Corporate & Investment Bank

In the dozen years since the global financial crisis, the banking system has been rigorously stress tested to ensure it can withstand severe market shocks. In 2020, the COVID-19 pandemic offered a stress test beyond any that our industry has experienced to date.

The demand for our balance sheet – in terms of capital and liquidity – was unprecedented last year. In the months of March and April alone, we helped clients raise more than $940 billion in the capital markets and extended more than $80 billion in credit, giving companies and governments the lifelines they needed.

As the pandemic took hold, markets saw the most rapid sell-off in history. Amid spiking volatility, our Equities business witnessed many days of record volumes, while at the height of the crisis, our Wholesale Payments team processed up to $11 trillion in payments in a single day.

Our firm's strategy – to be global, complete and at scale – has cemented its reputation as a port in the storm, able to shore up crisis-hit firms and national economies while continuing to grow even as margins tighten and capital buffers increase. That strategy has also provided the springboard for our growth into new markets and geographies and has enabled our heavy investment in technology. In 2020, that investment meant that we could not only move forward with advancements in artificial intelligence, cloud and blockchain but also ensure that more than 90% of our employees could work securely from home in a matter of days.

An exceptional performance

The Corporate & Investment Bank (CIB) achieved a 20% return on equity in 2020 by generating earnings of $17.1 billion on revenue of $49.3 billion – a historic performance in a tumultuous, impossible-to-predict year. Discounting that exceptional performance, over the last five years our return on equity has stood consistently between 14% and 16% on an adjusted basisfootnote1. In fact, during that time, we have increased revenue by 16% and net income by 32%.

