Introduction

Commercial Banking (CB) is the nexus of everything we do at JPMorgan Chase. The hard work of our dedicated team, along with the unmatched capabilities across our firm, allows us to build deep, lasting relationships with so many great companies. We are incredibly proud of the role we play in the success of our clients, and we are grateful every day for the confidence they place in us.

One such success story is siggi’s yogurt (siggi’s), celebrated as the fastest-growing national yogurt brand in 2017. What started as selling his unique recipe out of coolers at local outdoor markets in New York, founder Siggi Hilmarsson quickly turned his humble operation into a thriving business. Up until 2016, Siggi and his team had fully funded the company on their own, but when their growth accelerated, we worked with them to deliver their first bank credit facility. As Siggi shaped the company’s plans for the future, we provided differentiated industry advice, and in 2017, we were selected to advise siggi’s on the sale of the company — the capstone transaction for an incredible brand and business. At every step, we were delighted to support Siggi’s passion to share his native Icelandic recipe with households around the country.

Our dedication to clients, like siggi’s, continues to drive our strategy and how we do business in CB. I’m excited to share highlights of our 2017 performance, the investments we are making to deliver more value to our clients and the steps we are taking to reach our full potential.

2017 performance

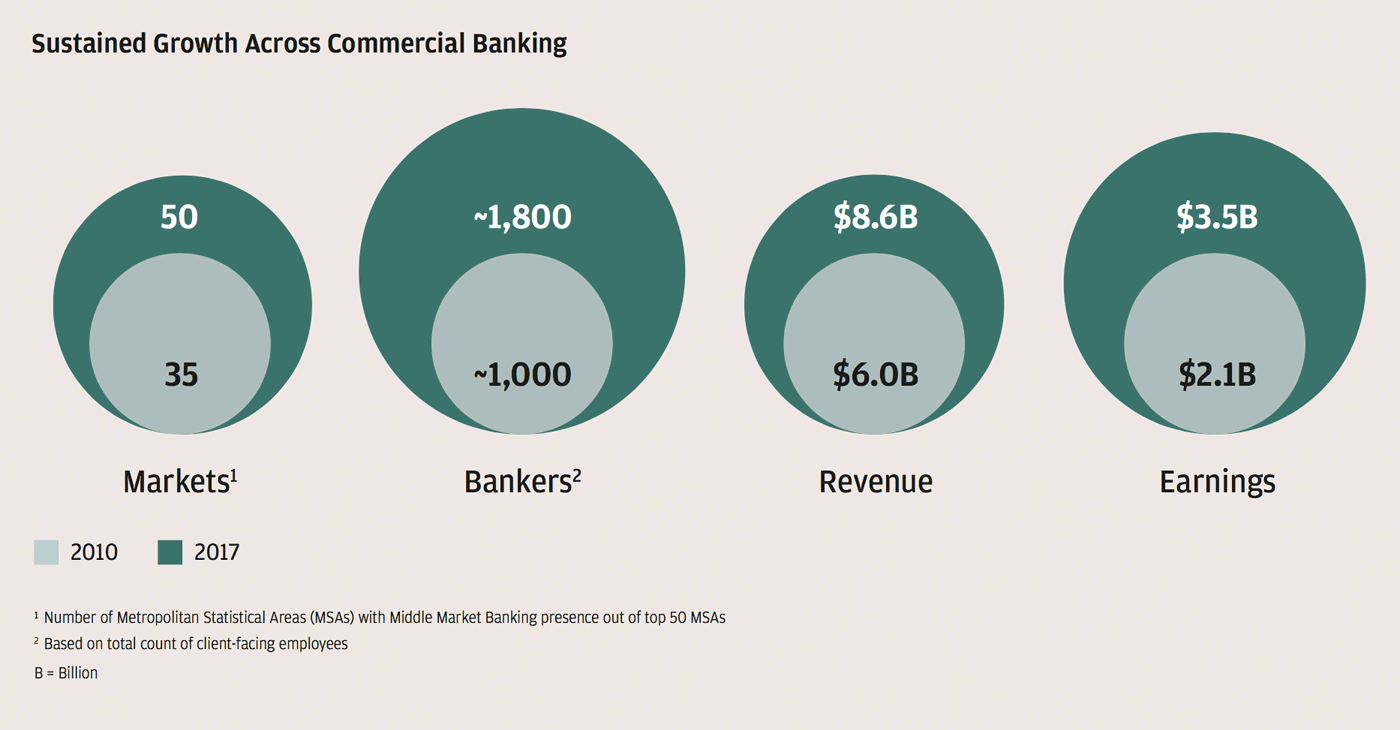

With strong momentum across all of our businesses and continued focus on executing our strategic priorities, CB delivered record financial results for 2017, earning $3.5 billion of net income on revenue of $8.6 billion. We achieved a notable return on equity of 17% and an industry-leading overhead ratio of 39%, even while making significant investments across the business.

Higher interest rates, disciplined loan growth and outstanding credit quality all contributed to our record performance. We ended the year with record loan balances across our Commercial & Industrial and Commercial Real Estate (CRE) businesses, up $15 billion or 8% from the prior year. Staying true to our proven underwriting standards, we have remained highly selective in growing our loan portfolio — 2017 marked the sixth straight year of net charge-offs of less than 10 basis points. This ongoing discipline is especially important given the late stages of the current economic cycle and competitive pressures in the market.

These record results reflect our sustained investment, the incredible effort of the CB team and their continued focus on our clients. We are committed to building upon these great milestones and see tremendous potential across our franchise.

Executing our long-term, organic growth strategy

Our strategy to grow CB remains consistent year after year: Add great clients and work hard to deepen those relationships over time by delivering valuable solutions to help them succeed. We have been steadily investing in the business, taking a long-term disciplined approach. Since 2010, we have expanded into 33 new cities and added more than 800 bankers, helping us achieve sustained organic growth across our business.

Expanding into new markets

Being able to deliver the broad-based

capabilities of JPMorgan Chase at a

very local level is a key competitive

