Introduction

Across our company, our clients are at the center of everything we do. In 2016, this meant supporting our energy clients as they weathered one of the worst sector downturns in 30 years. With oil prices down almost 75%, the industry has felt tremendous stress. During this time, we stood by our clients and have provided meaningful advice and much-needed capital. As many banks stepped away, we continued to demonstrate leadership in the industry, adding over 30 clients to our energy portfolio and extending more than $1 billion in new loan commitments last year.

It was our disciplined client selection and deep sector expertise that gave us the confidence and resolve to provide unwavering support during this significant downturn. I’m incredibly proud of our entire energy team for their relentless focus, leadership and hard work. We believe it is this enduring client commitment and our long-term view that set us apart in the industry.

2016 was a terrific year for Commercial Banking (CB) in so many ways, and our performance highlighted the strength and potential of our franchise. I’m excited to share our 2016 results, the investments we are making and our expectations for the future.

2016 Performance

For the year, Commercial Banking delivered strong financial results, with record revenue of $7.5 billion, $2.7 billion of net income and a return on equity of 16%. Notably, we absorbed incrementally higher capital and substantial investments in our platform and capabilities while maintaining strong returns and operating efficiency in the business.

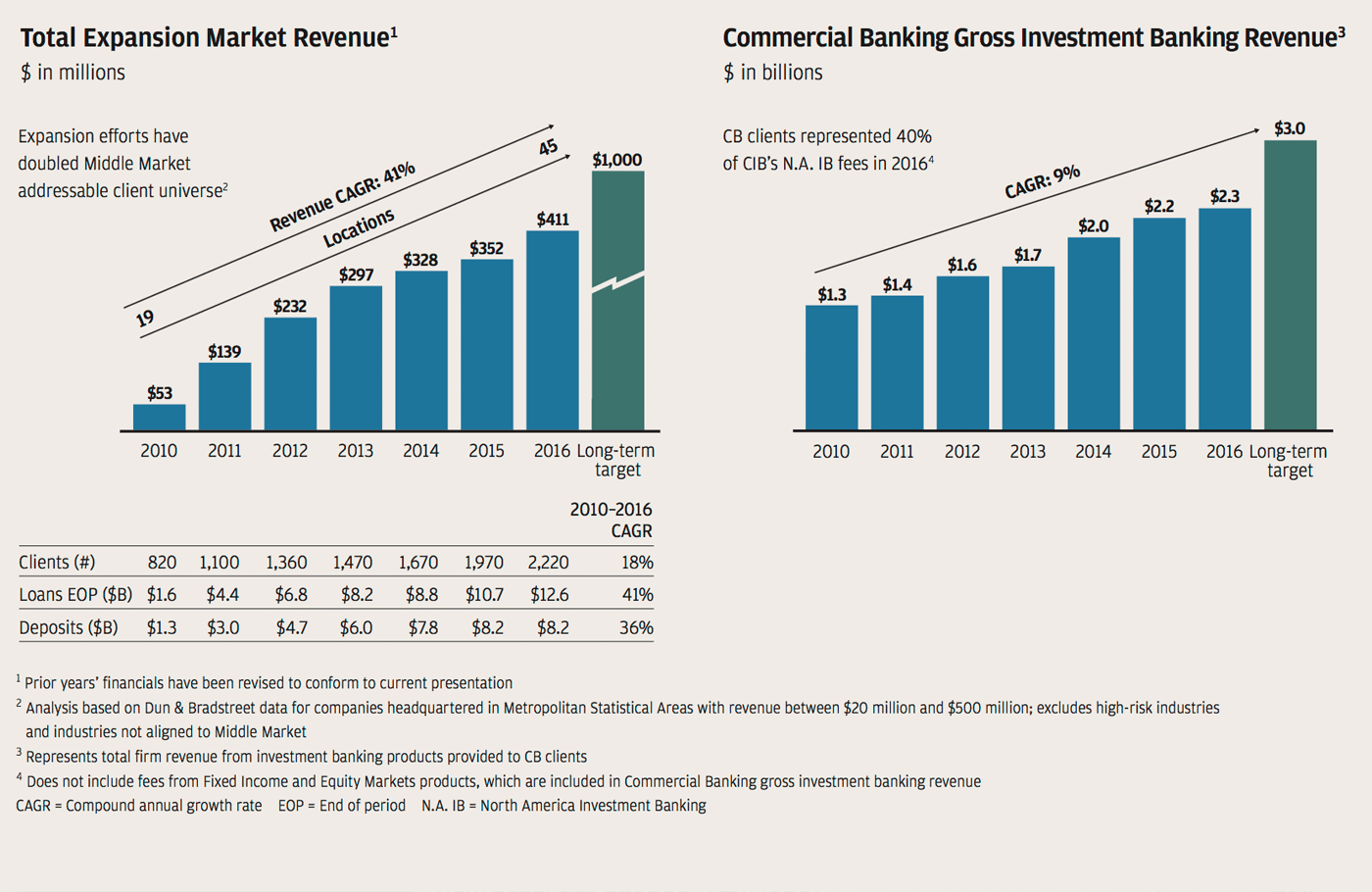

Our partnership with the Corporate & Investment Bank (CIB) continues to thrive and is a key differentiator for our business. Being able to provide strategic insights and leading capital markets and advisory capabilities distinguishes us from every other commercial bank. In 2016, we delivered record gross investment banking revenue of $2.3 billion, up 5% from the prior year. This outstanding partnership accounted for 40% of the firm’s North American investment banking fees, and we believe there is tremendous opportunity to grow.

Loan growth across our business was also outstanding, ending the year with record loan balances of $189 billion, up $21 billion from the prior year. Loans in our Commercial & Industrial franchise reached a new record, up 9% from the prior year, and loans in our Commercial Real Estate businesses completed another fantastic year, with record originations of $37 billion.

Staying true to our proven underwriting standards, we have remained highly selective in growing our loan portfolio. Despite pressures in the energy and commodities sectors, 2016 marked the fifth straight year of net charge-offs of less than 10 basis points. As we begin 2017, credit fundamentals across CB are quite strong, but we remain disciplined and focused. We are monitoring all new activity carefully and know that this will serve us well over time.

