,000 GPB advisors. Once hired, our advisors go through our world-class training programs to set them on a path to success and help them grow through each stage of their career.

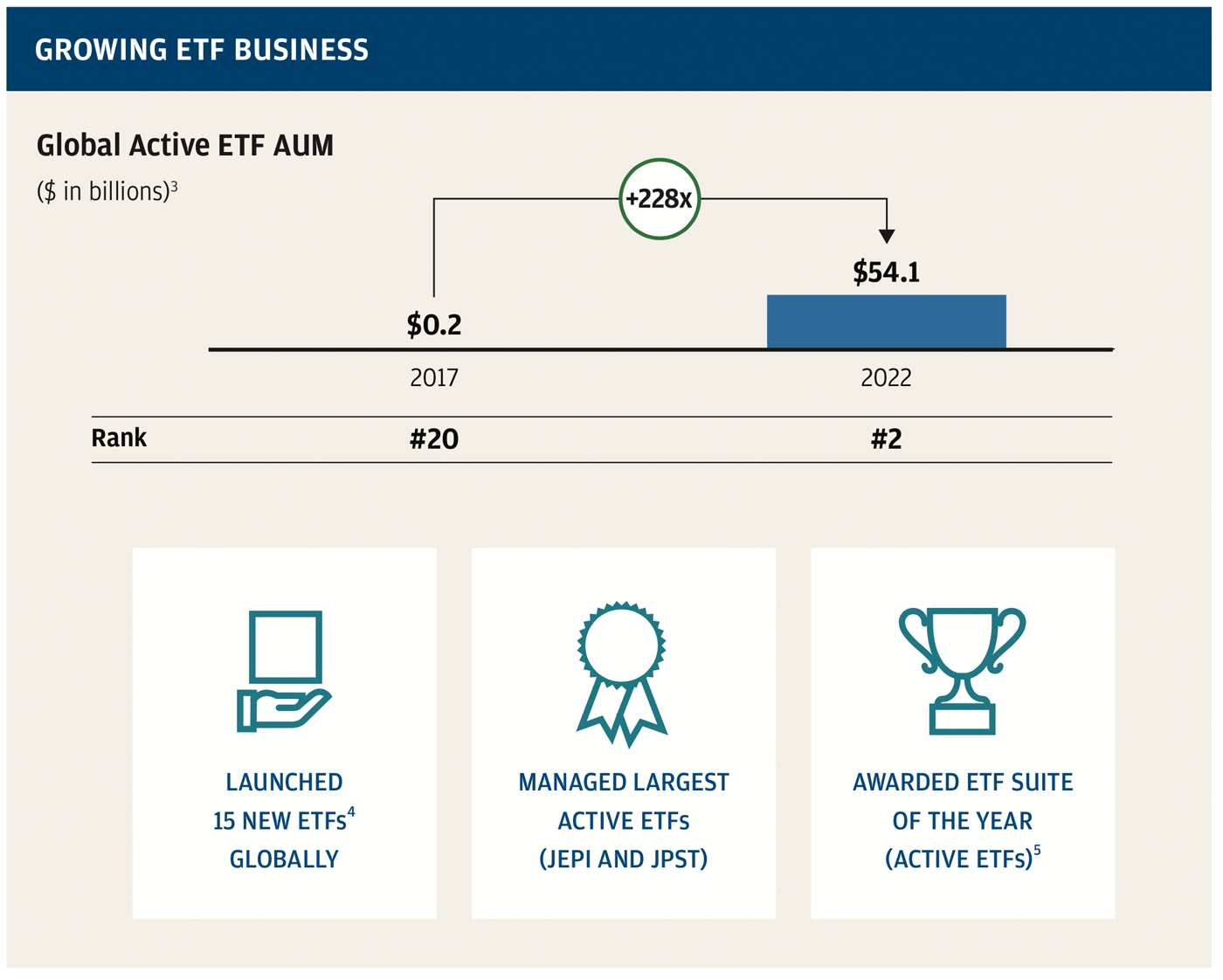

We also saw progress in our systematic efforts to expand our capabilities to meet client demand. We have invested heavily in JPMAM’s active exchange-traded fund (ETF) business, which in just a few years has grown from two solutions with $237 million in AUM to 78 U.S. and UCITS ETFs, representing more than $54 billion in AUM. With a lineup that includes two of the industry’s largest and top-performing active ETFs — JPMorgan Equity Premium Income ETF (JEPI) and JPMorgan Ultra-Short Income ETF (JPST) — JPMAM ended 2022 ranked #2 in global active ETF AUM.

