Consumer & Community Banking

I’m very proud to have co-led Consumer & Community Banking (CCB) for the past three years and am grateful to Jenn Piepszak for her partnership. When we took over this leading franchise, we established a strategic framework for continued, long-term success, and that framework guided CCB to deliver strong performance again in 2023. The evolving macro landscape means uncertainty on many fronts: the financial health of the consumer, the path of credit and interest rates, and the impact of new regulations. While the future will bring challenges, it will also create opportunities, and we’ve proved our ability to adapt and optimize.

In 2023, we remained focused on a consistent set of strategic priorities:

- Growing and deepening relationships by:

- Engaging customers with products and services they love and

- Expanding our distribution

- Delivering financial performance that is consistently best-in-class

- Leveraging data and technology to deliver customer value and drive speed to market

- Protecting our customers and the firm through a strong risk and controls environment

- Cultivating talent to build high-performing, diverse teams where culture is a competitive advantage

Our strategy is working as evidenced by our results last year.

GROWING AND DEEPENING RELATIONSHIPS

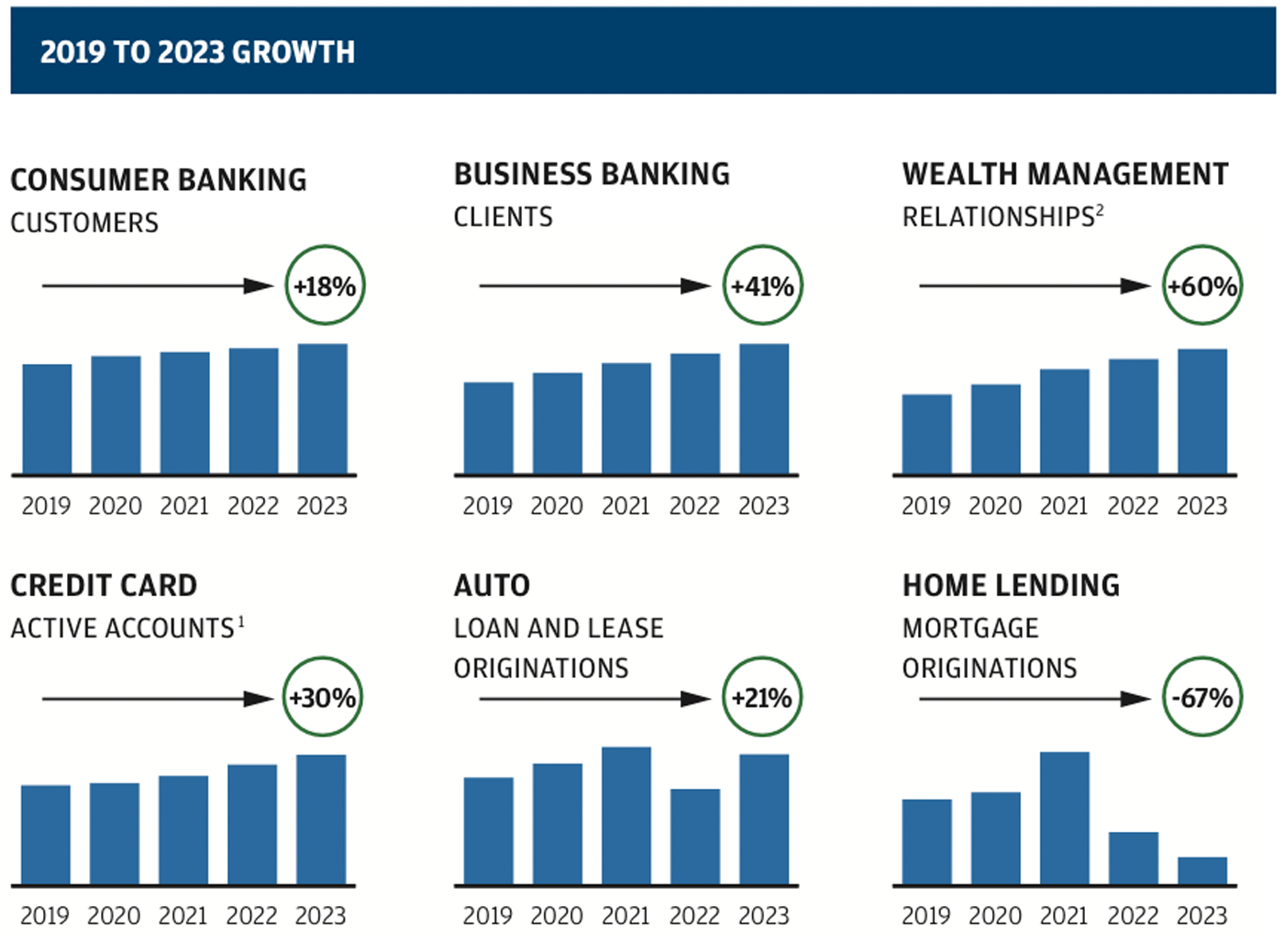

After the pandemic, we accelerated the pace of customer acquisition while lowering attrition. Maintaining that momentum, we now serve over 82 million consumers and 6.4 million small businesses, up 11% and 37%, respectively, since 2019. We’re driving that growth across businesses – during the same period, Consumer Banking customers are up 18%, Business Banking clients are up 41% and Card accounts are up 30%footnote1.

Read footnoted information here

We’re engaging customers with our products and services and delivering seamless experiences across digital and branch channels. Our digital banking platform grew to nearly 67 million active customers, up 28% since 2019. Once customers begin to use Chase.com and the Chase mobile app, we make it easy to help them save for the future, make small or big purchases (including a car or home), plan for retirement or a dream vacation, or find the perfect restaurant for a night on the town.

Our branches remain a critical touchpoint as over 900,000 people walk into one every day. We know being local matters and that customers increasingly value personal interaction and advice. In 2023, over 2 million more customers met with a banker than in 2022.

