Asset & Wealth Management

A landmark year setting the stage for future success

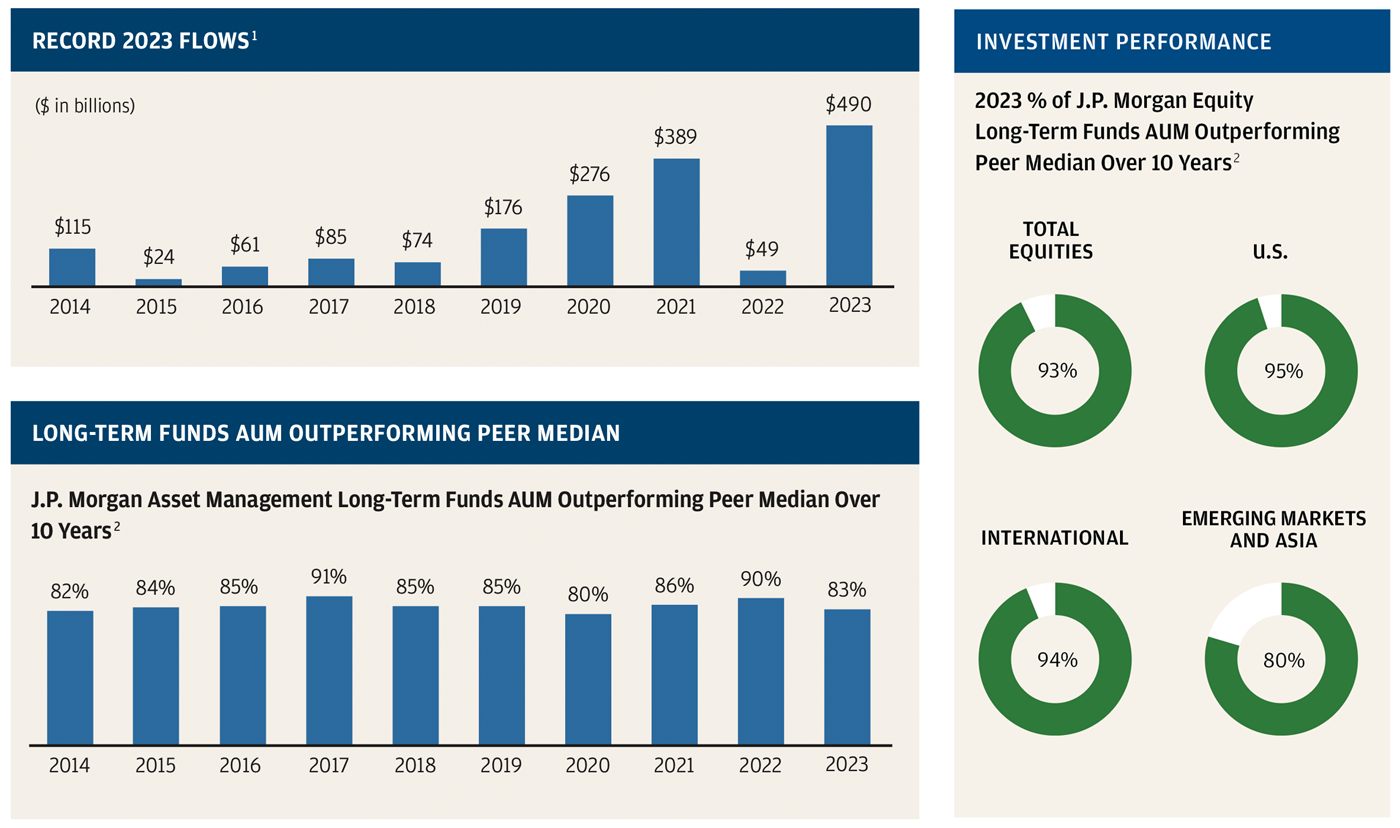

RECORD NEW CLIENTS AND FLOWS

Nearly half a trillion dollars — $490 billion to be precise. That sum represents how much net new money clients entrusted to J.P. Morgan Asset & Wealth Management (AWM) last year. During times of financial crises or market uncertainty, J.P. Morgan shines even brighter as a port in the storm — and 2023 was no exception. The U.S. regional banking crises served as a stark reminder that banking and lending are not to be treated as a commodity. As a reflection of this awareness, AWM drew an influx of client flows last year at a rate nearly twice that of our closest publicly listed competitor.

STRONG INVESTMENT PERFORMANCE AND LEADING SOLUTIONS FOR CLIENTS

As a fiduciary, delivering strong, long-term investment performance is our foremost priority. Approximately 80% of J.P. Morgan Asset Management assets under management (AUM) outperformed the peer median over a 10-year time period. This exceptional investment performance is an outcome of decades of refinement and involves close to 1,300 investment professionals along with one of the industry’s largest research budgets, which enables us to actively cover nearly 2,500 public companies, with over 5,000 company visits annually. This has resulted in more than 93% of our equity assets outperforming their peers over the past decade.

