Corporate & Investment Bank

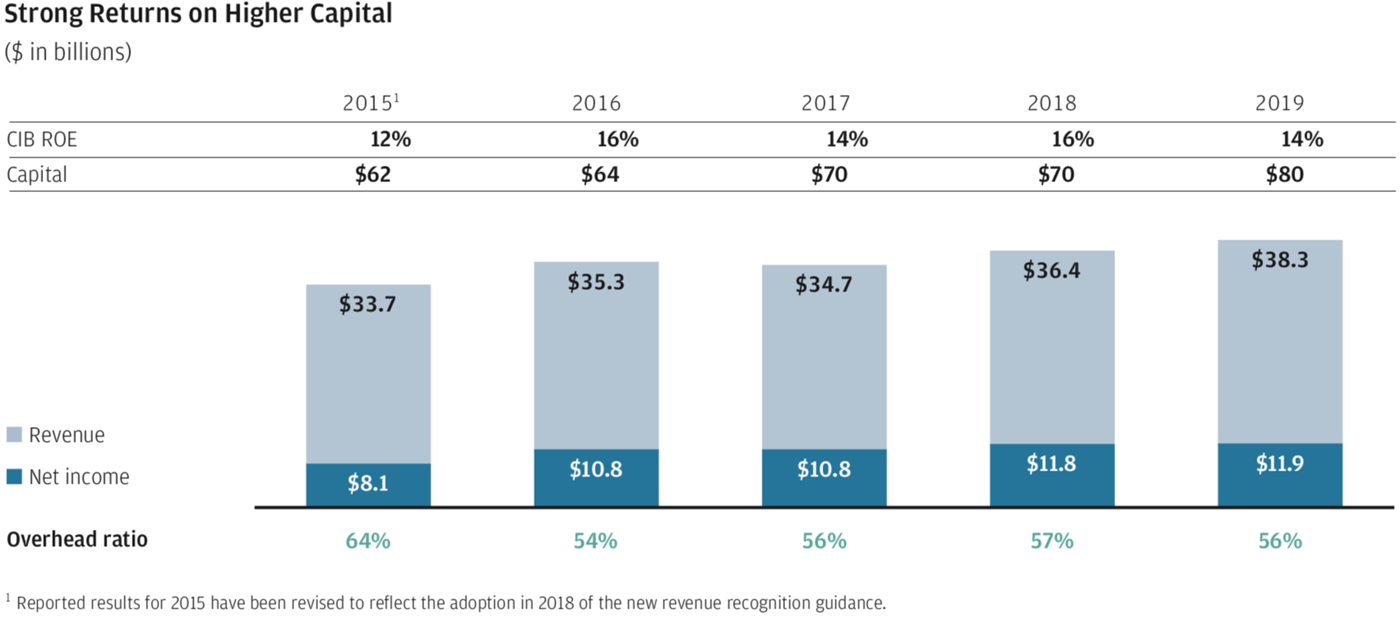

In 2019, the Corporate & Investment Bank (CIB) generated earnings of $11.9 billion on revenue of $38.3 billion – a record year for our business.

This standout performance is the culmination of a journey that began during the 2008 financial crisis when clients turned to J.P. Morgan for capital, liquidity and a safe haven.

In 2009, 10 years ago, client business drove earnings in our investment bank to a record $6.9 billion. By 2019, the CIB's earnings had topped the entire firm's net income from 2009. As we close out the decade, it is worth reflecting on the strategy that brought us to this point, helping us to generate record revenue and profits and a consistently strong return on equity (ROE) while adding $42 billion to the CIB's capital base and investing substantially in the business.

Global, complete and at scale

The success of our business over the last decade has hinged chiefly on our steadfast pursuit of three strategic goals: being global, complete and at scale. The benefits of these qualities may seem obvious today but weren't quite so clear a decade ago.

New regulations that followed the financial crisis helped make the banking system safer overall but also made investment banking more expensive. Banks had to hold a lot more capital, which reduced leverage and ROE. At the same time, major investments were needed in technology and compliance.

This created a predicament for banks emerging from the crisis, and they chose several different paths. Some decided to cut back on businesses that were less profitable or carried too much capital. Others retreated from traditional investment banking businesses altogether.

At J.P. Morgan, we believed that clients would always need an array of global banking products even though margins on these products varied. We looked at our client relationships holistically and prioritized long-term value for them over short-term profitability for us. That decision – to continue to provide a full suite of products and services for clients across the globe – has proved to be mutually beneficial.

Having scale has been equally critical to our success. Following the financial crisis, we believed that clients would gravitate to the best ideas and offerings, particularly if they could be accessed anywhere and at any time.