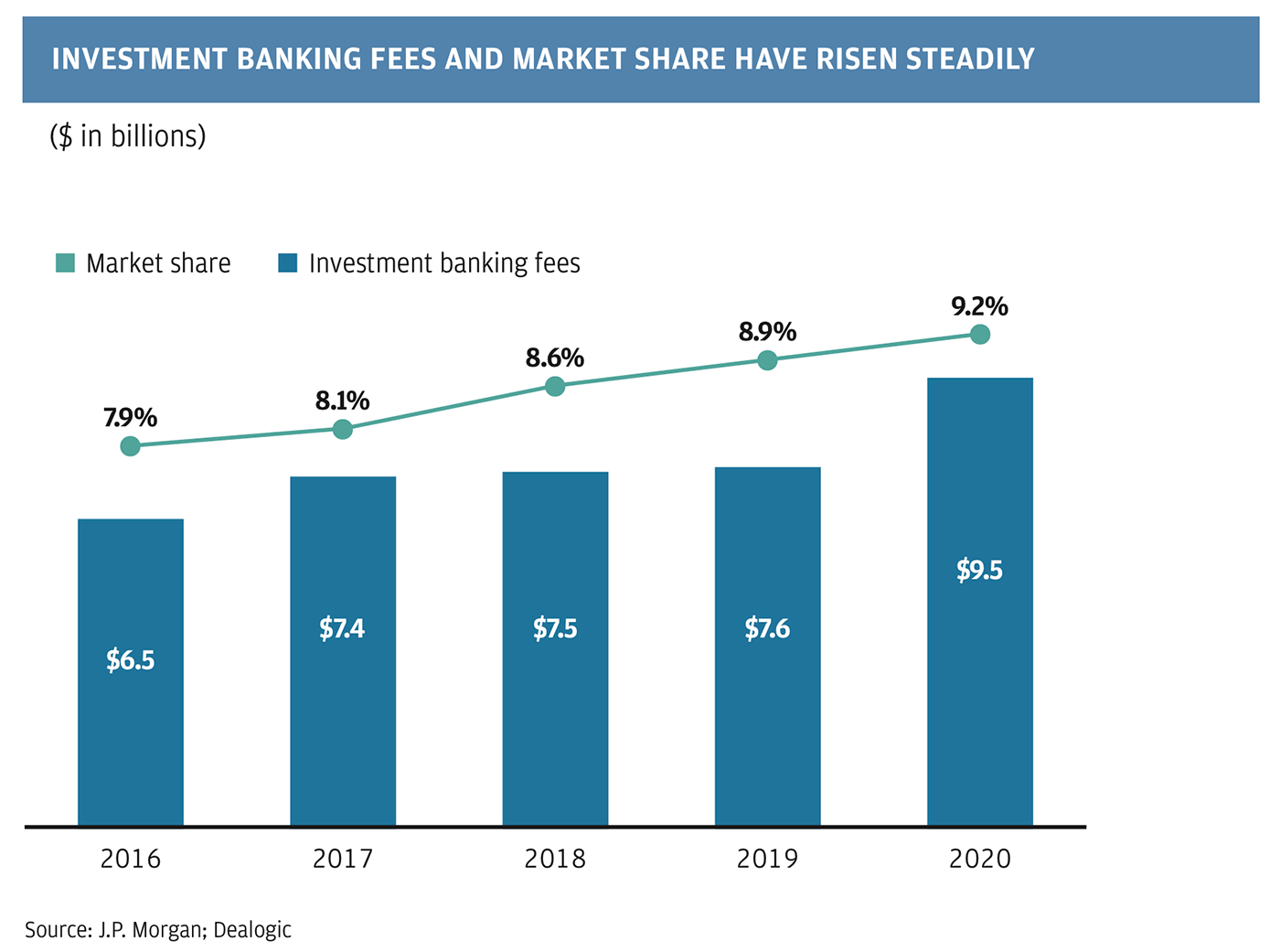

Our Investment Banking business ended the year with 9.2% of global market share, its highest since 2009, and generated record fees of $9.5 billion to maintain our #1 ranking.

Investment Banking Fees and Market Share Have Risen Steadily ($ in billions)

$6.5 investment banking fees and 7.9% market share in 2016

$7.4 investment banking fees and 8.1% market share in 2017

$7.5 investment banking fees and 8.6% market share in 2018

$7.6 investment banking fees and 8.9% market share in 2019

$9.5 investment banking fees and 9.2% market share in 2020

Source: J.P. Morgan; Dealogic

As COVID-19 spread across the globe, we helped clients bolster their balance sheets, including those in hard-hit sectors like retail, travel and hospitality. As a result, underwriting fees in our Debt Capital Markets business hit an all-time record. The business, which has ranked #1 for the last five years, extended its leadership position with nearly 10% of market share.

Stimulated by unprecedented central bank support, the reversal in market sentiment and the activity that followed in the second half of the year were extraordinary. In 2020, our Equity Capital Markets team helped clients raise $389 billion of capital in 563 deals around the world, which represented one-third of the total market.

One major development in 2020 was the evolution of the initial public offering (IPO) market as special purpose acquisition companies (SPAC) became mainstream, a byproduct of low interest rates and excess capital stockpiled by investors. These "blank check" companies, which are formed for the sole purpose of acquiring a private company, accounted for more than half of all IPOs in 2020. We have led our share of SPACs, but as with any growing trend, we want to remain diligent and seek to do the right deals with credible sponsors.

In our M&A business, announced volumes returned to pre-pandemic levels later in the year as government stimulus packages took effect and companies shifted their stance from defensive to more opportunistic. Our M&A ranking in EMEA rose to the #1 position, and we retained the #2 spot in North America.

The pandemic, the U.S. presidential election and Brexit all spurred trading activity. With so much to navigate, investors turned to J.P. Morgan as a reliable provider of liquidity, which resulted in record volumes across many of our trading areas. At peak moments, our foreign exchange (FX) desk was executing 730 trades per second, underlining years of investment in technology and highlighting just how critical we are to well-functioning markets during times of volatility. Overall, Markets revenue climbed 41% to a record $29.5 billion, with our Fixed Income Markets business generating $20.9 billion and Equity Markets producing $8.6 billion.

