Asset & Wealth Management

J.P. Morgan Asset & Wealth Management (AWM) has been a fiduciary of client assets for nearly two centuries, with our roots dating back to the earliest cross-border fund managers in the industry. Over these many decades, we have managed the assets of institutions, central banks, sovereign wealth funds and individuals, helping them navigate their assets from the beginning stages of cash management all the way through complex multi-generational portfolios.

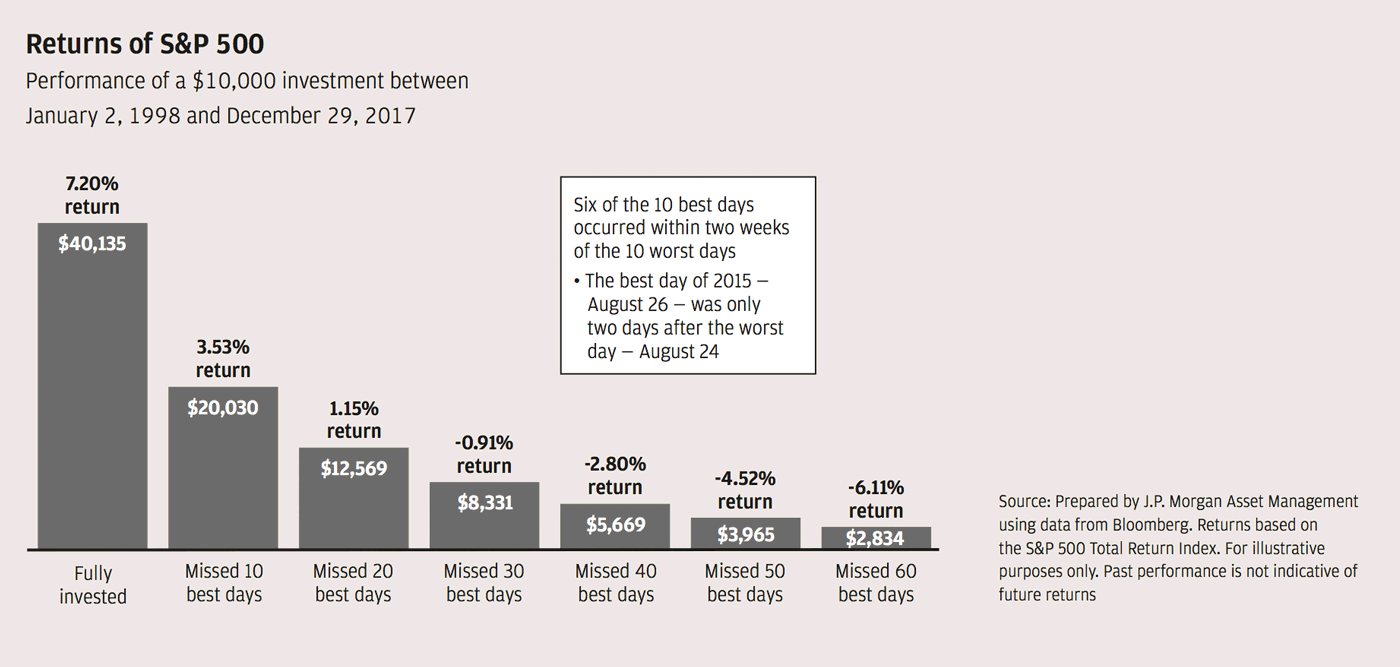

Our breadth of experience, through economic and geopolitical cycles, gives us the insights to help clients make smart, long-term investment decisions. It also gives our portfolio managers and advisors the perspective and fortitude to remain disciplined risk managers and opportunistic risk takers in today’s ever-evolving market environment.

Today, while the fundamentals of managing money still require having the best investment minds, they must be coupled with major investments in technology. This enables more comprehensive analysis of enormous data sets, faster and more optimal execution in portfolios, and seamless delivery of all that we do in both human and digital form. The global size and scale of AWM, as well as its connectivity with JPMorgan Chase’s broader technology expertise, continue to be competitive advantages for our teams, our clients and our shareholders.

