Asset & Wealth Management

2019 marked my 10th year as CEO of Asset & Wealth Management. During this past decade, we have successfully helped millions of individuals and institutions around the world invest for their futures. Our clients come to us for advice, ideas and solutions for some of their most important life events, and for help in navigating through turbulent times. We cherish our clients' trust and never take it for granted.

Strong investment performance for clients

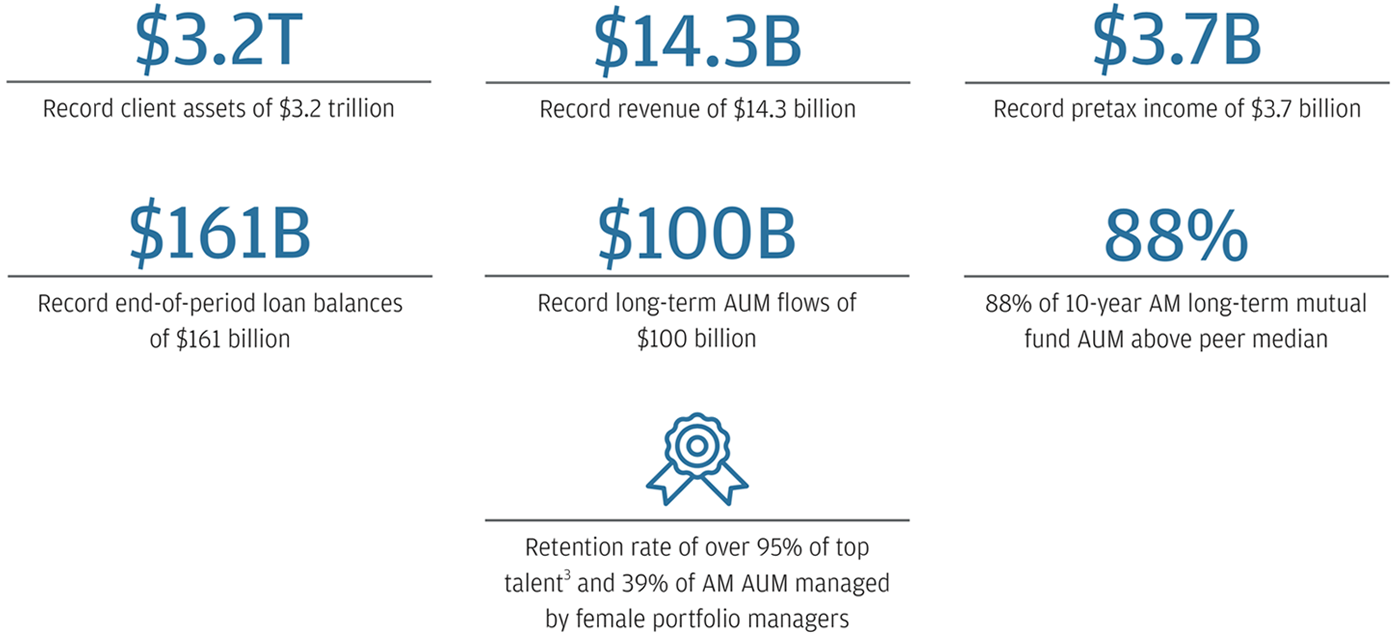

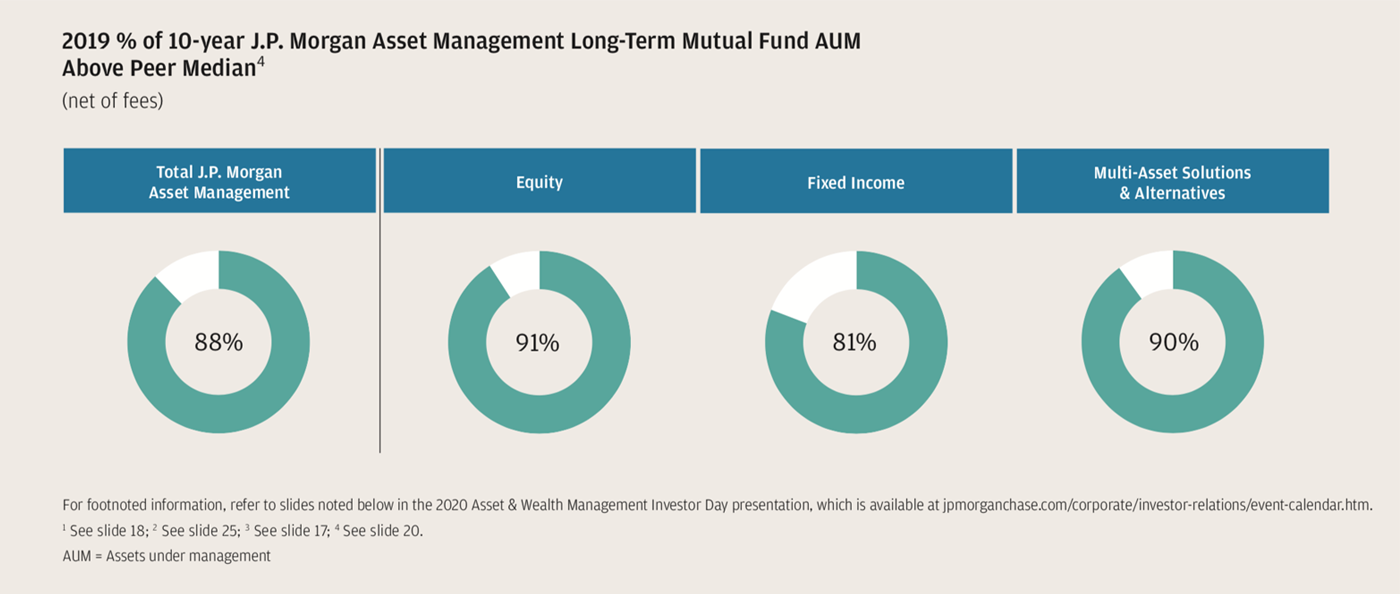

Our success begins with a focus on investment performance, which requires the unwavering, long-term prioritization and retention of our 1,000+ investment professionals. This has led to 88% of 10-year long-term mutual fund assets under management above peer median and 196 mutual funds 4- or 5-star rated1. It's worth noting that our performance is not concentrated in any asset class or region. It represents leading performance across all asset classes globally.