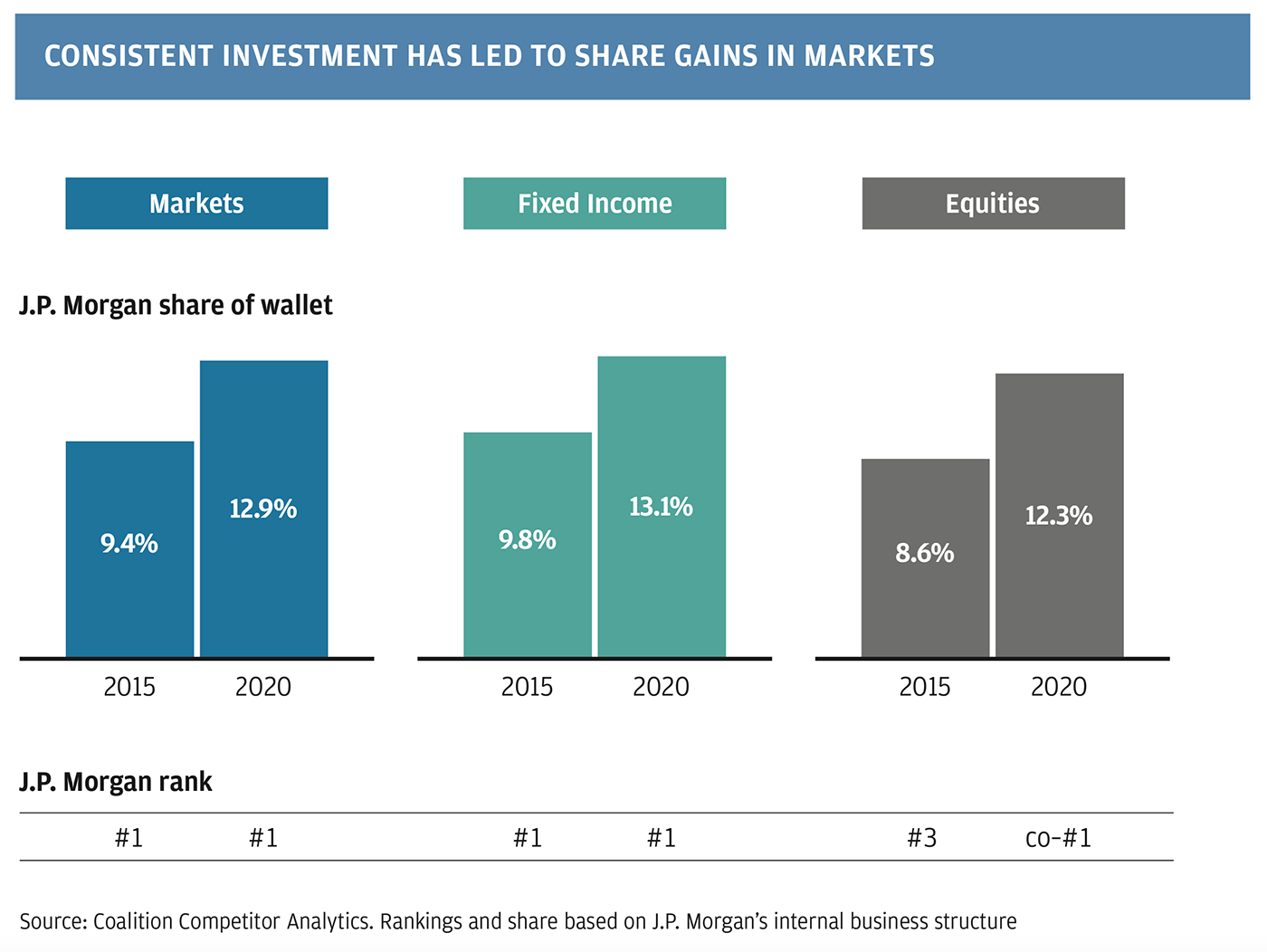

Consistent Investment has Led to Share Gains in Market

J.P. Morgan share of wallet

Markets: 9.4% in 2015 and 12.9% in 2020. J.P. Morgan rank #1 in 2015 and 2020.

Fixed Income: 9.8% in 2015 and 13.1% in 2020. J.P. Morgan rank #1 in 2015 and 2020.