A record year for AWM

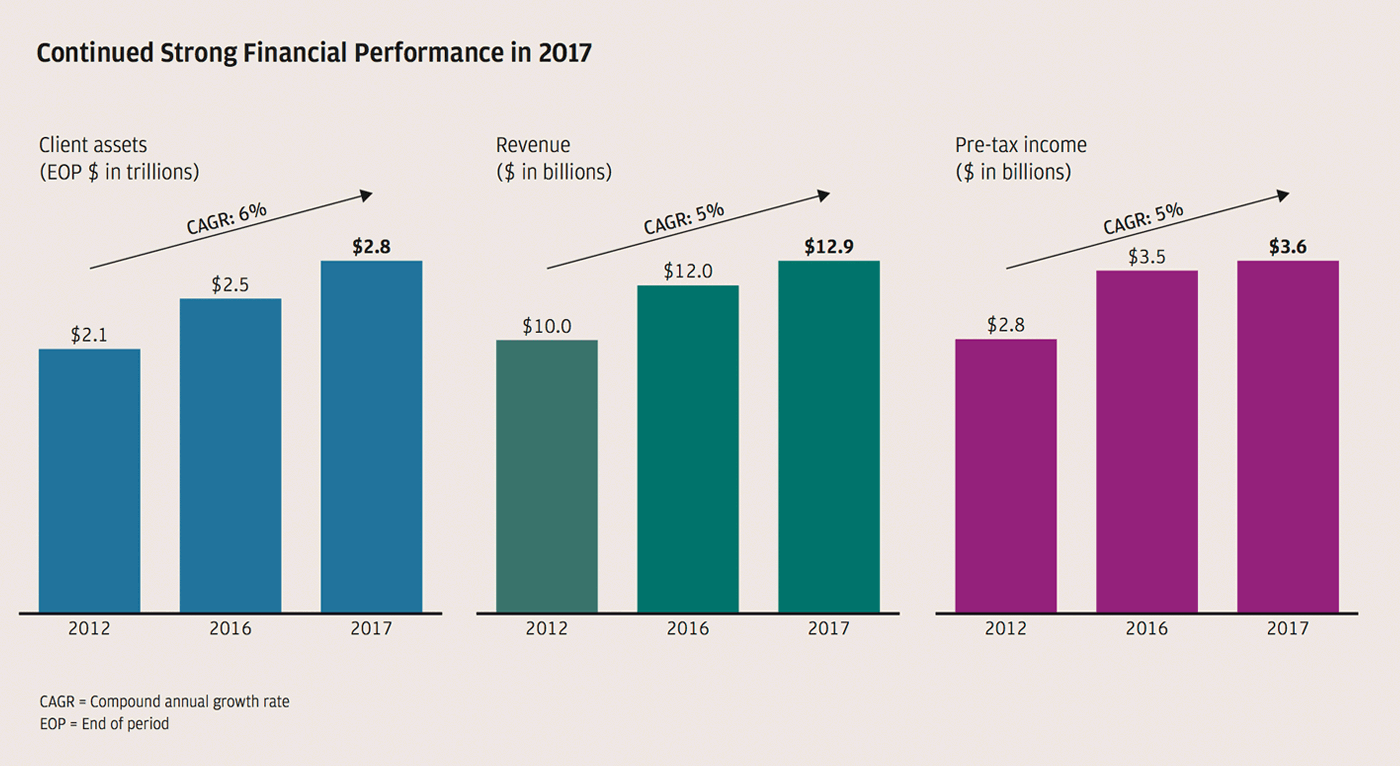

For investors in JPMorgan Chase, AWM continues to be a consistent revenue and earnings growth contributor to the company, with a very strong return on shareholder capital.

AWM’s total client assets in 2017 grew to a record $2.8 trillion, with revenue of $12.9 billion and pre-tax income of $3.6 billion also hitting their highest levels ever. However, the consistent growth trajectory those numbers represent is just as important. From 2012 to 2017, we achieved a 6% compound annual growth rate (CAGR) for client assets and a 5% CAGR for both revenue and pre-tax income.

Rising client assets is a critical indicator because it tells us that clients continue to entrust even more of their capital with us every year. In 2017, clients entrusted us with an additional $84 billion of long-term assets — or $1 billion to $2 billion of incoming money every week. We have increased net new assets every year since 2004, with $388 billion coming over the past five years.