Once we onboard a customer to the franchise, we focus on earning the right to deepen that relationship and serve more of their financial needs. Last year was a banner year for deepening as we ended 2023 with over 24 million multi-line of business (LOB) customers – up 9% from 2022 and 30% from 2019footnote3. We have prioritized growing multi-LOB relationships as it helps us address more of our customers’ needs while driving higher retention and engagement with our products and services. We constantly focus on improving the customer experience, which we measure in many ways. We’re proud to have all-time-high satisfaction ratings across branch and digital channels, while our complaint rate per account is down nearly 10% year-over-year. Customer attrition is below historic levels, and CCB’s overall net promoter score remains very healthy.

DELIVERING FINANCIAL PERFORMANCE THAT IS CONSISTENTLY BEST-IN-CLASS

While we recognize that favorable macro conditions contributed to overearning in net interest income and credit, we still outperformed as we delivered strong returns and grew market share across businesses. With a 38% return on equity, we exceeded our 25% target for the third straight year and would have done so even when normalized to reflect through-the-cycle credit and rate assumptions. Net income was $21.2 billion, up 42% over 2022. Revenue of $70.1 billion was up 28% from 2022, and CCB’s overhead ratio was 50%. Average deposits were $1.1 trillion, and although down 3% from 2022, we outperformed the industry average. Average loans were up 20% over the prior year to $526 billion, including the First Republic acquisition.

EXTENDING OUR #1 POSITION ACROSS INDUSTRY-LEADING BUSINESSES

Our momentum is driven by successful execution across all lines of business in CCB. We’re the clear market leader in Consumer Banking, Business Banking and Card and continue to grow.

Consumer Banking

We extended our #1 position in 2023 with an 11.3% deposit market share, up 40 basis points from 2022. Excluding First Republic, share growth was up 10 basis points. Since 2019, we’ve increased our share by 220 basis points. We’ll continue to drive growth by expanding branches and evolving products to meet customer needs by segment.

Branches remain the hub for our local team of experts – over 50,000 bankers, advisors and business relationship managers – and a key distribution channel for all parts of the firm. We continue to optimize our network of over 4,800 branches as we aim to be within a 10-minute drive for 70% of the U.S. population. This will help us grow share in major metropolitan areas like Boston, Philadelphia and Washington, D.C., as well as states with mostly rural populations such as Alabama and Iowa, where we are also expanding our presence.