What’s not in our financial results also tells a great story. We have made significant investments to build a fortress risk and compliance framework for our business. Moreover, we have executed a significant portion of our regulatory and control priorities and are committed to set the standard in the industry. This progress has allowed us to focus on improving our processes to deliver a better client experience. It is an ongoing priority, and we will continue to invest in safeguarding our clients and our business.

Investing in our franchise to better serve our clients

As strong as our business is, we are certainly not standing still. We are executing a multi-year transformation across CB, with a clear focus on bringing greater value to our clients.

Last year, we invested more than we ever have on technology, data and our key product capabilities. Looking forward, we will direct even more resources in 2017 to enhance our wholesale payments platforms, build upon our market-leading digital capabilities, use data to better manage risks, and drive improvements across critical processes like credit delivery and client onboarding. This is an effort with no finish line – through continuous innovation, we will seek better ways to serve our clients and extend our competitive advantages.

Improving the client experience through enhanced digital delivery

Given the rapidly increasing consumer and wholesale client expectations, we are focused on leading the industry in our digital and mobile capabilities. Our mission is to deliver greater speed, convenience, simplification, transparency and mobile access. We are working hand in hand with our partners in Consumer & Community Banking (CCB) and CIB to leverage their experience and technology investment in this area.

In 2016, we joined CCB to launch a new digital platform that is specifically tailored to meet the needs of small and midsized companies. It works across desktops, tablets and mobile devices to provide an integrated experience across all of our products and services. We are excited that this new platform will help us bring innovative functionality to our clients.

Expanding our footprint to reach more clients

Expanding our client base and building deeper client relationships remain top priorities for CB. During 2016, we made significant progress in executing our long-term growth strategy – opening offices in eight new markets and hiring over 100 bankers across our business. These long-term investments are bringing us much closer to our clients. We made 20,000 more client calls last year than we did in 2015, and this focus will continue to drive opportunity for us in the coming years.

