2018 performance and backdrop

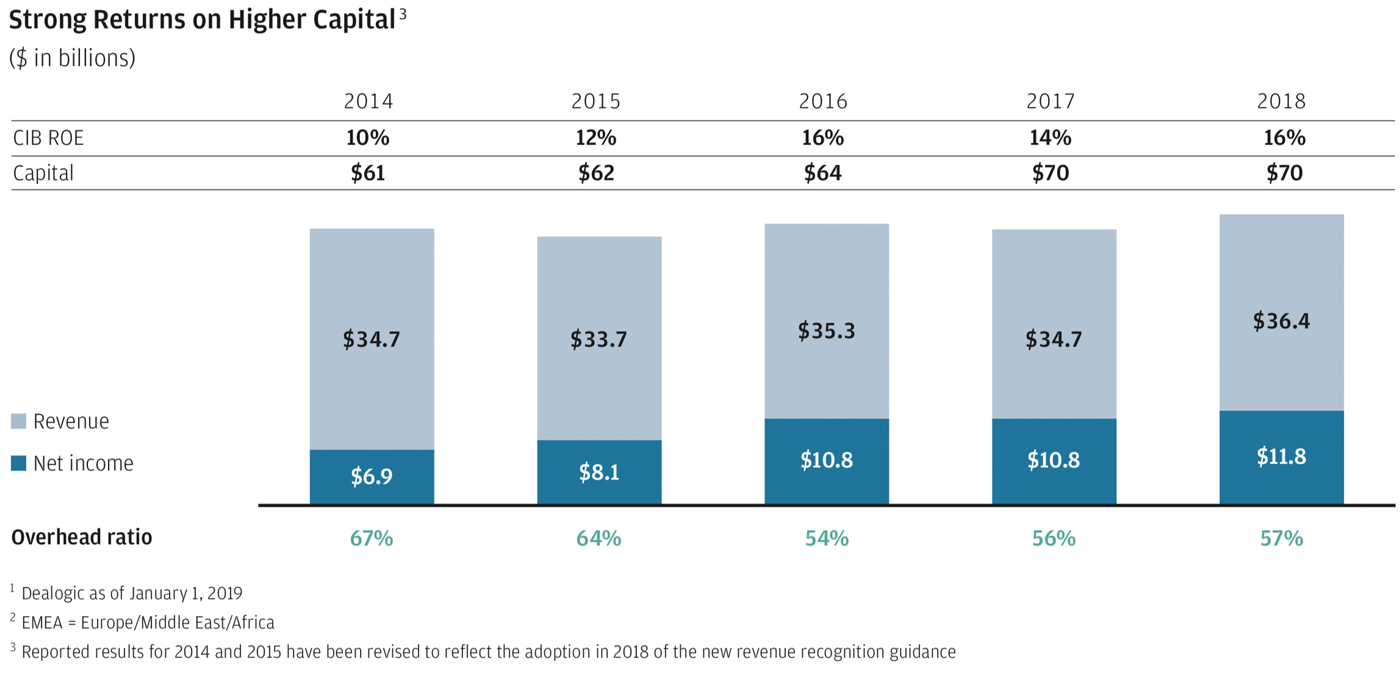

The Corporate & Investment Bank (CIB) had a record year in 2018, setting a new benchmark for earnings of $11.8 billion on $36.4 billion of revenue, resulting in a return on equity (ROE) of 16%.

We are now 10 years removed from the financial crisis of 2008, when J.P. Morgan was a safe haven for clients in chaotic markets. We remain that safe haven while we drive the industry forward through innovation and technology.

The standout performances of our businesses last year and over the past decade are the result of hard work, continuous investment and a belief that a complete, global offering helps clients meet their evolving financial objectives. As our clients grow in size and complexity, they require a financial partner who can provide the financing solutions they need, wherever they need them and however they want them delivered.

Last year was especially active for mergers and acquisitions (M&A) and equity markets. We advised on more than $1 trillion in announced M&A footnote1 in 2018, including significant deals such as Takeda’s $82 billion acquisition of Shire, IBM’s $34 billion purchase of Red Hat and Walmart’s $16 billion acquisition of Flipkart, India’s largest online retailer.

We ranked #1 in wallet share for both debt and equity capital markets and raised more than $475 billion for clients around the world. We led prominent initial public offerings (IPO), including for AXA Equitable Holdings, the largest U.S. insurance IPO since 2002, and for Siemens Healthineers, the largest healthcare IPO ever in EMEA. footnote2

As a result of our worldwide investment banking work for clients, we generated $7.5 billion in fees and solidified our #1 standing in market share for the 10th consecutive year. In fact, amid heavy competition in a relatively healthy economic environment, our share of global investment banking business stood at 8.7%, the highest of any bank since 2009.

