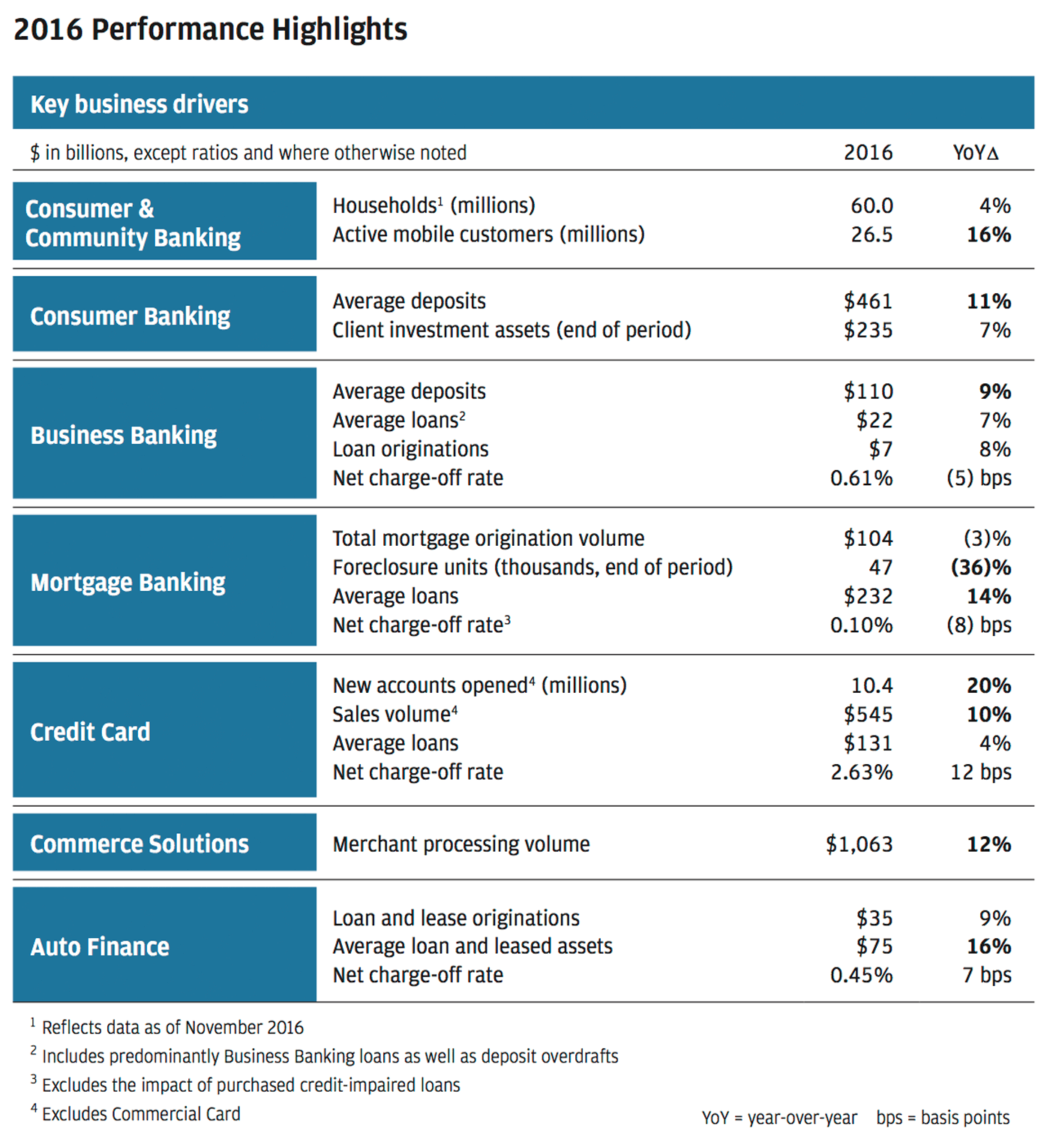

2016 financial results

2016 was another strong year for Consumer & Community Banking (CCB). All our businesses performed well and delivered very strong results. We gained market share in each of our six business units. For the full year, we achieved a return on equity of 18% on net income of $9.7 billion and revenue of $44.9 billion.

We made meaningful progress on our 2016 priorities – a strategy we have been following consistently since we unified our Consumer businesses in 2012 under CCB:

- Deepen relationships with our customers and simplify and improve the customer experience

- Lead payments innovation by delivering solutions that address merchant and consumer needs

- Increase digital engagement by delivering differentiated experiences

- Protect the firm and its clients/customers, investors and employees from cyberattacks, as well as protect the privacy of their data and transactions

- Continue our unwavering commitment to build and maintain an effective and efficient control environment

- Execute structural expense management strategies while continuing to invest for the future

- Attract, train, develop and retain the best talent and strengthen our diversity

Simply put, our commitment to customers is at the heart of everything we do. It’s what drives our work and our strong results. We know that happy customers will do more business with us and stick with us throughout their lives. For us, our goal is not only to acquire customers – it’s to acquire customers who view Chase as their primary bank or credit card. We want to be our customers’ first call when they are seeking financial advice.