Over the years, that scale has become a springboard for growth. In 2010, we began to expand our international corporate banking effort to include multinational clients around the globe, with 100 bankers dedicated to serving 2,200 clients. Today, our 400 corporate bankers cover 3,300 companies and their subsidiaries worldwide. In addition, we are partnering with Commercial Banking to extend our services to middle market clients internationally.

Commitment and consistency

Supporting clients during periods of crisis has always been a hallmark of our business. A decade ago, when investors were worried about bank exposures in struggling economies such as Ireland, Greece, Portugal, Spain and Italy, we did not retrench. On the contrary: In 2009 and 2010, we stood by those countries, raising €7.5 billion and €11 billion for Greece and Italy, respectively. That support continues to this day. Last year, we opened a state-of-the-art office in Dublin, which is now a thriving center of technology and commerce.

That commitment and consistency are now spurring the firm's expansion in the world's fastest-growing economies. Ten years ago, regulatory constraints on foreign banks severely restricted what we could offer clients in China. Today, we have approvals from Chinese authorities to open a majority-owned securities joint venture with a path to 100% ownership. Bringing our full suite of banking capabilities to China will enable its companies to grow beyond the country's borders and allow more investors to access its market. This sets us up for tremendous growth in one of the world's largest economies while retaining a prudent approach to expansion.

Stable returns and continuity

The diversity of our CIB businesses has served us well, especially during times of market stress, and we have delivered consistent returns through the entire economic and market cycle. Our traditional investment banking businesses of Markets and Banking have delivered a combined ROE ranging from 14% to 18% over the past five years. Meanwhile, Securities Services and Treasury Services, the traditional transaction banking businesses, have delivered between 10% and 20% during the same period. This means that for the past five years, the combined CIB has achieved an average ROE of 15%.

Equally critical to our long-term success is attracting and, more important, retaining top talent to ensure our clients receive best-in-class execution and consistency in their experience. This is a particular priority in the Investment Banking business, where clients choose us to lead deals because of trust earned over many years.

Our financial stability and continuity of personnel enable us to build effectively on our progress and invest year after year. That investment includes a firmwide technology budget of about $12 billion, much of it directed toward CIB systems. Not only is technology the structural underpinning of our business, but it is also a power that we have learned to scale and selectively share with clients who seek the same cutting-edge analytical and risk mitigation tools that our professionals use in-house.

And while we are more efficient than we were five years ago, there is still more output to be won per dollar of investment. As we modernize our infrastructure and scale our technology capabilities, we will continue to make key investments required to "change the bank" while deploying resources needed to "run the bank" efficiently.

2019 performance

The CIB's record 2019 earnings of $11.9 billion on record revenue of $38.3 billion allowed us to maintain our position as the world's top investment banking franchise for the 11th consecutive year. In addition, we earned $7.6 billion in global investment banking fees, narrowly beating our all-time record of $7.5 billion in 2018.

In the context of generally flat industry revenue, the CIB has won more business and gained greater wallet share than any other competitor over the last five years, according to Dealogic. We ended 2019 with a global wallet share of 9.0%, the highest attained in a decade.

By line of business, we ranked #1 in wallet share for both Equity and Debt Capital Markets during 2019, raising more than $530 billion for clients around the world. J.P. Morgan was bookrunner on more equity deals than any other bank, a feat we achieved in eight of the last 10 years. And our 9.4% share of the global wallet was the highest of any bank during the last decade.

J.P. Morgan brought 79 companies public in 2019, including several highly anticipated "unicorns," finishing the year as the #1 underwriter of initial public offerings (IPO) by wallet share. At the same time, our Private Capital Markets group raised more than $13 billion for clients, making it a fast-growing part of our business last year.

In a year characterized by cross-border deals, our Debt Capital Markets business acted as the world's leading bookrunner and retained its #1 position with 8.7% of global wallet share. The business showed its strength across product lines, ranking #1 for wallet share in high-grade, high-yield and investment-grade issuance, as well as in leveraged loans.

In our Mergers and Acquisitions (M&A) business, J.P. Morgan ranked #2 globally in announced dollar volume and wallet share, as clients continued to turn to us for complex and transformative deals. Although the global M&A wallet decreased 10% year-over-year, J.P. Morgan gained share across regions, earning global advisory fees of $2.4 billion, 5% shy of our 2018 record.

In our Markets business, which serves more than 6,500 clients, revenue totaled nearly $21 billion in 2019, up 7% from the prior year. The business achieved an overall ROE of 13% despite the additional capital we invested in our trading businesses in recent years.