Despite volatile trading markets at the end of the year, we continued to be a leading provider of trading liquidity to institutional investors, reporting full-year Markets revenue of $19.6 billion, up 6% from 2017. In Equities, we achieved record full-year revenue of $6.9 billion, up 21%. Our Cash Equities, Equity Derivatives and Prime Finance businesses each gained market share, and each generated double-digit revenue growth during the year. The investments we have made in people and technology have led to stronger execution capabilities and significant growth in both client balances and volumes. Over the past five years, our Equities business has gained more wallet share than our top three competitors combined.

Even with the fourth quarter’s turbulent markets, stronger performances during the year in areas such as Currencies & Emerging Markets and Commodities contributed to $12.7 billion of Fixed Income Markets revenue in 2018, nearly matching our 2017 result. Once again, we gained share as the industry wallet declined.

In Treasury Services, we continued to outpace competitors, growing firmwide revenue to approximately $9 billion. Our performance was helped by higher interest rates and operating deposits, which have grown by 9% since 2016.

Looking ahead, Treasury Services will benefit from our recent decision to integrate its operations with Chase Merchant Services, the largest merchant acquirer in the U.S. and Europe. Together, these businesses form the biggest wholesale payments network in the world, processing more than $6 trillion payments daily. It serves 1.6 million small business customers and more than 80% of Fortune 500 companies. By combining units, we will be able to reduce legacy platform costs, accelerate the expansion of our merchant acquisition business into Latin America and Asia Pacific, and continue to innovate across networks using blockchain technology.

Securities Services continued to grow and transform in 2018 while benefiting from higher interest rates and client balances. The business took on an unprecedented amount of new client business while at the same time streamlining infrastructure and upgrading systems.

In addition to onboarding more than $1 trillion in assets from BlackRock, there were many other significant successes. New business wins globally have led to a growth in assets under custody of approximately $2.7 trillion since the start of 2017. Such mandates helped drive revenue up 8% in 2018 to $4.2 billion, while we maintain industry-leading operating margins and high client satisfaction scores.

Although our overall results are impressive, it’s important for us to stay hungry and focused on our clients, anticipate changes and never lapse into complacency. We embrace disruption – even as the market leader – and continually invest in digital technologies to provide clients with data and insights when and where they want them.

That focus has generated results for our shareholders, too. In addition to earning an industry-leading return on equity, our market share among the CIB’s largest competitors grew the most year-over-year, even after outpacing the group between 2014 and 2017, according to data from Coalition.

We know that profitability stems from serving clients well, and the choices we are making today always start with the same two-part question: Is this the right thing to do for our clients and for the long term?

The economic cycle

From an economic perspective, fundamental growth continues to support the longest postwar expansion in history. Corporate earnings and balance sheets are healthy, U.S. unemployment is near record lows and we are not seeing signs of deteriorating credit quality.

That said, I believe we are closer to the end of the expansionary cycle than the beginning. My sense is that the market volatility in the fourth quarter of 2018 was partly due to fear among investors that the downturn was coming sooner than expected. Meanwhile, “flash crashes” are becoming more frequent. These are a function of a number of factors, including thinner liquidity across asset classes, fewer participants in the market and a growing percentage of automated trading volumes.

We expect to see periods of volatility in the future, and we are committed to managing risk in a dynamic way no matter what market conditions we face. That requires us to be disciplined and not overextend ourselves, trusting in our strengths and doing what is right.

Around the world

Investors always assess geopolitical risks, and 2018 provided no shortage of them. For our part, we constantly monitor and stress test our positions. We take a long-term view of client relationships and investments while maintaining discipline on underwriting standards and risk concentrations across clients, countries and products.

Potential opportunities in Asia Pacific, particularly China, remain significant. Last year, we announced major growth plans for China, including the appointment of a new country chief executive officer along with a formal application to Chinese regulators to establish a new, majority–owned securities company.

In Europe, our attention remains on Brexit. Despite the uncertainty of the U.K.’s future relationship with the European Union, J.P. Morgan has been planning for the worst while hoping for the best. Regardless of Brexit’s ultimate consequences, J.P. Morgan will be able to serve clients in any scenario. We’re fortunate to have branches, offices and talented people across Europe, ensuring seamless client service before, during and after Brexit.

Technology

We’ve learned the hard way that it is incredibly costly to lose a leadership position due to a failure to embrace change. Our firm was a leader in foreign exchange in the late 1990s, but by resisting rather than embracing electronic trading, we lost market share. It took many years and millions of dollars of investment to recapture our leadership – illustrating the crippling effect that short-term thinking can have on a business.

That lesson is one of the many reasons we continue to reinvest such significant sums – now more than $11.5 billion per year – into technology across the firm.

As electronification of the trading markets continues across asset classes, we are building sophisticated trading platforms, such as Algo Central, enabling clients to use predictive analytics to tailor orders and even change the speed and execution style while the trade is live.

In Securities Services, which safeguards more than $23 trillion in client assets, we extended our Investment Analytics Platform to more than 200 large investor clients, giving them clearer insight into their own portfolios and helping them better manage the risks and concentrations associated with their positions.

