Introduction

During 2017, the Corporate & Investment Bank (CIB) maintained its position as the most successful and profitable institution of its kind.

But the seeds of our current strength were planted years ago. As other banks retrenched, cutting back on products and geographies, we chose a different path. We believed that growth would come from being global, having scale and maintaining a complete product offering for clients. Those elements anchored the profitability that enabled us to invest consistently and to sustain our growth, all while improving the client experience.

Staying true to our character and reputation, we also knew we had to be open for business under all market conditions, not just when markets were strong. Whether in Europe, Latin America, Asia or North America, our teams have worked hard, built trust and gained share in recent years.

In 2017, the CIB generated earnings of $10.8 billion on $34.5 billion of revenue, resulting in a return on equity (ROE) of 14% that allowed us to continue our pace of investment in our people and technology.

Our CIB franchise also benefits from being part of JPMorgan Chase and collaborating with our firmwide partners: Commercial Banking (CB), Asset & Wealth Management (AWM) and Consumer & Community Banking (CCB).

To cite some examples, CB’s universe of more than 20,000 clients has access to the CIB’s treasury services and foreign exchange products as a result of the close working relationship they share. On the strength of that relationship, nearly 40% of North America Investment Banking fees were derived from CB clients — a record. Family office clients served by AWM are often interested in investing in the types of transactions the CIB brings to market, and the CCB’s relationships with major merchants and businesses generate opportunities as these businesses need to raise capital, seek advisory expertise or require payments services.

Maintaining share, and even growing it, in recent years hasn’t been easy. Having scale and expertise across a set of businesses enabled us to sustain profitability under various market conditions. And while we take pride in our standings, we aren’t complacent about them. Each day, our employees know that J.P. Morgan has to earn client business with innovative solutions that tap the appropriate mix of our products. More than ever, that means delivering best-in-class ideas and service through cutting-edge technology.

Providing easy-to-use technology in order to deliver a great client experience will continue to be a major differentiator in the coming years. That’s why we are always exploring ways to offer our clients faster, better and simpler ways to do business with us. The banks that don’t invest will lose ground and will have a long, difficult catchup process.

