Asset & Wealth Management

The major geopolitical events of 2016, namely the U.S. presidential election and Brexit, surprised many as the outcome of these two major votes had been deemed improbable. As such, market reactions were volatile and unsettling to many.

The emotional response to such events often makes it difficult to objectively reassess and position portfolios. For 180 years – through countless political challenges and conflicts – J.P. Morgan Asset & Wealth Management (AWM) has brought its fiduciary mindset to help clients navigate portfolios. Over these many decades, we have institutionalized our insights and passed on the cumulative wisdom and knowledge of those before us to incoming generations.

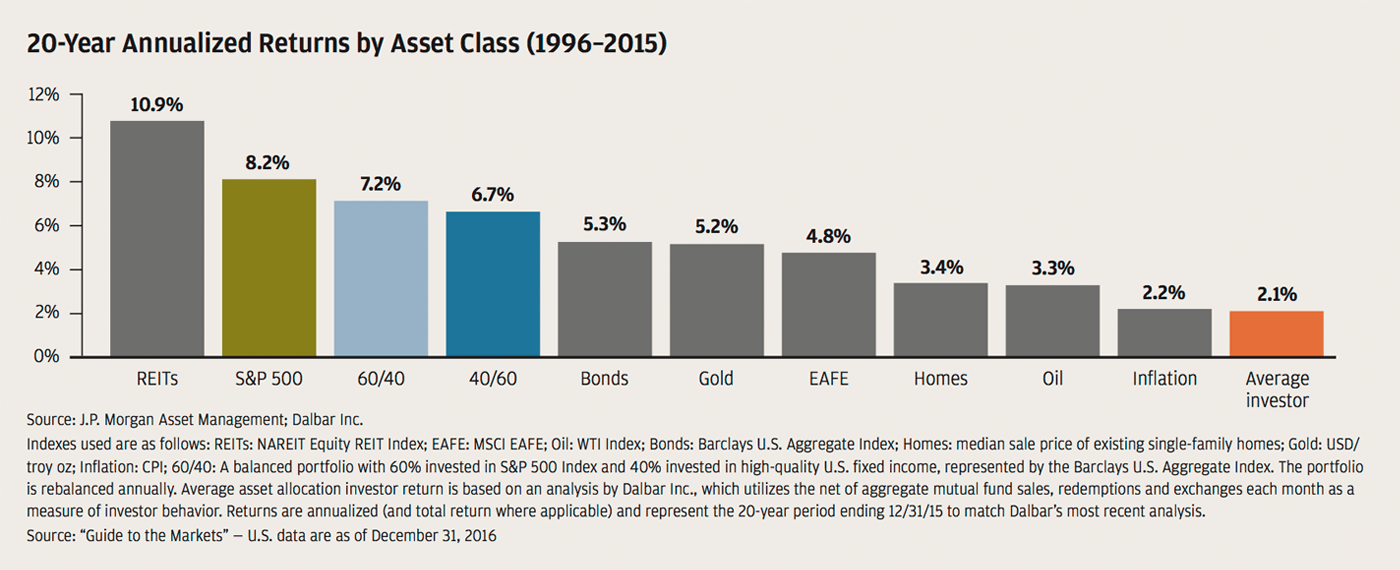

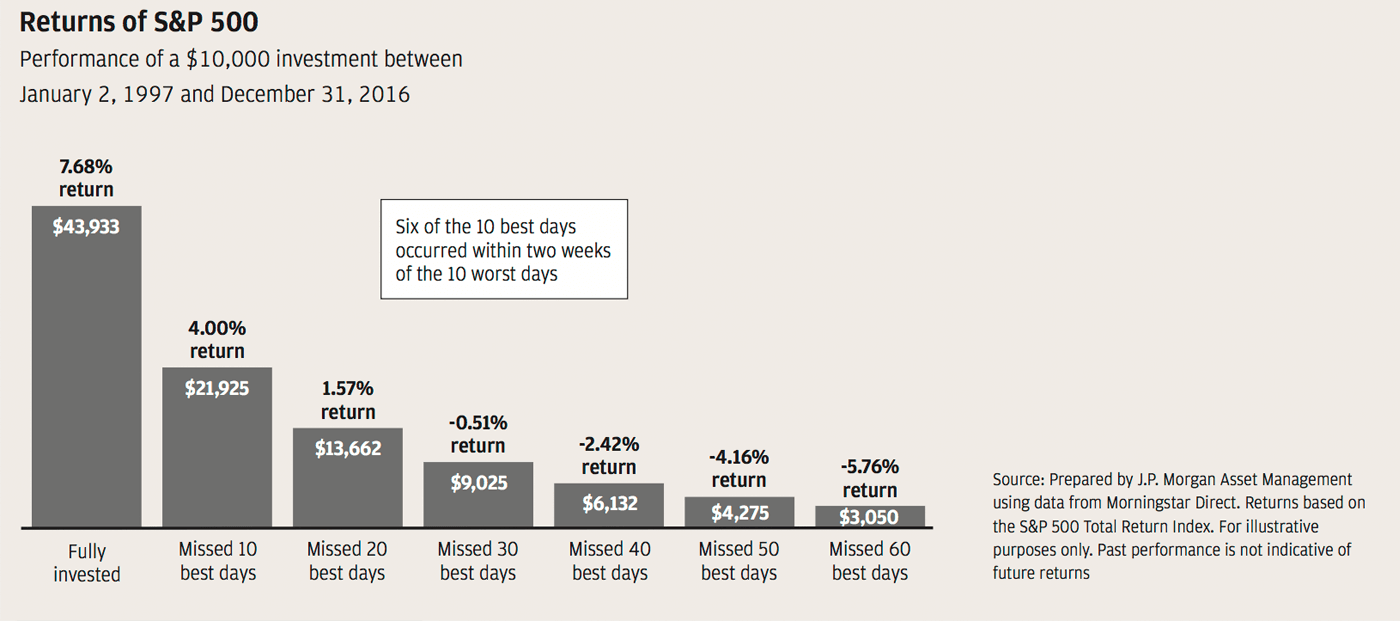

Perhaps the two most important investment lessons passed on through these centuries are around long-term focus and diversification. Diversification across and within asset classes helps clients avoid overexposure to a particular region or asset class, protecting their portfolios from significant drawdowns and enabling them to be nimble and take advantage of market opportunities when they arise. When investors make emotional decisions related to current events, the benefits of long-term investing and properly diversified portfolios can be eroded.

Instead of focusing on proper longterm, diversified investment portfolios, today’s debate is centered more on how to invest. Questions relating to “active vs. passive” investing and “humans vs. computers” have taken over the headlines.