Today, we have a relationship with almost half of all households in the U.S. We grew our customer base in 2016 by 4% to 60 million U.S. households. We are the primary bank for more than 70% of our consumer households and nearly 50% of our small businesses. Our household attrition is at record lows. And according to our 2016 Brand Health Survey, the Chase brand is at the strongest levels we have seen, ranking #1 in key categories, including consideration, which measures if survey participants would consider doing business with Chase and have a positive perception of Chase.

While we are extremely pleased with where we are, we know we have plenty of work to do. There is tremendous opportunity literally on our own doorstep. More than 80% of Chase households with a mortgage got it somewhere else. Only one-third of our customers are engaged with more than one product across Chase. And only 10% of our small business customers who have a Chase banker use us for business banking, credit card and merchant services, while 43% of small businesses need all three. We can continue to grow simply by serving our existing customers exceptionally well and earning their trust to do more business with us.

Building a strong business for the future

We have been fortunate to be in an extended, historically benign credit environment. Despite that, we have not forgotten the painful lessons of 2008 and have maintained an extremely disciplined approach to credit throughout the cycle.

In Mortgage Banking, we’ve increased our loan balances while improving the quality of our servicing portfolio. Today, our delinquency rate is approaching its lowest level in a decade, and our foreclosure inventory is down 85% since 2012. That’s important because a nonperforming loan is 25 to 30 times more expensive for us to service than one that is performing. We are continuing to evolve Mortgage Banking into a less volatile and more profitable business. In our Card business, we have been very consistent in terms of our modest exposure to the less than 660 FICO segment. And when you look at the mid-prime space, characterized as FICO scores between 640 and 720, we have the lowest share among the players in the industry. Our credit card losses remain at very low levels.

Along with credit discipline, we remain fiercely devoted to expense discipline. We reversed a trend of rising expenses with relatively flat revenue. Since 2016, we achieved $2.4 billion in structural expense reductions and improved our overhead ratio from 58% in 2014 to 55% in 2016. Importantly, during that same time period, we continued to prudently invest in our core businesses to deliver value for the long term. In particular, we’ve invested heavily in technology and marketing associated with new product launches, digital and payments innovation, and cybersecurity. Our investments have also improved our control environment, leading to more automated processes and better customer and employee experiences. Expense discipline is part of how we do business every day, and the work to reduce our structural expenses will continue.

Payments innovation

Payments are at the very core of what our business does for customers. We are one of the few companies that can deliver the full payment chain from merchant to consumer. The payments industry is one that is evolving rapidly with innovation and new entrants. Our strategy has been consistent:

- Build our own proprietary wallet with Chase Pay®

- Be top of wallet in other wallets, whether that is Apple Pay®, Android PayTM, Samsung Pay, or other embedded payment systems such as Amazon or Uber

- Have the best person-to-person (P2P) payments experience anywhere

- Create card products that our customers love, with rich reward offerings to make them top of the physical and digital wallet

The future here is still unknown as customers adopt new capabilities. But we know payments are core to what we do, and we are investing across multiple fronts to create the best payments experience for our consumer and merchant customers as technology evolves. In 2016, we achieved some key milestones in payments:

Commerce Solutions – Our Chase Commerce Solutions business has earned double-digit growth since 2012 and in 2016 surpassed a staggering $1 trillion in processing volume.

Chase Pay – We introduced Chase Pay, our payment solution that provides benefits to both customers and merchants. Chase Pay has unique features other payment methods don’t and has the Chase brand and security behind it. Several large retailers, including WalMart, Starbucks and Best Buy, have partnered with us to offer Chase Pay to their customers. It’s early, but we’re already seeing promising results and expect 2017 to show continued strong momentum.

Person-to-person payments – Chase QuickPaySM has been an industry leader with 94 million transactions in 2016. The number of households using QuickPay has gone up 30% in just the past year. As strong as it is, we took an important step to make it even better. We worked with 20+ other financial institutions on a solution called Zelle that speeds up P2P real-time payments between banks.

Sapphire ReserveSM – This past year, our team noticed an important insight from our customers: People are traveling differently. They want to feel more like locals than tourists, and the shared economy has revolutionized the travel industry. When choosing a credit card, customers want a card that rewards them more for doing what they love to do and helps them discover the future of travel. We created Sapphire Reserve with one of the strongest point programs in the industry. And while we knew we had designed a superb card, frankly, even we were surprised by the sensation it became. We exceeded our annual target of customers in less than two weeks.

Sapphire Reserve has introduced Chase to an exciting and passionate customer base with average FICO scores above 785 and an average deposit and investment wallet of over $800,000. Even more exciting, the majority of our new Sapphire Reserve customers are millennials. That is significant because millennials make up the majority of our new deposit accounts today, and their wealth is expected to grow at the fastest rate of all generations over the next 15 years. Since we are more than a credit card company and given our new customers’ strong satisfaction and engagement with their Sapphire Reserve cards, we are confident they will also choose Chase to do more of their banking, investments and loans.