We’ve added more than 650 new branches in the last five years, by far the most of any bank in the U.S. We’re doubling down on that investment and will add 500+ branches over the next three years. The result is a significantly younger branch network, which creates embedded growth that already has driven share gains and will continue to do so for years to come. Newer or “unseasoned” branches represent more than $150 billion in incremental deposit upside as they mature. At the same time, we are consolidating older branches in certain markets in response to shifting customer behavior.

We aim to be the bank for all, so tailoring products, services and experiences for each customer segment and community is central to our strategy. We’re increasingly focused on supporting the financial health of customers and communities through digital and in-person resources, such as our nearly 150 dedicated Community Managers. We now have 16 Community Center branches and plan to open three more in 2024.

We started 2023 with a goal of maintaining primary bank relationships and capturing money in motion, and we did both. We retained over 95% of our primary bank customers and succeeded in deepening with investments and an enhanced, higher-yield product set – including competitive-rate CDs and the new J.P. Morgan Premium Deposit account. As a result, we successfully captured more than 80% of yield-seeking flows in 2023.

We offer small business owners a comprehensive product suite to help them start, run and grow their businesses. We’re #1 in small business primary bank share with 9.5% of a fragmented market and plan to grow by:

- Increasing banker capacity to better cover large clients, which drives higher retention, cross-product deepening and client satisfaction. In 2023, we added more than 350 bankers against our target of 1,000 incremental bankers.

- Rolling out value-added services like payroll, broadening our payment acceptance suite with new offerings such as invoicing (currently in pilot) and launching Tap-to-Pay, which enables merchants to accept card payments on their mobile devices.

- Continuing to expand support for small business owners in underserved communities through special purpose credit programs, one-on-one mentoring and local events.

Card

In 2023, we extended our #1 position in credit card, with sales and outstandings market share up approximately 50 and 30 basis points, respectively, compared with 2019footnote4.

Read footnoted information here

We drove growth by leveraging our marketing capabilities to get the right products in the right customers’ hands. In 2023, we invested nearly $7 billion in gross marketing to generate 10 million new credit card accounts and deliver benefits to existing cardholders. The continued demand for our leading products has fueled portfolio growth, enabling us to deliver more value and drive engagement with our customer base.

In 2023, we focused on enhancing our Card product continuum to effectively serve the unique needs of each customer segment and:

- Launched Chase Freedom RiseSM for younger, new-to-credit customers, which has shown strong adoption using our branches as its primary distribution.

- Launched DoorDash Rewards Mastercard®, adding a new strategic partner to our co-brand portfolio.

- Scaled Ink Business PremierSM, launched in late 2022, to grow share with small businesses.

- Continued to enhance the Sapphire value proposition by opening lounges in five airports to date and leveraging the travel, dining and shopping experiences we’re building in Connected Commerce.

SCALING GROWTH BUSINESSES

In Connected Commerce and Wealth Management, we have the assets to win and outsized opportunity to grow to what we view is our fair share, given the breadth of CCB relationships. These businesses are natural adjacencies to banking and credit card, with scale and distribution that will fuel their growth.

Connected Commerce

We continue building out a powerful two-sided platform to connect Chase customers with top brands, helping them book travel, discover new dining experiences and save money while shopping. We expect to drive approximately $30 billion in volume and about $2 billion in revenue through the platform in 2025. We’ve nearly doubled volume over two years, driving more than $18 billion in 2023. Going forward, we’re focused on:

- Scaling Travel. We are a top 5 consumer leisure travel provider with $10 billion in booked volume last year, up more than 25% from 2022. We’ve just relaunched ChaseTravel.com to help customers dream, discover and book travel, including a new collection of more than 600 of the world’s finest hotels.

- Expanding Shopping through Chase Offers. In 2023, we generated more than $8 billion in attributed spend volume, up over 30% from 2022. We’re accelerating growth by launching Chase Media SolutionsSM, a new digital media business aimed at merchants that allows them to target and connect with Chase customers.