We believe proper portfolio construction should include both active and passive strategies, depending on a client’s time horizon and risk profile. We also believe advisors and technology need to work together. Clients want to choose how, when and from where they interact with us – whether it’s through online platforms, on the phone or face to face. The person-to-person interaction becomes even more important as our clients’ lives grow more complex and they require more comprehensive advice.

As stewards of our clients’ wealth, our mission at J.P. Morgan is to help clients of all types get, and stay, properly invested. Our clients span the entire spectrum – from retail investors working with our Chase branch network, to wealthy individuals or families working with our Private Bank, to sophisticated institutional investors working with our Asset Management business.

We have direct relationships with 60% of the world’s largest pension funds, sovereign wealth funds and central banks and 50% of the world’s wealthiest individuals and families. We also deliver our insights and advice to more than 1 million U.S. families through Chase Wealth Management.

These clients can choose to work with any firm they wish. They turn to J.P. Morgan because they know we will be there for them when they need us most and that we will always put their interests first.

World-class investment performance

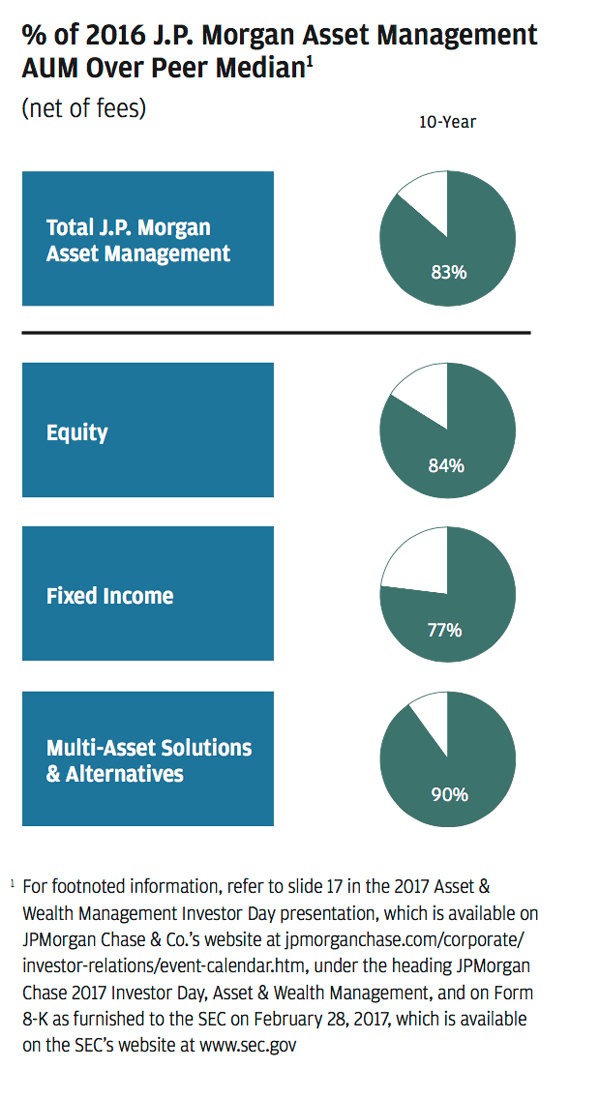

While trust is the primary reason clients choose J.P. Morgan, our superior investment performance is also critically important to the compounding of clients’ wealth. In 2016, 83% of our 10-year, long-term mutual fund assets under management (AUM) ranked in the top two quartiles.