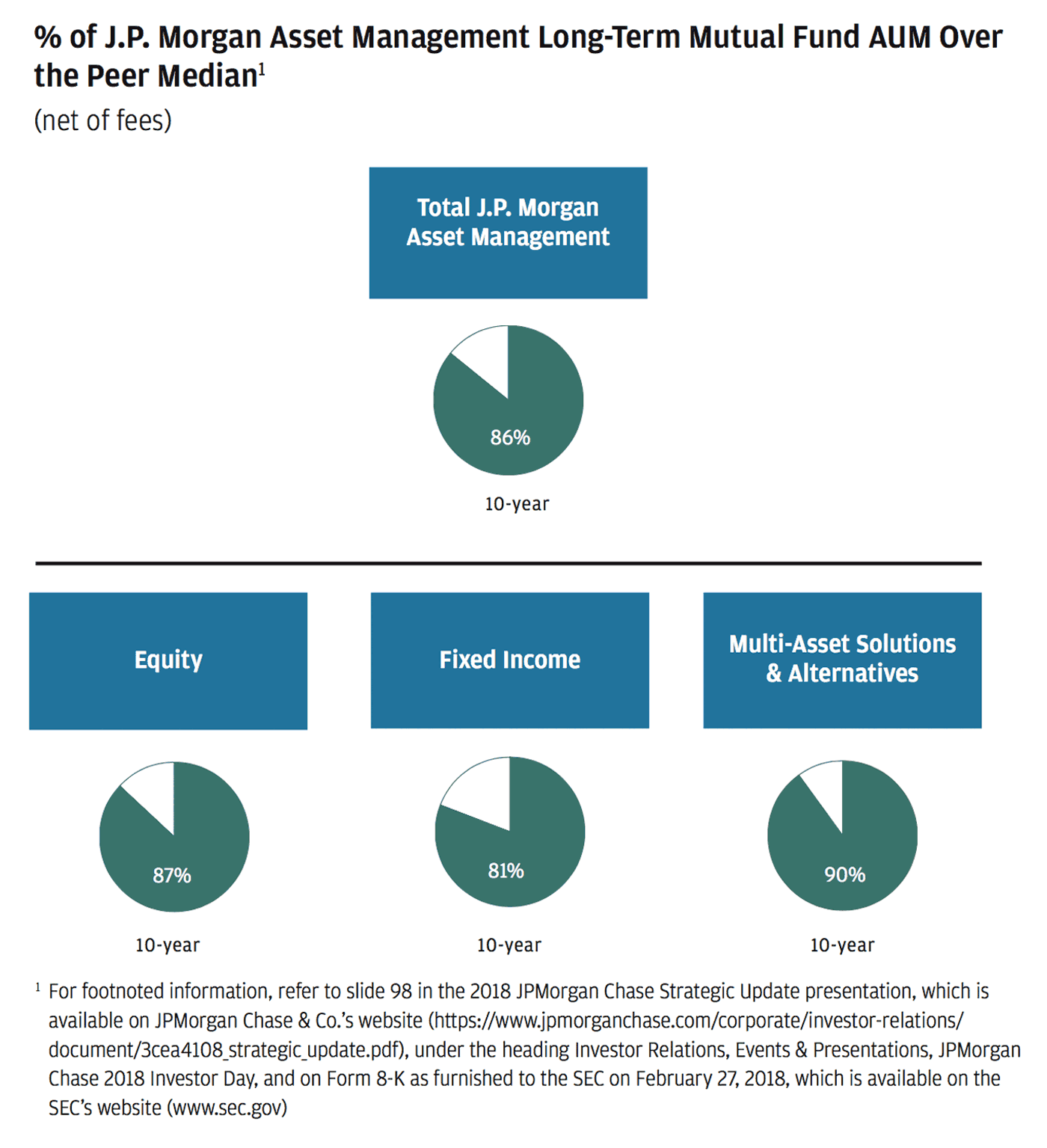

The primary reason clients turn to J.P. Morgan to manage their assets is because of our strong and consistent investment performance. In 2017, 86% of our long-term mutual fund assets under management outperformed the peer median in the 10-year period, including 87% for equity, 81% for fixed income, and 90% for multi-asset solutions and alternatives.