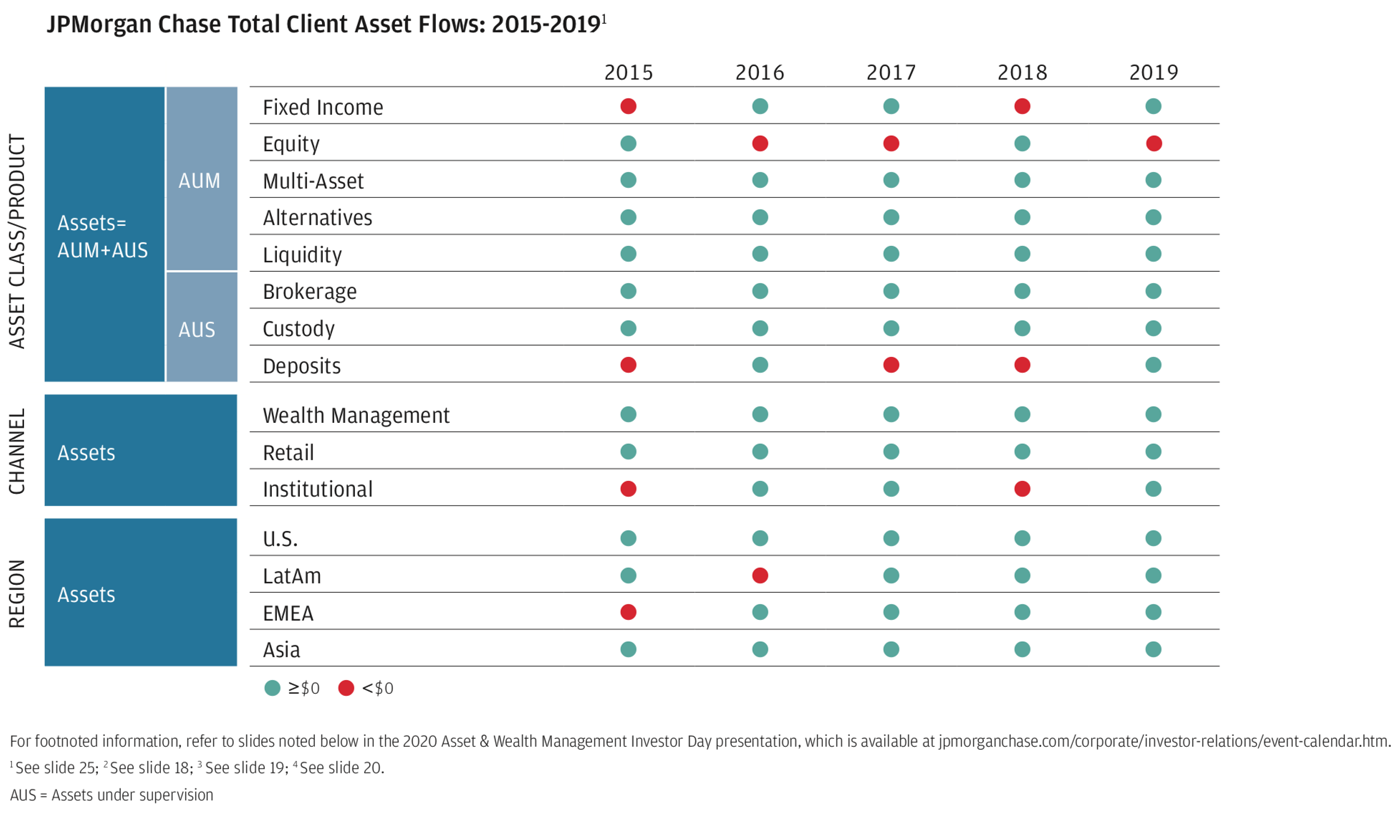

We strive to be the best, not the biggest. If you relentlessly work to be the best, you will have years like 2019, in which we received $194 billion in net new client asset flows2. In fact, since 2015, we received half a trillion dollars in net new client asset flows2. Similar to our investment performance, our flows are not concentrated in any one asset class, region or client segment, but come from a well-diversified set of businesses.

Strong financial performance for shareholders

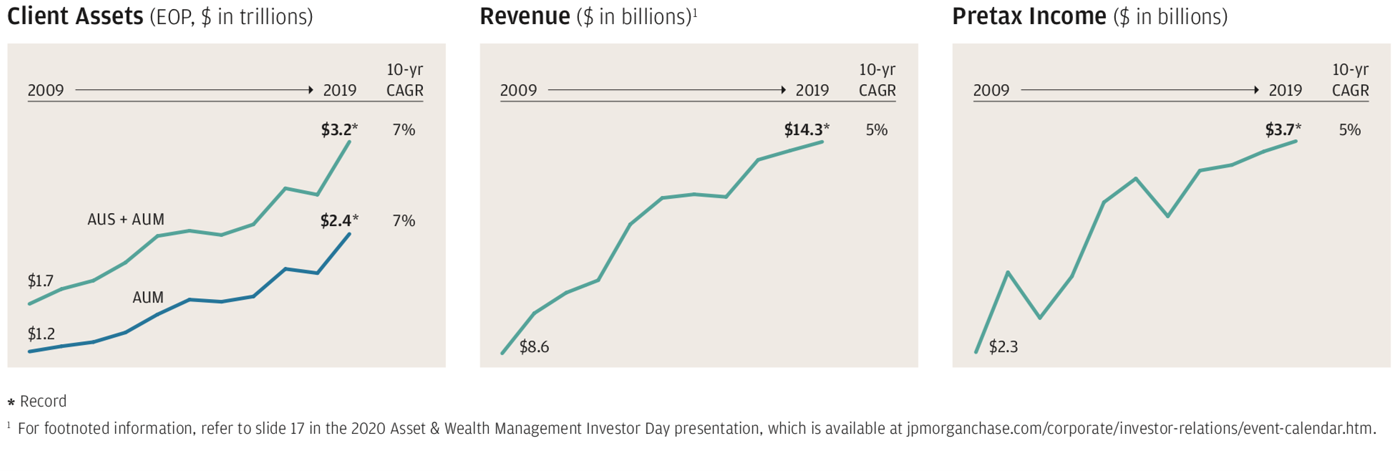

I am proud of our results for our clients, while, at the same time, we continue to deliver strong financial performance for our shareholders. In 2019, Asset & Wealth Management achieved record total client assets of $3.2 trillion, record revenue of $14.3 billion, record pretax income of $3.7 billion and return on equity of 26%. Our reliable and consistent growth has been powered by success across our diversified Asset Management (AM) and Wealth Management (WM) franchises. Given our long-term approach, we are even prouder of our sustained performance over the past 10 years.

Asset Management

Since 2009, AM grew revenue footnote2 by 1.5x to $7.3 billion and pretax income by 1.4x to $1.9 billion. That success has been driven by a broad, diversified platform. On long-term AUM, we achieved record levels across asset classes (Equity, Fixed Income, Multi-Asset), segments (Retail and Institutional) and geographies (U.S. and International). We also achieved success in key growth areas of the market, with Multi-Asset AUM growing by 6.4x to $267 billion and, in particular, Target Date AUS growing by 25x to $125 billion.