Our market-leading performance spans asset classes – 90% of assets for multi-asset solutions and alternatives, 84% for equity and 77% for fixed income ranked in the top two quartiles over the 10-year period. This outstanding track record has resulted in 140 of our equity strategies and 41 of our fixed income strategies receiving a four- or five-star ranking from Morningstar.

This consistent performance also has led to clients entrusting J.P. Morgan with more of their assets. Over the past five years, we ranked #2 in total inflows among our large public peers, with an average of $82 billion annually and $408 billion cumulatively.

A diverse and balanced business mix driving strong financial performance

Much like the portfolios we manage, our business is diversified across asset classes, regions and client types. That diversity, coupled with our proven track record, has led to strong financial performance for AWM.

In 2016, we delivered $12 billion in revenue and record pre-tax income of $3.5 billion. We also reached a record $2.5 trillion in total client assets. These numbers have consistently grown over the past five years, with a 5% compound annual growth rate (CAGR) for revenue and client assets and a 7% rate for pretax income.

In addition, clients are increasingly using us for their primary banking services. Wealth Management deposits grew to $290 billion in 2016 and recorded an impressive 19% CAGR over the past decade. In credit, our $121 billion in loan balances, including mortgages, represent a 15% CAGR over the past 10 years. Our focus on strong risk management has helped us do that while maintaining charge-off rates that are among the lowest in the industry.

Never stop investing in people and technology

We work hard to make J.P. Morgan a place where our people can have long and successful careers. We have a history of investing in our people at every level, from the thousands of training sessions and leadership development courses to our continuous work on talent mobility.

Over the past five years, we’ve increased our front-office spend by 14% to ensure we have the right people with the right skills in the right roles. As a result of this commitment to developing our talent, we proudly maintained a top talent retention rate of over 95%.

One of the best ways we can invest in our people is by also investing in our technology. Our emphasis is on having a technology platform that allows us to automate and improve processes while, at the same time, helps our advisors to serve clients more quickly and efficiently, as well as focus on the value-added client work.

We have successfully reduced our legacy technology footprint and error rates and significantly increased our spend on forwardlooking initiatives. These efforts include building out an enhanced digital wealth management platform that will launch later this year and introducing new client management systems for our advisors.

Asset & Wealth Management — difficult to replicate

One of the keys to our success has been our ability to bring to the table a unique combination of a two-century heritage and a focus on continuous investment, innovation and improvement. That means clients can have confidence that we will be there for them over the long term and also know that we have the foresight to adapt and innovate to help them through whatever the future brings.

The long-term focus of this business is part of what makes AWM so difficult to replicate. A franchise with a 10-year investment performance track record, a 50-year relationship with a state pension fund and a 100-year relationship with a multigenerational family cannot be built overnight. The culture of our firm – both what we do and how we do it – is equally special and one of our greatest competitive advantages.

When you combine our AWM capabilities with the world’s leading investment, consumer and commercial banks, our story is even more powerful and enables us to bring the best the firm has to offer to help solve our clients’ most important issues.

I am so proud to be part of this great firm and our AWM business. Our commitment to you, our shareholders, is that we will continue to do first-class business in a first-class way so that we can create even more value for you and for our clients.

Mary Callahan Erdoes

CEO, Asset & Wealth Management

2016 Highlights and Accomplishments

Business highlights

- Fiduciary mindset ingrained since mid-1800s

- Positive client asset flows every year since 2004

- Revenue of $12 billion

- Record $2.5 trillion in client assets

- Record pre-tax income of $3.5 billion

- Record average loan balances of $113 billion

- Record average mortgage balances of $29 billion

- Retention rate of over 95% for top senior portfolio management talent

Leadership positions

- #1 Global Asset Management (Euromoney, February 2017)

- #1 Institutional Money Market Fund Manager Worldwide (iMoneyNet, December 2016)

- #1 Private Bank Overall in North America (Euromoney, February 2017)

- #1 Private Bank Overall in Latin America (Euromoney, February 2017)

- Best Asset Management Company for Asia (The Asset, May 2016)

- Best Infrastructure Manager of the Year (Institutional Investor, May 2016)

- Top Pan-European Fund Management Firm (Thomson Reuters Extel, June 2016)

- Best Large-Cap Core Equity Manager of the Year (Institutional Investor, May 2016)

- #3 Hedge Fund Manager (Absolute Return, September 2016)