New card launches – While receiving less hype than Sapphire Reserve, we’ve also introduced several other popular cards. Chase Freedom UnlimitedSM simplified our cash-back proposition by offering customers 1.5% cash back on everything they buy. And not to be outdone, Ink Business PreferredSM and our Amazon PrimeSM card also earned a very strong customer reception. Together, these cards have contributed to our momentum. In 2016, we saw new accounts up 20%, card sales volume up 10% and outstandings up 8%.

Digital

We think we can confidently say that Chase is the digital leader in the industry. We have the #1 rated mobile banking app, #1 ATM network and #1 most visited banking portal in the U.S. This is important because, increasingly, digital is a critical driver in why customers choose to do business with Chase. Banking no longer is a sometimes activity – customers engage with us every day. More than 26 million customers are active on our mobile app today. Digital also drives tremendous loyalty. Households that use our digital channels have credit and debit spend levels over 90% higher than those that don’t. Customers who are digitally engaged have higher satisfaction and retention rates, spend more and have far lower transaction costs.

Advancing our digital and technology capabilities is job #1, but we are also paying close attention to the emerging technologies in our industry. Many new fintech companies are mastering ways to simplify the customer experience. Those we meet with have huge respect for the Chase brand, and they envy our scale and distribution. In cases where we think their solutions will improve the customer experience quickly, we partner with them. A few of those 2016 partnerships have worked out very well:

- Chase Business Quick Capital® – A partnership with OnDeck to provide fast funding to small businesses using Chase underwriting standards

- Chase Digital MortgageSM – A partnership with Roostify that helps our customers manage the mortgage process online or on mobile

- Chase Auto DirectSM – A partnership with TrueCar that allows customers to shop for and finance the specific car they want online and simply pick it up at the dealership

We continue to study and meet with new players to evaluate which partnerships could benefit our customers.

Chase in the community

Chase’s 5,258 branches are the face of our firm to local communities. Roughly two-thirds of our customers visit a Chase branch four times a quarter on average. Our branches are located in the fastest growing markets in the country, and we are outpacing our competitors wherever we compete.

If you visit our branches regularly, you will see how they have changed. There are fewer teller lines and more options for customers who choose to self-serve. There are more private spaces and conference rooms for customers to meet with a banker and privately discuss transactions. And the branches just look better. Most branches are refreshed roughly every six to seven years to update the technology and brand experience.

We know one thing that will drive a customer crazy is a long teller line. Since 2014, we’ve reduced total teller transactions by ~130 million and increased self-service/digital transactions by ~180 million. That’s great progress, but we still can do more. In 2016, 70% of our 400 million teller transactions could have been performed through a self-service channel. We continue to work with our customers to help them understand how to complete transactions on their own if they so choose.

And as transaction volumes come down, we will rationalize our branch footprint. We have been opening branches in higher growth areas and consolidating those with less foot traffic. As a result, we reduced our net branches by about 150 in the past year. However, by being smart about where we open branches, even in markets where we consolidated, we still grew share.

Our branches also are advice centers for many of our 4 million small businesses. There are few things more gratifying than watching a small business owner turn an idea into a sale and then sales into a business. Since 2012, our share of business customers who use Chase as their primary bank grew from 6% to 9%. We improved our Net Promoter Score by 38%. And since 2014, average deposits are up by 21% and loans by 13%.

At Chase, we take very seriously the role our business plays in helping customers make the most of their money. Our goal is to offer products, advice and tools to help them make the best choices. It’s such a privilege to be in the business of banking and payments. We are honored to be part of our customers’ lives in a way that few businesses are.

On behalf of the more than 130,000 employees in Consumer & Community Banking, thank you for your investment in us.

Gordon Smith

CEO, Consumer & Community Banking

2016 Highlights and Accomplishments

- Consumer relationships with almost half of U.S. households

- #1 in primary bank relationships within our Chase footprint

- Consumer deposit volume has grown at more than twice the industry average since 2012

- #1 most visited banking portal in the U.S. — chase.com

- #1 rated mobile banking app

- #1 ATM network in the U.S.

- #1 credit card issuer in the U.S.

- #1 U.S. co-brand credit card issuer

- #1 in total U.S. credit and debit payments volume

- #2 merchant acquirer

- #2 mortgage originator and servicer

- #3 bank auto lender

2016

West

Coast

Bus

Tour

2016

West

Coast

Bus

Tour

Every

summer,

we

go

out

on

the

road

to

meet

with

our

employees

and

ask

for

their

feedback.

They

tell

us

what

they

are

hearing

from

our

customers

and

give

us

ideas

on

how

we

can

make

our

Chase

customer

experience

even

better.

We’ve

made

many

customer

improvements

as

a

result

of

our

bus

tours,

and

we

have

a

lot

of

fun

along

the

way.