advantage. In 2017, we added client

coverage in six new high-potential

markets and now have dedicated

teams in all of the top 50 metropolitan

statistical areas. We look forward

to growing our business in these

terrific locations and expanding into

additional communities in the future.

Investing in our team

Our success depends 100% on our

people. As such, we are making significant

investments in our training

and development capabilities, all

focused on providing our bankers

with the deep expertise they need to

best serve our clients. In 2017, we

hired more than 100 bankers to support

the growth and expansion of our

business, and we expect to add more

great bankers in the coming year.

Delivering value to our clients

Expansion is only one part of our

growth strategy — deepening our relationships

with our clients is equally

important. Given the breadth of our

capabilities, we can support the needs

of businesses of all sizes — fast-growing

companies, like siggi’s, as well as

large, multinational corporations.

With the quality of our team, differentiated advice, and ability to deliver a full range of solutions locally, not many other banks can serve clients the way we can. In 2017, our clients had more than $135 billion in assets managed by our leading Asset & Wealth Management business, generated nearly 40% of all North America Investment Banking (IB) fees for the Corporate & Investment Bank (CIB), and made over 13 million transactions in our branches.

Smart growth in our CRE business

We have been building a CRE business

that will stand the test of time.

Although we are in the late stages

of the real estate cycle, market conditions

for our targeted asset classes

remain strong, and we were able to

grow our CRE loan portfolio by $12

billion in 2017. Importantly, maintaining

our strict underwriting standards

and conservative approach, we are

focusing only on the loans and markets

we know best. If we can stay true

to these fundamentals, we believe we

can continue to selectively grow our

real estate loan balances.

Innovating across CB

Complementing our investments to drive growth in our business, we are working to bring new technologies and innovation to transform how we interact with our clients. Our approach to innovation is anchored on having a full understanding of the identified, as well as unidentified, needs of our clients. Over 99% of companies in the U.S. are small to midsized businesses. We know they have unique behaviors and concerns. They tell us they don’t feel in control. Small business owners and their teams can be stretched, and they struggle with forecasting, collecting receivables and managing vendors. To help, this past year we increased our payments, technology and digital investments and put more capital and resources into delivering real solutions to these challenges.

Digital

In 2017, we partnered with Consumer

& Community Banking to launch a

new digital platform, Chase Connect,

that is tailored to meet the needs of

small and midsized companies. This

platform provides our clients with a

simple and convenient experience,

integrating account information, payables

and receivables. Chase Connect

allows clients to see all of their

accounts in one place, stay organized

when paying bills, view payment

history, approve transactions quickly

and easily from one location, and

receive customized account alerts.