Achieving outstanding investment results is never easy, but after several years of extensive quantitative easing — which often led to undifferentiated asset moves in concert with one another — we are returning to a market that prioritizes fundamentals in valuing companies and securities, giving us plenty of reasons to be optimistic about the future for our investors across asset classes.

We provide our clients with expertise and effective solutions to support them through all market cycles and prepare them for the future. Equipped with state-of-the-art technology and artificial intelligence (AI)-enhanced tools and capabilities, our advisors stand ready to guide our clients and deliver more personalized offerings — from the first dollar they invest in the markets to the decisions they make about their long-term retirement planning. Simultaneously, to assist our clients in navigating the intricacies of retirement, we offer robust strategies through our SmartRetirement solutions.

Our dedication to research is at the heart of everything we do, from stock selection to unique market and asset allocation insights. For example, we deliver exclusive insights to our clients through our proprietary, industry-leading Eye on the Market and J.P. Morgan Guide to the Markets, viewed by hundreds of thousands of financial advisors and millions of clients every year. And we draw on the depth and breadth of our market and economic expertise to provide insights into investment themes to enable more confident portfolio decisions. Clients rely on us to help them distinguish the signals from the noise.

IMPRESSIVE RESULTS FOR SHAREHOLDERS

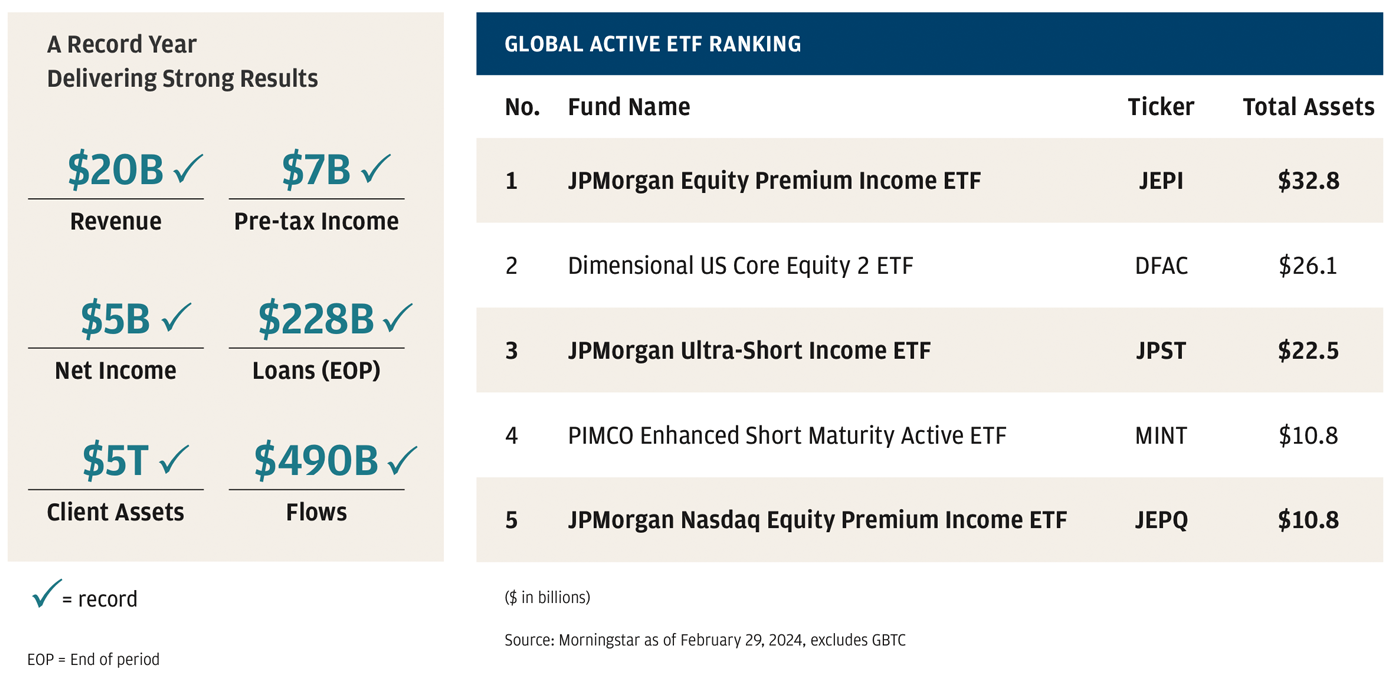

Our success across our preeminent diversified investment and client franchises drives our consistent growth. This year, our total client assets grew to a record $5 trillion, our revenue to a record $20 billion and our pre-tax income to a record $7 billion — resulting in a return on equity of 31%. These results underscore the power of a global, highly diversified platform with exceptional investment performance and dedicated client service.