Our Middle Market business in California is a great example of the progress we’ve made so far and the tremendous potential we see in our expansion markets. It’s an extremely exciting market for us as it represents the sixth largest global economy. Our team entered California following the Washington Mutual acquisition in 2008, and we now have 13 offices across the state. We are delighted with our progress as we have added more than 450 clients, and we are growing with discipline, maintaining fantastic credit performance with essentially zero net charge-offs.

Since 2010, our Middle Market team has opened 45 offices in major markets, including Los Angeles, San Francisco, Boston, Miami and Washington, D.C. We are in 48 of the top 50 markets in the U.S., and by the end of 2017, we will be in all 50. Through these efforts, we have organically built a nice-sized bank with over 2,200 clients, $13 billion of loans and $8 billion of deposits. Our Middle Market expansion strategy is a significant growth opportunity – one in which we believe will reach $1 billion in revenue over time.

Our opportunity

As we look forward, our strategic priorities are clear. We are going to continue to drive innovation and strengthen our business processes to improve the client experience, operate with fortress principles and have the best team in all of our markets to serve our clients. We remain committed to growing with discipline and will continue to take a long-term view with our business and our clients, investing for their success and ours.

With these priorities guiding us, I’m excited by the future and the potential of our business. We see enormous opportunity across our franchise as the investments we have made over the last several years have set a solid foundation. Expanding our footprint and adding new bankers puts us in front of a tremendous number of potential clients. Moreover, the enhancements we are making in our platform and capabilities give us confidence in our ability to compete and add differential value to our clients.

Our success depends completely on our people. They are knowledgeable, dedicated and deeply embedded in the communities they serve. I’m excited by the enthusiasm they show every day and am proud to work with such an incredible team. As always, we are optimistic about the U.S. economy and our clients’ role in driving growth and opportunity for CB. If we stay true to our proven strategy, we believe this team will continue to deliver strong results for our shareholders.

Douglas Petno

CEO, Commercial Banking

2016 Highlights and Accomplishments

Performance highlights

- Delivered record revenue of $7.5 billion

- Grew end-of-period loans 13%; 26 consecutive quarters of loan growth

- Generated return on equity of 16% on $16 billion of allocated capital

- Continued superior credit quality – net charge-off ratio of 0.09%

Leadership positions

- #1 U.S. multifamily lenderfootnote1

- #1 in Perceived Customer Satisfaction, CFO magazine's Commercial Banking Survey, 2016

- Top 3 in Overall Middle Market, Large Middle Market and Asset Based Lending Bookrunner footnote2

- Winner of Greenwich Associates’ Best Brand Awards in Middle Market Banking – overall, loans or lines of credit, cash management, trade finance and investment banking, 2016

- Recognized in 2016 by Greenwich Associates as #1 cash management overall satisfaction and #1 cash management market penetration in the $20 million–$500 million footprint

Business segment highlights

- Middle Market Banking – Added more than 700 new clients

- Corporate Client Banking – Record gross investment banking revenuefootnote3

- Commercial Term Lending – Record originations of over $20 billion

- Real Estate Banking – Completed its best year ever with record originations over $10 billion

- Community Development Banking – Originated over $1 billion in new construction commitments, financing more than 10,000 units of affordable housing in 90+ cities

Firmwide contribution

- Commercial Banking clients accounted for 40% of total North American investment banking fees footnote4

- Over $130 billion in assets under management from Commercial Banking clients, generating more than $460 million in Investment Management revenue

- $475 million in Card Services revenue footnote3

- $2.8 billion in Treasury Services revenue

Progress in key growth areas

- Middle Market expansion – Record revenue of $411 million; 24% CAGR since 2011

- Investment banking – Record gross revenue of $2.3 billion; 10% CAGR since 2011

- International Banking – Revenue footnote5 of $285 million; 8% CAGR since 2011

- 1

- SNL Financial based on Federal Deposit Insurance Corporation data as of 12/31/16

- 2

- Thomson Reuters as of year-end 2016

- 3

- Investment banking and Card Services revenue represents gross revenue generated by CB clients

- 4

- Calculated based on gross domestic investment banking revenue for syndicated and leveraged finance, M&A, equity underwriting and bond underwriting

- 5

- Overseas revenue from U.S. multinational clients

- CAGR = Compound annual growth rate