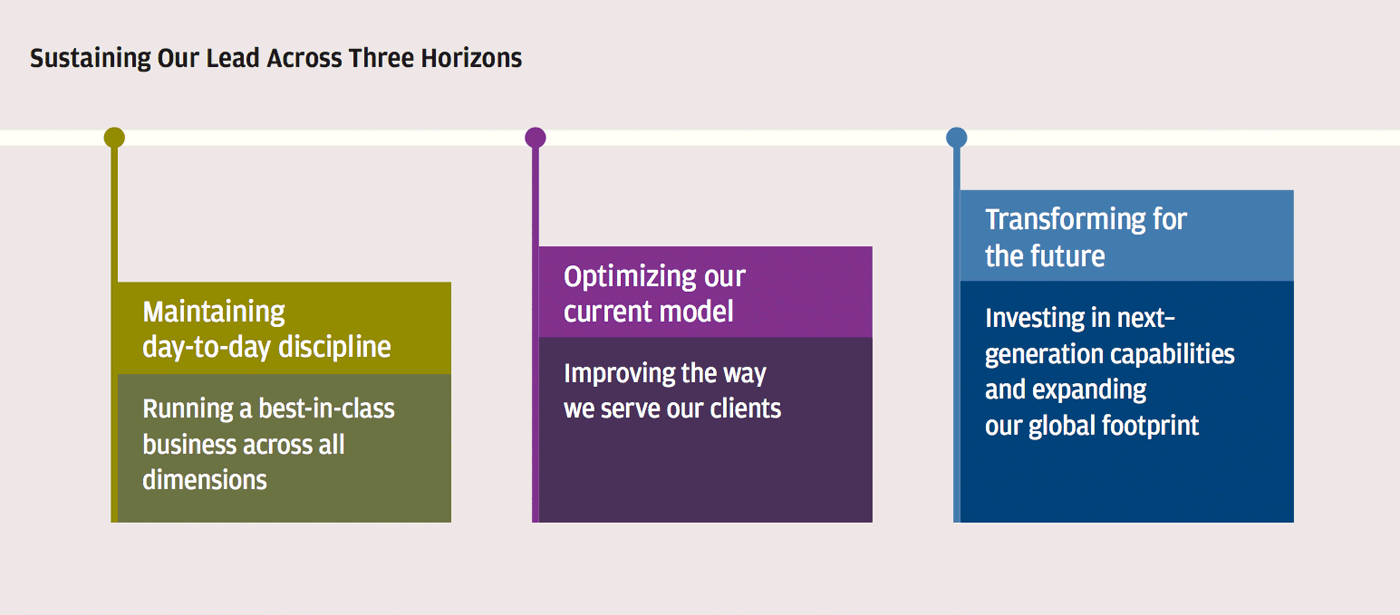

Looking ahead, we are implementing a set of simultaneous priorities — a blueprint for investing that runs in parallel tracks across three time horizons. In the immediate period, we are focused on maintaining day-to-day discipline to support organic growth while holding firm on costs and integrating efficiencies.

At the same time, we are planning and preparing for the changing industry conditions that will affect the business over the medium term, a period defined as the next two to three years, and the longer term, extending 10 years out. The medium term investments we’re making are already enhancing our ability to serve clients and hold the promise of transforming our business.

Looking five to 10 years out, the pace of technological innovation will only quicken as artificial intelligence, robotics, machine learning, distributed ledgers and big data will all shape our future.

We will continue the prudent expansion of our global footprint. J.P. Morgan has been doing business in China, India, Brazil and countries in Africa for decades. And as global economies grow, we are making judicious decisions that will reaffirm our unique position as the leading global financial institution.

Our efforts to expand our coverage of global clients over the last eight years are paying dividends today. Now, with economic growth taking hold across the globe, these clients have turned to us for services, such as cash management, electronic payments and fraud detection.

On the following pages, I will discuss the CIB’s 2017 performance in greater detail, outlining how we intend to prepare for the industry changes that are certain to affect our business over the foreseeable future.

By the numbers: Working for clients

The CIB’s revenue was more than $6 billion higher than its closest competitor, according to industry data provider Coalition.

That financial success is directly tied to how well the CIB delivers for our clients across our businesses. Their success is our success. With the increasingly competitive environment we inhabit today, we take pride in every client assignment and the number of times they choose us for repeat business.

We kicked off 2017 announcing that J.P. Morgan’s Custody & Fund Services business won the largest custody mandate in history. BlackRock is in the process of shifting $1.3 trillion in assets under management over to our platform, validating the investments we’ve made and the resources we’ve added to that business. As the only global custodian with a top Markets franchise, we’re confident that scale, technology and seamless execution will continue to draw clients.

Custody & Fund Services built on its momentum, as evidenced by the $3.9 billion revenue in Securities Services, which was up 9% for the year. Our business has record assets under custody of $23.5 trillion, which increased by 14% compared with 2016.

Treasury Services, a business that supports clients in their cash management needs and is rolling out its real-time payments capability, also continued to perform well through the year, with revenue rising to $4.2 billion, an increase of 15% over 2016. As it serves the needs of increasingly global commerce, Treasury Services’ state-of-the-art technology is reducing to seconds what once took days.

Turning to investment banking, J.P. Morgan set a record in global Investment Banking fees, $7.2 billion, including debt underwriting of $3.6 billion. Measured by market share, in Mergers & Acquisitions (M&A), Equity Capital Markets (ECM) and Debt Capital Markets (DCM), the firm has scored gains since 2015: M&A share rose to 8.6% from 8.4%; ECM was up to 7.1% from 6.9%; and DCM moved to 8.3% from 7.9%.

Our debt underwriting team closed on the largest number of deals in its history, up about 16% over last year. While we witnessed an overall decline in the number of deals over $1 billion, J.P. Morgan still played a key role in the year’s biggest transactions. We served as joint active bookrunner on AT&T’s $22.5 billion bond offering, the third largest of all time, and also served as joint active bookrunner on Amazon’s $16 billion offering to support its acquisition of Whole Foods Market.