Wealth Management

Growth since 2009 is an equally powerful story in WM, where revenue grew by 1.8x to a record $7.1 billion and pretax income by 1.7x to $1.9 billion. We continue to differentiate ourselves by providing the advice, solutions and client experience that our clients need. As an example of their commitment, we've nearly tripled the number of clients with over $100 million of total positions to a record level. In addition, we've grown the number of managed accounts by 7.6x to a record 730,000.

x = times

Growth priorities for the next decade

Looking ahead to the next decade, we are highlighting five major drivers to continue our momentum:

- Focusing on U.S. Wealth Management: This is one of the firm's biggest opportunities with the U.S. representing approximately $50 trillion in market size footnote3. For example, Chase banks half of the 22 million households within the $1 million to $10 million net worth segment footnote3, but only 5% have investments with us. We have a tremendous opportunity to capture new clients and deepen current relationships.

- Expanding the Global Private Bank: Over the last five years, we've hired approximately 1,300 advisors, successfully converted hundreds of referrals from around the firm, attracted over 11,000 net new clients and captured around $200 billion in client asset flows. We still have a significant expansion opportunity, particularly internationally, where we have less than 2% market share footnote3. We plan to capture share by continuing to be the go-to bank, delivering solutions across the balance sheet.

- Scaling Asset Management: To scale, we need strong, diversified long-term investment performance, which we have with 91% of Equity, 81% of Fixed Income and 90% of Multi-Asset Solutions & Alternatives 10-year mutual fund AUM above peer median. This performance has driven our above-industry growth over the last 10 years footnote4 and will continue to be our foundation to scale over the next 10 years. And with around 2% market share across asset classes footnote4, we have significant opportunity to capture share.

- Building Alternatives: We are celebrating our 50th anniversary of managing what is now nearly a quarter of a trillion dollars in Alternative assets. I am excited about the opportunities to continue building our franchise, from expanding our leading core real estate capabilities to building out our newly consolidated private credit capabilities.

- Considering M&A: While we always prefer organic growth, there are times when the industry changes drastically, and we need to be on top of it, which is what we are doing now. We are very selective, evaluating every M&A opportunity for an adjacent capability. But most important, we always prioritize our clients' needs and increasing shareholder value.

Continuing to invest in the business

Our long-term commitment means that we will continue to serve our clients and invest in making our business better for the future:

- Front office: We will continue to hire top front office talent. Additionally, we will continue to invest in our investment capabilities, spending around $320 million on AM research and making thousands of company visits annually.

- Technology: We are creating and leveraging tools, such as You Invest and machine learning, to help our clients and employees focus on higher-value activities and make better decisions. We always look to simplify our production processes so that 50+% of our technology spend is dedicated to new and exciting capabilities that deliver stronger client outcomes.

- Environmental, Social & Governance (ESG): With the help of industry experts we have hired, we are doing more than ever before, focusing on our clients' needs and delivering across AM and WM. In AM, we are working toward 100% of AUM being ESG-integrated while we launch new ESG-focused WM strategies.

- China: We've been in China since the 1970s, and we are set to become the first foreign asset manager to fully own a Chinese fund manager with China International Fund Management. Our increased stake will further solidify our position in China and better address our clients' needs.

As I write this letter, we are at an unprecedented moment in time. The global COVID-19 pandemic has caused many people to suffer, created historic volatility and changed how we work and live. However, we can take comfort in knowing that people around the world are coming together to respond to these challenges in powerful and inspiring ways.

As a fiduciary, we view events that completely disrupt an industry, country or way of living as the times when active security selection (and deselection) is of the utmost importance. With all three of these areas being impacted concurrently in 2020, now is the most important time to have portfolios actively managed.

In times like these, I'm also reminded of how fortunate I am to be part of JPMorgan Chase. For more than 200 years, we have been at our best in the most difficult of times. I am proud of, and inspired by, how our colleagues and partners have responded to this crisis, and I remain incredibly optimistic about the firm's future.

Mary Callahan Erdoes

CEO, Asset & Wealth Management

For footnoted information, refer to slides noted below in the 2020 Asset & Wealth Management Investor Day presentation, which is available at jpmorganchase.com/corporate/investor-relations/event-calendar.htm.

- Return to footnote reference 2

- See slide 18;

- Return to footnote reference 3

- See slide 19;

- Return to footnote reference 4

- See slide 20.