Approximately $46 billion of stocks cross our Equities Markets trading desks each day. The business generated $6.5 billion in revenue in 2019, making J.P. Morgan the top bank by wallet share, with 11.3%, up from 8.4% in 2015. Our Cash Equities business continued to grow revenue and share, and our balances in Prime Finance finished the year at all-time highs.

It was an exceptional year for our Fixed Income Markets business. Revenue rose 13% to $14.4 billion, with a particularly good performance in securitized products and a recovery in the credit and rates markets from the previous year.

Wholesale Payments celebrated its first year as a combined business that brought together the services we offer to corporate treasurers with those for global merchants. The business performed well during a year in which the Federal Reserve cut interest rates multiple times and margins on deposits tightened.

Wholesale Payments supports clients across the bank; within the CIB alone, Treasury Services revenue was up 39% since 2015. Cash management and clearing were among the strong revenue generators in 2019. In addition, the acquisition of Philadelphia-based InstaMed, an innovative healthcare payments company, was the firm's largest since the financial crisis.

Ongoing investments in the business, which processed $43 million in payments per second last year across more than 120 currencies, helped drive organic growth and a healthy pipeline. In basic terms, Wholesale Payments enables clients to make, manage and accept payments securely anytime, anywhere and by any method. Our opportunity here is tremendous, particularly as business gravitates to larger banks with global scale.

Securities Services, which provides post-trade services such as custody and fund administration, generated $4.2 billion in revenue during 2019, down slightly from the previous year but up 16% since 2015. Although deposit margins narrowed due to lower interest rates, we continued to invest in products, systems and services. The business has generated record growth over the last five years, with assets under custody footnote1 up 41% and assets under administration footnote2 up 55%.

Embedding sustainability

At J.P. Morgan, a readiness to adapt has always characterized the way we do business, and our approach to environmental, social and governance issues is no different. The issue of environmental sustainability is gaining urgency by the day and is among the growing risks being evaluated by our business and policymakers.

We understand the pressing nature of climate change and believe that companies like ours can add tremendous value by helping global companies – and the global economy – transition to cleaner energy.

Currently, around 80% of the world's energy is sourced from fossil fuels, which remain the primary source for heating homes and powering cars. We are working to reduce this dependency by committing billions of dollars to sustainable projects in 2020 alone, including green technologies. Furthermore, we are embedding sustainability into many of our daily business practices, from assessing risk to designing products to advising clients.

We have also tightened restrictions on certain activities, such as financing for coal mining and Arctic drilling, and are on track to meet our own commitment from three years ago to source renewable energy for our entire 2020 global power needs. These initiatives are enthusiastically supported by our employees, as well as by the next generation of recruits, who want J.P. Morgan to lead in this space.

That said, business alone cannot ensure the transition to a lower-carbon economy. Government policy is crucial. Recently, we joined the Climate Leadership Council, a group promoting a bipartisan road map for a revenue-neutral, carbon tax-and-dividend framework for the U.S.

Conclusion

Our impressive 2019 performance was not easily won, as competition and geopolitical uncertainty intensified. The year 2020, however, has already presented all of us with our most challenging problem yet: a pandemic of proportions not seen for 100 years.

Across the firm, taking care of our employees and standing by our clients during events like the coronavirus are critical priorities. With so many companies, institutions and governments relying on J.P. Morgan for their own operations and economic well-being, it's essential that we do the right things day to day, staying focused on risk, costs and making sure our clients have access to the capital they need. We must also think about optimizing the business for the near future, continuously making adjustments to ensure that we are as efficient and effective as possible while closing addressable gaps.

Finally, we must think creatively about next-generation transformation and ways that our businesses will change over the next five to 10 years. To that end, we are evaluating emerging technologies and reshaping our approach to data to bring the power of artificial intelligence and machine learning to all our businesses. We're also building out our infrastructure to reduce friction, improve client service and offer access to sophisticated analytics.

We have the most solid underpinnings for the enduring success of a world-class business: the capital, the brainpower and the hard-earned experience to get things right. Although we will be tested by any number and variety of uncertainties in the years to come, these qualities make me confident and optimistic about our shared future.

Daniel E. Pinto

Co-President and Chief Operating Officer, JPMorgan Chase & Co., and CEO, Corporate & Investment Bank

- Return to footnote reference 1

- Assets under custody: Represents assets held directly or indirectly on behalf of clients under safekeeping, custody and servicing arrangements.

- Return to footnote reference 2

- Assets under administration: Represents the market value of client assets for which administrative and other related services are performed.