J.P. Morgan was also #1 in U.S. initial public offering (IPO) volume and managed the largest number of deals during 2017. Our equity team served as global coordinator or helped to lead more than 40% of the IPOs over $1 billion in size, including Pirelli at $2.8 billion, Altice at $2.1 billion and Netmarble at $2.3 billion.

Our Global M&A team completed the most M&A deals during the year, 354, and had record post-crisis fees for its advisory work. The firm advised on six of the top M&A announced transactions in North America. One of our more visible roles is our work serving as advisor to The Walt Disney Company on its acquisition of portions of 21st Century Fox, including its film and television studio.

Looking at the Markets business, after an exceptionally strong 2016, J.P. Morgan’s 2017 share in Fixed Income, Currencies and Commodities (FICC) decreased marginally to 11.4% from 11.7%. However, offsetting that slight drop, the market share in Equities and Prime rose to 10.3% from the previous year’s 10.1% and shared the top ranking for the category.

We are particularly proud of progress in Prime Services. We have a competitive and complete platform, and we grew global prime balances by 28% last year while increasing market share to 13.8% from 11.3% since 2015.

The CIB’s Global Research team also continued to rank #1 worldwide and across a broad range of equity and debt market categories, providing clients with actionable insights on the markets. The regularity with which our analysts top the rankings is a remarkable achievement. As Markets in Financial Instruments Directive regulations take on a greater impact, quality research will continue to set us apart.

Our fintech future

The CIB is an investment bank, but financial technology forms the bank’s backbone. As part of JPMorgan Chase, the CIB benefits from being part of a firm that draws on the expertise of nearly 50,000 technologists and a 2017 technology budget that amounted to $9.5 billion. But to underscore the firm’s overall commitment, this year’s technology budget totals $10.8 billion, with more than $5 billion earmarked for new investments.

Over the last several years, I have mentioned in my annual letter J.P. Morgan’s commitment to embracing technology. Being creative requires a willingness to take risks. As part of our technology culture, experimentation and failure are okay — it is encouraged, in fact, in order to achieve breakthroughs.

It was only a few years ago that programmers and technology graduates seemed reluctant to build their careers in banks; that’s not the case at J.P. Morgan. Nearly 30% of our recent senior hires in technology came from non-financial services firms, and they’re working on finding solutions to some of the most complex issues in the field.

The divide between the front office and the back office is no more. Our technologists and our product people work side by side, in the same rooms and at the same tables. They’re fully assimilated. That way, the teams are able to work in tandem to build the next-generation systems best targeted to meet the needs of our clients and the business.

In the age of smartphones, when people only need an app in order to trade, our mission is to make it possible for clients to trade and interact with us easily and in whatever way they choose. If they want to access our top-rated research or conduct business with us, we want them to have the freedom to choose the option they prefer — whether it’s in person or by telephone, website, mobile app, online trading platform or third party.

On the strength of its scale and technology, J.P. Morgan processes $5 trillion in payments and trades billions of dollars electronically every day. In equities, nearly 100% of the tickets are handled electronically, representing 89% of notional volume. The macro desk, primarily foreign exchange, handles 97% of its tickets electronically, corresponding to 46% of its volume.

We have assembled talented teams to drive innovation in artificial intelligence, blockchain technology, big data, machine learning and bots, with the objectives of improving our efficiency and enabling us to serve more clients with greater effectiveness, depth and sophistication. As a result, many of our initiatives are already showing promise in terms of charting their future expansion and application.

We’re piloting several ventures to test the viability of technology in real-world situations. Late in 2017, J.P. Morgan’s Treasury Services and its Blockchain Center of Excellence launched a payment network powered by distributed ledger technology in partnership with the Royal Bank of Canada and the Australia and New Zealand Banking Group. Called the Interbank Information Network, the pilot’s objective is to use blockchain technology to process bank-to-bank transactions faster, alleviating situations where payments get held up due to mismatched information.

Because our people are our greatest strength, we value technology as a tool to enhance their ability to provide the best-in-class ideas and solutions that our clients expect from us.