PERSONALIZATION, GOVERNANCE AND STEWARDSHIP

I have never in my time running the AWM franchise found two clients alike in their needs, goals and risk tolerances for their assets. For a sovereign wealth fund or a first-time individual investor, investing is deeply nuanced in terms of volatility tolerances, income and distribution requirements, taxes, preferences and passions. The proprietary technologies we gained from our acquisitions of 55ip and OpenInvest, for example, enable us to combine over 600 different investment strategies to create highly customized portfolios in a smart, efficient way. We know our clients have a choice — not only in managers and investment styles but also in preferences around sectors or tilts and, where appropriate, in a tax-optimized way. We do not believe it is J.P. Morgan’s job to tell clients what to include or exclude inside their portfolio sectors or stock selection. Instead, we empower clients to guide us and drive their own decisions.

And because preferences are often personal in nature, we are steadfast in focusing our stewardship on voting matters that maximize long-term shareholder value and good governance. With the increased prevalence of outsourcing proxy voting, by the end of 2024, generally we will have eliminated third-party proxy advisor voting recommendations from our internally developed voting systems. We have also increased our own investor engagement with companies while bolstering transparency on our voting decisions. We believe these enhancements will allow companies to better understand our independent rationale regarding voting issues.

INVESTING FOR THE FUTURE

Active ETFs and SMAs

Innovation forms the core of our business. Having launched our active exchange-traded fund (ETF) platform less than 10 years ago, we have emerged as a global leader — ranking #2 in AUM and net flows, led by having the #1, #3 and #5 largest actively managed ETFs in the world (JPMorgan Equity Premium Income, JPMorgan Ultra-Short Income and JPMorgan Nasdaq Equity Premium Income). We persist in our efforts to innovate, expanding our offerings by launching 17 new solutions (12 U.S. and five UCITS) in the past year. We are equally enthusiastic about our separately managed account (SMA) platform. Acquiring 55ip enabled us to provide our clients with improved tax management and portfolio customization, and our clients now have greater control over their investments and taxes. Since the acquisition, our AUM increased 16-fold in this area.

Alternatives

As a top 10 manager and investor, with more than $400 billion in assets and a 60-year legacy, we continue to invest in scaling and expanding our alternatives capabilities across private equity, hedge funds, private credit, real estate and infrastructure. After launching J.P. Morgan Private Capital two years ago, we successfully introduced technology, consumer and life sciences strategies. As access to alternatives continues to widen, we launched J.P. Morgan Real Estate Income Trust (JPMREIT) and JPMorgan Private Markets Fund (JPMF), which is one of the industry’s first private equity funds available to individual investors. Overall, alternatives across AWM continue to grow.

Acquisitions

Global Shares, a share plan administrator of both public and private companies around the world, is one of our most recent acquisitions. As we build out our broader J.P. Morgan Workplace offering, we are leveraging Global Shares as the foundation to help new companies accelerate growth and encourage employees and owners to invest. With plan participants from over 100 countries, the number continues to grow — up 15% this past year. Just as impressive, client assets are up 32% since the acquisition. We also completed the acquisition of China International Fund Management (CIFM), rebranding it as J.P. Morgan Asset Management (China). We commemorated this pivotal rebrand by moving 400 new onshore colleagues into Shanghai Tower. This served not only as a celebration but also as a testament to our shared heritage, global strengths and deep-rooted expertise in the local market, as J.P. Morgan’s history in China dates back more than 100 years.

J.P. Morgan Asset Management (China)’s headquarters in the heart of downtown Shanghai.

A rigorously controlled environment

To ensure scalable growth, we are committed to operational excellence — from enhancing trades, client transactions and money movement to simplifying interactions and implementing robust controls and safeguards. Some of these efforts are being further enhanced using AI to streamline our processes, manage risk and make informed decisions to protect our clients. Additionally, these investments in our infrastructure help us — as fiduciaries — perform optimized stress testing of client portfolios on a consistent basis.

CONCLUSION

As I have said from the beginning of my tenure as CEO of AWM, our focus is on being the best in the industry, not the biggest. And by best, I mean the best performer for clients. Advice is not a simple commodity. Strong investment performance across a broad, diversified offering paired with best-in-class advice and thought leadership are critical elements. I am confident that our capabilities and commitment to future-focused investments, as well as enhancements using technology and AI, will bolster our ability to serve our clients and empower them to attain their future success. By achieving optimal results through these efforts, clients reward us with their flows, and future growth will follow. Furthermore, we hold a unique advantage that sets us apart from all of our competitors: Being part of JPMorgan Chase provides us with unmatched resources, opportunities and scale.

I am so proud of how we helped our clients and shareholders navigate the challenges of 2023 and previous market cycles. Our industry-leading growth of client assets is a testament to our unwavering commitment to delivering on our fiduciary responsibilities and dedication to serving clients' best interests. We are deeply grateful for this trust and will continue to strive for excellence in all we do, each and every day.

Mary Callahan Erdoes

CEO, Asset & Wealth Management

- Return to footnote1

- In the fourth quarter of 2020, the firm realigned certain wealth management clients from AWM to CCB. Prior periods have been revised to conform with the current presentation.