We are focused on having the best integrated, digital capabilities for

clients and will continue to invest in

enhancing the functionality of this

robust platform.

Payments

Recognizing that managing payments

is a major pain point for our

clients, we completed a comprehensive

analysis to determine a digital

solution. In 2017, we announced our

investment in and partnership with

Bill.com, the largest digital business-to-business payments network in the

U.S. Seamlessly integrated into

Chase Connect, this new automated

payments capability will enable our

clients to easily send and receive

electronic invoices and payments,

saving them substantial time and

effort. We are very excited about this

innovative solution and look forward

to bringing this functionality to our

clients in 2018.

Client experience

In addition to offering new capabilities,

we are making great progress in

re-engineering our core processes to make it easier for clients to do business

with us. For example, we are

working to streamline and digitize

the onboarding process to ensure

that our clients’ first experience with

JPMorgan Chase is simple and transparent.

Through these efforts, clients

will be able to provide information

electronically, e-sign and upload documents

digitally, and receive realtime

support via online chat capabilities.

Clients are at the center of

everything we do, and our work to

deliver more value and an exceptional

experience has no finish line.

Looking forward

While we celebrate CB’s record 2017, we do not take our performance for granted. We understand that complacency and standing still in any way will threaten the future success of our business. As such, we remain focused on building upon our franchise to provide even more support to our clients. By combining the core strength of our business with new technologies and innovation, we believe we can further extend our competitive advantages.

I want to thank all of our great clients, like siggi’s, for the trust and confidence they place in JPMorgan Chase. I also want to thank the entire CB team for their continued dedication to our clients and their communities. I am excited about the direction of the business for 2018 and beyond.

Douglas Petno

CEO, Commercial Banking

2017 Highlights and Accomplishments

Performance highlights

- Delivered record revenue of $8.6 billion

- Grew end-of-period loans 8%; 30 consecutive quarters of loan growth

- Generated return on equity of 17% on $20 billion of allocated capital

- Continued superior credit quality — net charge-off ratio of 0.02%

Leadership positions

- #1 U.S. multifamily lender footnote1

- #1 in overall satisfaction, perceived satisfaction, customer relationships and transactions/payments processing — CFO magazine’s Commercial Banking survey, 2017

- Top 3 in Overall Middle Market, Large Middle Market and Asset Based Lending Bookrunner footnote2

- Winner of 2017 Greenwich Best Brand Awards in Middle Market Banking — overall, loans/lines of credit, cash management, international products/services and investment banking

- Winner of 2017 Greenwich Excellence Awards in Middle Market Banking: international capabilities, cash management online banking functionality, cash management mobile banking functionality

Business segment highlights

- Middle Market Banking — Record gross Investment Banking revenue footnote3; added eight new offices

- Corporate Client Banking — Record revenue, with average loans up 10% from prior year

- Commercial Term Lending — Record average loans; completed rollout of Commercial Real Estate Origination System for MFL business

- Real Estate Banking — Record revenue, with average loans up 27% from the prior year

- Community Development Banking — Record New Market Tax Credit equity investment production of $1.2 billion — Financed more than 9,000 units of affordable housing in 70+ cities through construction lending commitments of over $1 billion

Firmwide contribution

- Commercial Banking clients accounted for 38% of total North America Investment Banking fees footnote4

- Over $135 billion in assets under management from Commercial Banking clients, generating more than $475 million in investment management revenue

- $479 million in Card Services revenue footnote3

- $3.4 billion in Treasury Services revenue

Progress in key growth areas

- 1

- Rank based on S&P Global Market Intelligence as of 12/31/17

- 2

- Thomson Reuters LPC, FY17

- 3

- Investment Banking and Card Services revenue represents gross revenue generated by CB clients

- 4

- Represents the percentage of CIB’s North America IB fees generated by CB clients, excluding fees from fixed income and equity markets, which is included in CB gross IB revenue

- 5

- Non-U.S. revenue from U.S. multinational clients

- CAGR = Compound annual growth rate

MFL = Multifamily lending