Sustainability

Before I close, I want to highlight what the CIB, along with the overall JPMorgan Chase organization, is doing to further a sustainable environment. On behalf of the entire organization, I have been asked to champion our sustainability efforts. It’s an issue that is important to me and is one that our employees care about deeply as well. Employees want to work for an organization they can be proud of and that shares their values. Through our sustainability initiatives, the firm is demonstrating its commitment to those shared concerns and is taking action.

In 2017, the Operating Committee ramped up our firmwide sustainability efforts in a big way. Over the next three years, JPMorgan Chase intends to become 100% reliant on renewable power. In our own workspace, we are executing several strategies to increase our energy efficiency. We are installing building management systems and are in the process of retrofitting 4,500 Chase branches with LED lighting as part of the world’s largest LED lighting installation. We will also produce power for some of our own buildings by developing on-site solar power generation. We expect that these measures will reduce total power consumption by 15%.

Using the firm’s expertise in the renewable power sector also enables us to support the development of renewable projects — and advances our goal of 100% reliance on renewable power — in other substantive ways. One example is the Buckthorn wind farm, a 100-megawatt project in Texas that came online last December. More than half of the wind farm’s output will be purchased by our Global Real Estate team and the remainder by our Commodities team. This is good for the environment and good for business.

In our effort to finance green initiatives, we’ve raised the stakes, committing $200 billion for such projects by 2025. From 2016 to year-end 2017, we reached $60.6 billion cumulatively toward that goal. The company plans to increase its recycling efforts and to pioneer the use of greener materials in its products and processes.

We’ve also continued our leading role as an underwriter of green bonds. In 2017, Apple Inc. raised $1 billion using green bonds — the second green bond Apple has issued with J.P. Morgan as an active bookrunner.

In addition, J.P. Morgan led some of the largest clean energy transactions, such as serving as financial advisor to Enbridge on its C$2.1 billion partnership with EnBW on the Hohe See and Albatros offshore wind farms in the North Sea. J.P. Morgan also was a bookrunner for energy company Iberdrola’s first issue of green hybrid bonds on the euromarket, valued at €1 billion. The proceeds will be used to refinance investments in various renewable projects in the United Kingdom.

Closing

The CIB has had another successful year, gaining share and generating healthy profits by remaining intently focused on serving our clients and benefiting from our scale, breadth and global reach.

J.P. Morgan is known for being a place where people want to work, where we can attract and retain the best talent, where their work is recognized and where the culture is collaborative. That is critical to our ongoing success. I, along with the entire CIB management team, appreciate the dedication, enthusiasm and intelligence our employees bring with them every day.

Finally, on a personal note, I’d like to express my gratitude to my partners on the Operating Committee. The collaboration that exists throughout the firm is the foundation that supports our strength year after year.

Daniel Pinto

Co-President and Chief Operating

Officer, JPMorgan Chase & Co., and CEO, Corporate & Investment Bank

2017 Highlights and Accomplishments

- The CIB had earnings of $10.8 billion on $34.5 billion of revenue, producing a best-in-class ROE of 14%.

- We retained our #1 ranking in global Investment Banking fees with an 8.1% market share, according to Dealogic.

- Debt Capital Markets was #1 in closing deals, setting a record for the highest number of deals bookrun in the firm’s history.

- Equity Capital Markets was #1 in U.S. IPO volume and in the number of deals.

- M&A was #1 in the number of deals completed: 354.

- The CIB continued investing in technology to offer clients a broader array of trading platforms while making it easier and faster to trade with us.

- Institutional Investor magazine’s survey of large investors ranked J.P. Morgan as the #1 Global Research Firm. Across individual categories, J.P. Morgan ranked #1 in All-America Fixed Income Research and All-Europe Fixed Income Research. It also ranked #1 in All-America Equity Research and ranked #2 in Emerging Markets.

- Treasury Services revenue rose to $4.2 billion, an increase of 15% over 2016, and continued momentum in Custody & Fund Services drove 9% growth in Securities Services revenue for the year.

- Custody & Fund Services had a record $23.5 trillion in assets under custody while also achieving the highest ever client satisfaction and retention levels.