In wholesale payments, more than 180 international banks have signed on to be part of J.P. Morgan’s Interbank Information Network, which uses blockchain technology to instantly transfer global payment information among correspondent banks, allowing funds to reach beneficiaries faster and with fewer steps. We are also the first bank to offer real-time payments in U.S. dollars, euros and British pounds, and the first U.S. bank to create and test a digital coin for instantaneous crossborder payments using blockchain.

In investment banking, we are using technology to empower bankers and strengthen connections with clients. With access to a wealth of information about M&A and the capital markets, bankers can sit side by side with clients, review trends and evaluate timely capital raises or even model what might happen to their stock in an activist situation. Treasurers can view our top-ranked research, evaluate various financial metrics and create custom reports on an easy-to-use dashboard. This transparency only strengthens relationships and provides even more value to companies that look to us for strategic advice.

There is also a large opportunity to improve efficiencies internally using technology. About 40% of time in global operations is spent on servicing client accounts, including answering queries. As we develop systems to better direct those requests, we will spend less time searching for answers and more time responding to client needs.

With our scale, global footprint and leadership, we have the ability to analyze data and generate insights like no other financial services company in the world. We increasingly see our business as a platform to which clients can connect for whatever financial products and services they need.

Most exciting, perhaps, is the innovative spirit surging through the bank. Last September, we kicked off a competition in which teams of analysts and associates across the CIB were invited to submit their best ideas for making the company faster, smarter and better. In a span of several weeks, the teams submitted 469 ideas, many of which we are already taking forward with funding. The competition showcased the amazing talent emerging within the organization and fueled optimism about our bank’s future.

Communities and partnerships

Being part of a firm that has four best-in-class franchises is extraordinary. The talent and resources we can mobilize for a client, a government, an industry or a new market are unmatched. Our work in Detroit is well-known: We have partnered with local officials and organizations, investing $150 million in the city’s economic recovery. This effort goes beyond a financial commitment. Through the JPMorgan Chase Service Corps, teams of our colleagues are working on-site at local nonprofit partners to solve specific challenges.

I’m proud to say that the firm is extending its resources to other cities and communities, such as Greater Paris and Chicago. As a global bank with clients and employees around the world, we believe we can add value by partnering with local governments and organizations to expand access to jobs and skills for young people and adults and help regional businesses grow.

We are also working with colleagues across the bank to support different segments of the economy. The CIB’s integration with Chase Merchant Services is aimed at making international payments seamless for both consumers and e-commerce companies. Similarly, being able to offer best-in-class advice and capital markets expertise to 19,000 midsized companies on Commercial Banking’s roster helped yield $2.5 billion of North America investment banking revenue during 2018 – a record. Our bankers are planning to gradually extend efforts to midsized companies in Europe and Latin America as well. We’re also working with the Private Bank to expand our coverage of family offices across the U.S. and around the world.

Conclusion

We have worked hard over many years to earn our place as an industry leader – in market share, financial strength and reputation. As we transform our business for the future, we will build on our legacy of success by taking advantage of strategic growth opportunities while maintaining day–to–day discipline. Our experienced and talented CIB leadership team, bolstered by the next generation of vibrant, energetic employees, is propelling our company to the forefront of digital banking and is positioning us to serve our clients with the innovative, effective financial strategies they will need in the years to come.

Daniel Pinto

Co-President and Chief Operating Officer, JPMorgan Chase & Co., and CEO, Corporate & Investment Bank

2018 Highlights and Accomplishments

- The CIB had earnings of $11.8 billion on $36.4 billion of revenue, producing a best-in-class ROE of 16%.

- J.P. Morgan ranked #1 in global investment banking fees for the 10th consecutive year, ending 2018 with an 8.7% market share, the highest share of any bank since 2009.

- J.P. Morgan ranked #1 in wallet share for both debt and equity capital markets, raising more than $475 billion for clients around the world

- .J.P. Morgan advised on 10 of the top 20 M&A transactions in 2018 and generated a full-year record in M&A revenue

- J.P. Morgan ranked as the #1 Global Research Firm in Institutional Investor magazine’s annual investor survey. We also ranked #1 in both All-America and All-Europe Fixed Income, #1 in All-America Equity Research, and #2 in All-Europe Equity Research and Latin America Research

- Overall Markets revenue of $19.6 billion was up 6%, led by record revenue in Equities trading, which was up 21%.

- Firmwide revenue in Treasury Services grew to nearly $9 billion in 2018. Our decision to integrate the business with our Merchant Services offering now provides clients with access to the largest wholesale payments network in the world.

- With $23.2 trillion in assets under custody, our Securities Services business continued to win more client mandates across the globe, helping to drive revenue up 8% in 2018.

- More than 180 international banks have signed on to be part of J.P. Morgan’s Interbank Information Network, which uses blockchain technology to instantly transfer global payment information among correspondent banks.