Covering the full spectrum of clients

AWM delivers investment advisory expertise to clients across the firm, ranging from Chase customers investing their first $100 to the world’s wealthiest individuals and families. We also manage the portfolios of many of the largest sovereign wealth funds, pension funds and central banks in the world.

Across the Wealth Management business, in addition to investments, we help clients with their banking needs. This ranges from cash deposits to loans across many areas from real estate to investment capital for a new business. The deposit base of these private clients has grown consistently over the past five years, achieving a 10% CAGR and reaching nearly $300 billion. On the lending side, year-end spot balances of $134 billion represent a 9% CAGR over the past five years. This was accomplished with a well-managed risk profile, resulting in strong and consistent credit performance, and low charge-offs of less than 10 basis points over a cycle.

In addition to traditional investing and banking, AWM has developed a full suite of solutions to meet the complexity of our clients’ needs — from alternative investments to trust and estate planning to philanthropic advice. Our platform is among the most comprehensive in the industry, enabling us to serve clients across both sides of their balance sheet and to offer insights and expertise into virtually every area of their financial life.

As wealth grows around the world, we continue to hire advisors to deliver J.P. Morgan’s capabilities to more clients. We expect to hire in excess of 1,000 advisors over the coming years to expand in both new and existing markets. Our extensive experience in hiring and training has led our advisor productivity to rank among the top in the industry.

An increasingly digital world

Our clients’ needs and behaviors are changing — and we are changing along with them.

Last year, we formed a new business, Intelligent Digital Solutions (IDS), to help drive our efforts around digital transformation and big data. This group is unifying and optimizing our use of data analytics to transform how we apply these added insights efficiently and effectively in managing portfolios. IDS also is helping us digitize everything we do to make it easier for clients to gain 24/7 access to our investment ideas, insights and execution.

Additionally, we are building a digital wealth offering that provides clients access to proprietary tools that can complement their personal relationship with an advisor or be used when they want to interact with us entirely online. Ultimately, we want to be at the intersection of human and digitally enhanced advice.

Simplify for growth

Our goal is not to be the biggest asset manager but rather to be the best at what we do. Knowing that what has made us successful in the past will not necessarily be sustainable or sufficient for the future, we relentlessly challenge ourselves to focus on the products and services that are most important to clients and in which we have a competitive advantage.

We bring equal parts innovation and introspection in evaluating where to place our extra investment dollars and resources to ensure we have a differentiated offering. Last year, we launched more than 70 new fund strategies to our platform, a third of which are in our Beta Strategies lineup.

At the same time, if we aren’t convinced we have a long-lasting advantage, we realign those resources to areas in which we do. In 2017, we liquidated or merged more than 70 funds and implemented significant fee reductions on 58 different funds across 235 share classes.

Above all, first-class business in a first-class way

I am proud of what we have delivered for our shareholders and clients and am even more excited about the investments we are making to position ourselves for the future. We have been working for two centuries as stewards of our clients’ wealth to continuously refine what we do and how we do it. We remain committed to delivering first-class business and that in a first-class way.

Mary Callahan Erdoes

CEO, Asset & Wealth Management

2017 Highlights and Accomplishments

Business highlights

- Fiduciary mindset ingrained since mid-1800s

- Positive client asset flows every year since 2004

- Record revenue of $12.9 billion

- Record pre-tax income of $3.6 billion

- Record $2.8 trillion in client assets

- Record average loan balances of $123 billion

- Record average mortgage balances of $37 billion

- Retention rate of 98% for top senior portfolio management talent

Leadership positions

- #1 Private Bank Overall in North America (Euromoney, February 2018)

- #1 Private Bank Overall in Latin America (Euromoney, February 2018)

- Best Private Bank in Asia for Ultra-High-Net-Worth (The Asset, July 2017)

- Best Asset Management Company in Asia (The Asset, May 2017)

- Top Pan-European Fund Management Firm (Thomson Reuters Extel, June 2017)

- Best New Alternatives ETF and Best New Active ETF (ETF.com, March 2017)

- IT Team of the Year (Banking Technology magazine, December 2017)

- Social Media Leader of the Year (Fund Intelligence, March 2017)