- Innovating payments and lending capabilities. To provide customers with innovative, convenient ways to pay and borrow, last year we began to roll out Pay in 4SM, which has scaled to over 20 million customers. We also saw more than 50% year-over-year growth in card-linked installment originations through My Chase Plan®.

Wealth Management

In 2023, we grew client investment assets by 25% to $800 billion before accounting for the First Republic acquisition. In total, we ended the year with $950 billion in assets, up $450 billion since 2019, as we close in on our goal of reaching $1 trillion in assets under supervision. We now have 2.5 million client relationships – up 60% from 2019 – with a record 120,000 first-time investors in 2023.

This momentum stems from the investments we’ve made in products, channels and talent in the last four years since we established J.P. Morgan Wealth Management. In 2023, we:

- Added more than 400 total advisors, ending the year with nearly 5,500 on a path to 6,000.

- Scaled Wealth Plan, an omnichannel financial planning experience that customers start digitally and can finish with an advisor. Customers have created more than 1 million financial plans since the experience launched in December 2022.

SECURED LENDING

Auto and Home Lending

In Auto and Home Lending, our objective is not market share but to be there for customers during key moments and to create franchise value while continuing to maximize the strength of the firm’s balance sheet, capital and liquidity. Given the cyclical nature of both businesses, we manage returns on a through-the-cycle basis.

Despite recent market headwinds, Auto and Home Lending delivered a return on equity of 17% and 15%, respectively, averaged over the last five yearsfootnote6. While the acquisition of First Republic’s mortgage portfolio helped bolster Home Lending returns last year, CCB’s mortgage business was key to enabling the transaction.

Across both businesses, we continue to leverage data and artificial intelligence (AI)-enabled techniques to enhance and optimize our underwriting and credit decisioning.

We also remain committed to increasing homeownership among underserved communities. Our Chase Homebuyer Grant program has scaled to over 15,000 communities since its launch in 2021, and we recently increased the grant amount to $7,500 in select markets.

LEVERAGING DATA AND TECHNOLOGY TO DELIVER CUSTOMER VALUE AND DRIVE SPEED TO MARKET

Data and technology make everything we do better – our products, channels and experiences. In 2023, CCB spent over $3 billion on technology investments spanning both product development and modernization.

A little over half of our annual investment is focused on product development, helping to ensure we have the best products, services and channels to meet customers’ evolving needs. From paying a bill and checking a balance to replacing a card and disputing a transaction, we’re making processes more seamless, taking friction out of customers’ everyday financial lives. At the same time, customers are increasingly engaging with our advice-oriented digital and omnichannel experiences to meet their more complex needs, like buying a home or planning for retirement. Engaged online activity – beyond viewing balances – is up 25% since 2019.

The rest of our technology investment is focused on modernization, which is both offensive and defensive. We need to deliver new products and experiences more quickly while executing with resiliency at massive scale to stay competitive and avoid being disrupted. We’ve made significant progress and are on track to substantially complete data center migration by the end of 2024. We’ve also migrated almost 90% of our data to the public cloud. Looking ahead, we’ll continue to focus on modernizing our core banking infrastructure, which will enable us to launch products faster, improve platform stability and reduce run-the-bank expenses over time.

Our data migration efforts help us take full advantage of our extraordinary data assets to deliver personalization at scale and accelerate existing and future AI initiatives. We’ve been using AI for years and have a strong foundation in place. Initially, we focused on using AI to drive cost reduction and risk avoidance, but we’ve pivoted to focus more on revenue growth. We’ll continue to invest where we will realize the greatest benefit, including:

- Optimizing marketing efforts to better target profitable prospects.

- Identifying unmet customer needs, then addressing them in the moment with digital nudges and personalized offers.

- Increasing the productivity and efficiency of our sales force through lead management and propensity models.

- Predicting in real time the likelihood of fraud to better protect customers and the firm.

- Supporting specialists with AI advancements like call prediction, real-time insights and intelligent routing to drive customer and employee satisfaction.

PROTECTING OUR CUSTOMERS AND THE FIRM

Risk management is core to our culture and a key competitive advantage, helping us build trust and providing security to customers. We are focused on protecting shareholders, customers and the firm by maintaining our fortress balance sheet, strong controls environment and through-the-cycle decision-making approach.