In addition to organic growth, AWM has made several acquisitions in recent years, each of which is making valuable contributions to our business:

- 55ip, our customized tax-loss harvesting engine, built new, more highly scalable platforms to handle separate accounts, along with additional tax-managed strategies.

- Campbell Global, our timber- and forestry-focused investment manager, had notable new investment flows. Additionally, several other alternative funds started with newly acquired teams of experts in their various fields.

- OpenInvest, our customized investment preference screener, delivered several new screening capabilities to our advisors and clients.

- Global Shares, our cloud-based provider of equity share plan management to public and private companies, ended 2022 with nearly 1 million employee participant clients and continues to onboard new companies and their respective employees at a record pace.

To ensure we can scale our growth, we are investing in operational excellence across all that we do, with a particular focus on trade processing flows and client transactions/money movement, strong controls and protection around client activities, and ease of interaction. These investments are part of our ongoing efforts to streamline our processes and make it easy for our clients and advisors to work with us.

OPTIMISTIC FOR THE FUTURE

We know there will always be unexpected volatility in the broader environment. As a fiduciary, we constantly stress test portfolios to prepare clients for those scenarios. Recent events in 2023’s first quarter have reminded us of those risks. Today’s financial system is stronger than any time before, and it will emerge even more resilient as we apply lessons learned to the future. As tough as 2022 was on markets, the good news is the starting point for the next 10 to 15 years of future return assumptions has increased nearly 70%, from 4.3% last year to 7.2%footnote8.

I am so proud of the breadth and consistency of our success in delivering value to our clients and shareholders. We remain relentlessly focused on being the advisor of choice to the world’s most prominent institutions, pension funds, central banks, individuals and families. Our commitment to doing first-class business in a first-class way for these clients is what makes AWM a special gem inside JPMorgan Chase.

I also take great pride in how we helped clients and our shareholders navigate the challenges of 2022 and across past market cycles, and I am optimistic about the opportunities ahead and our role in helping to deliver the best possible outcomes for all our stakeholders.

Mary Callahan Erdoes

CEO, Asset & Wealth Management

- Return to footnote reference 1

- All quartile rankings, the assigned peer categories and the asset values used to derive this analysis are sourced from the fund ranking providers. Quartile rankings are done on the net-of-fee absolute return of each fund. The data providers re-dominate the asset values into U.S. dollars. This % of AUM is based on fund performance and associated peer rankings at the share class level for U.S.-domiciled funds, at a “primary share class” level to represent the quartile ranking of U.K., Luxembourg and Hong Kong funds, and at the fund level for all other funds. The “primary share class” is defined as C share class for European funds and Acc share class for Hong Kong and Taiwan funds. In case the share classes defined are not available, the oldest share class is used as the primary share class. The performance data could have been different if all share classes would have been included. Past performance is not indicative of future results. Effective September 2021, the Firm has changed the peer group ranking source from Lipper to Morningstar for U.S.-domiciled funds (except for Municipal and Investor Funds) and Taiwan-domiciled funds, to better align these funds to the providers and peer groups it believes most appropriately reflects their competitive positioning. This change may positively or adversely impact, substantially in some cases, the quartile rankings for one or more of these funds as compared with how they would have been ranked by Lipper for this reporting period or future reporting periods. The source for determining the rankings for all other funds remains the same. The classifications in terms of product suites and product engines shown are J.P. Morgan’s own and are based on internal investment management structures.

- Return to footnote reference 2

- In the fourth quarter of 2020, the firm realigned certain wealth management clients from AWM to CCB. Prior-period amounts have been revised to conform with the current presentation. Percentage increases represent compound annual growth rates.

- Return to footnote reference 3

- Includes U.S.-domiciled ETFs and European-domiciled ETFs with UCITS labels.

- Return to footnote reference 4

- U.S. and UCITS ETFs, including four ETFs in Australia.

- Return to footnote reference 5

- Award by With Intelligence in 2022.

- Return to footnote reference 6

- Sustainable Equity Strategy Assets

- Return to footnote reference 7

- Projected by 1H23.

- Return to footnote reference 8

- Any forecasts, figures and opinions set out are for information purposes only, based on certain assumptions and current market conditions and are subject to change without prior notice.