CULTIVATING TALENT

The work we do matters to customers, communities and the economy overall. Our goal is always to attract and retain great talent and create a culture where everyone’s voice matters. We help employees build a long-term career at the firm and have a workforce that reflects the communities we serve. Our high-performance culture rewards the hard work, heart and humanity that our more than 140,000 employees deliver every day. All of this leads to the best business outcomes.

ACQUIRING FIRST REPUBLIC

In the midst of widespread instability in the banking sector, it was the strength and breadth of our franchise and the dedication of thousands of employees that enabled us to complete the acquisition of virtually all of First Republic’s assets in one weekend.

We had long admired First Republic’s capabilities and culture of client service, which complement our existing affluent strategy. We already serve customers across the wealth spectrum, but the acquisition will help us deepen relationships with the affluent segment. In 2023, we prioritized stabilizing First Republic’s existing business. We retained the vast majority of customers, and deposits have increased approximately 20% since the acquisition. While we are on track against key integration milestones, 2024 will be critical as we aim to largely complete integration efforts by year-end.

2024 LOOK AHEAD

Macro factors

The macro environment going forward will likely look very different from 2023. While we anticipate the Federal Reserve will lower rates this year, the trajectory is still uncertain. Lower rates will be a headwind for deposit margins but a tailwind for businesses such as Home Lending. The diversification of our franchise provides natural offsets and hedges and creates resiliency in earnings and performance.

We are rigorous in monitoring our portfolios at a granular level using multiple data sources to assess direct risk and the overall health of consumers and small businesses. Based on what we’re seeing, consumers and small businesses both still remain generally healthy. Although consumers have largely spent the excess cash reserves built up from the fiscal response to the pandemic, balance sheets remain strong. Spending on a per account basis is largely flat year-over-year. Delinquencies played out as expected in 2023, and credit card losses should fully normalize later this year.

Regulatory environment

The banking industry is facing an unprecedented barrage of untested and unstudied proposed regulations and legislation targeting multiple aspects of our business. The combined impact of all of these – Basel III, Regulation II (Debit Card Interchange Fees), overdraft and late fee changes, the Consumer Financial Protection Bureau’s Sections 1033 and 1071, and the Credit Card Competition Act – will meaningfully disrupt the economics of consumer financial products and services. This level of intervention will lead to some combination of the following:

- Fewer financial products and services available, and the remaining ones will become more expensive and harder to access, especially for lower-income consumers.

- Less investment and innovation in the financial services industry, leading to an erosion of the customer experience.

- More consolidation across the industry, which will limit consumer choice.

- More financial activity handled by nonbanks outside of the regulatory perimeter, increasing risk for consumers.

Of course, we will comply with the final rules and regulations and are relatively well-positioned to do so. However, consumers and small businesses will likely bear the largest burden.

Our hand

We continue to operate from a position of strength with a relentless focus on the customer, a proven strategy and the best team. We recognize headwinds on the horizon and will adapt accordingly, taking a through-the-cycle approach to managing our business. Moving forward, we’ll continue to:

- Execute with excellence and a focus on efficiency and flexibility as the environment around us changes.

- Engage with regulators on how current proposals will negatively impact consumers and the industry.

- Reshape our business where necessary in response to new regulations, balancing impacts to shareholders, customers and the communities we serve.

I remain very confident about the future of our franchise, yet approach the opportunities and challenges we’ll face with great humility.

Marianne LakeCEO, Consumer & Community Banking

- Return to footnote1

- Defined as average sales debit active accounts

- Return to footnote2

- Unique families with primary and joint account owners for open and funded accounts

- Return to footnote3

- Reflects consumers and small businesses that have relationships with two or more CCB lines of business

- Return to footnote4

- Card outstandings market share has been revised to reflect a restatement to the 2022 reported total industry outstandings disclosed by Nilson, which impacted annual share growth in 2023

- Return to footnote5

- #1 most-visited banking portal in the U.S. (Chase.com) based on Similarweb

- Return to footnote6

- Excluding loan loss reserves