Equities: 8.6% in 2015 and 12.3% in 2020. J.P. Morgan rank #3 in 2015 and co-#1 in 2020.

Source: Coalition Competitor Analytics. Rankings and share based on J.P. Morgan's internal business structure

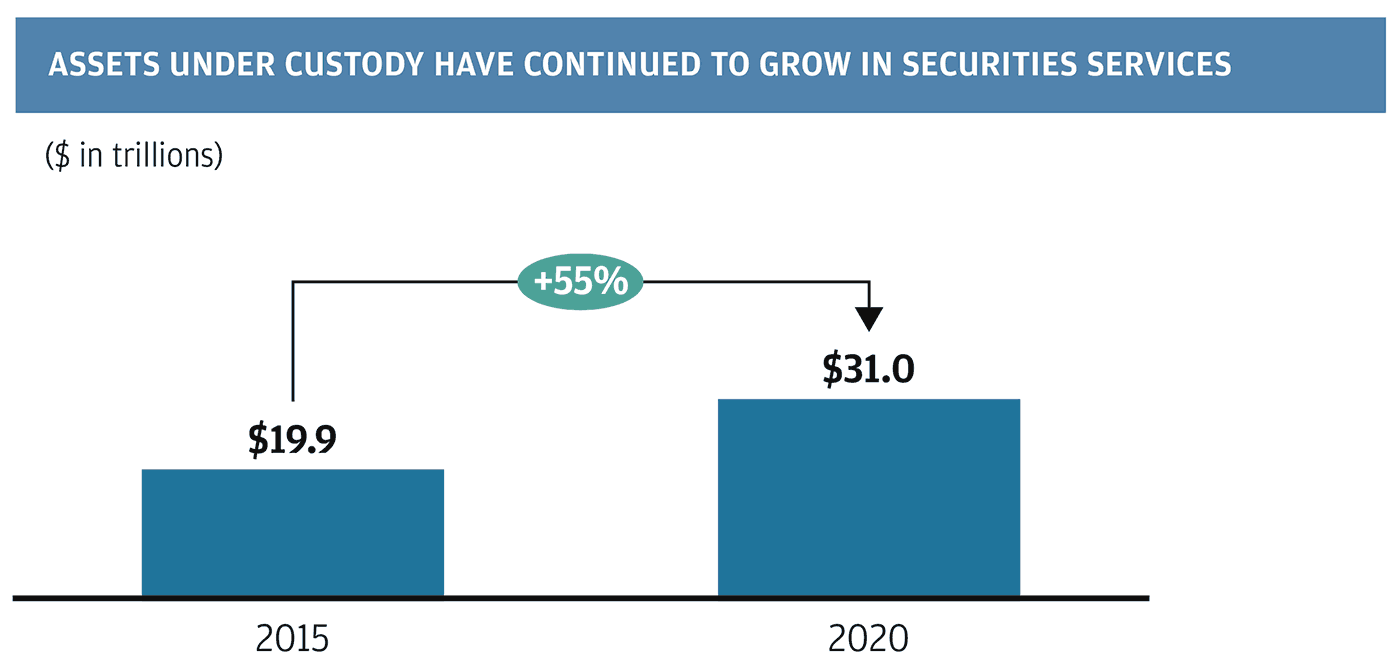

Our Securities Services business, which provides pre- and post-trade services to asset manager clients, had a strong year of growth in 2020. Clients outsourced more of their middle and back office functions to J.P. Morgan as scalable infrastructure and timely insights became critical to handling massive spikes in volume and volatility. The team onboarded $4 trillion in assets under administrationfootnote2, and ended the year with record assets under custodyfootnote3, further strengthening our position as a leader in fund accounting and administration of $31 trillion. We launched our next-generation Middle Office offering, leveraging the capabilities of the CIB to offer market-leading solutions to our clients at a time of industry consolidation and growth in complex assets.

Assets under custody have continued to grow in securities services. ($ in trillions)

$19.9 in 2015 and $31.0 in 2020. +55% from 2015 to 2020.

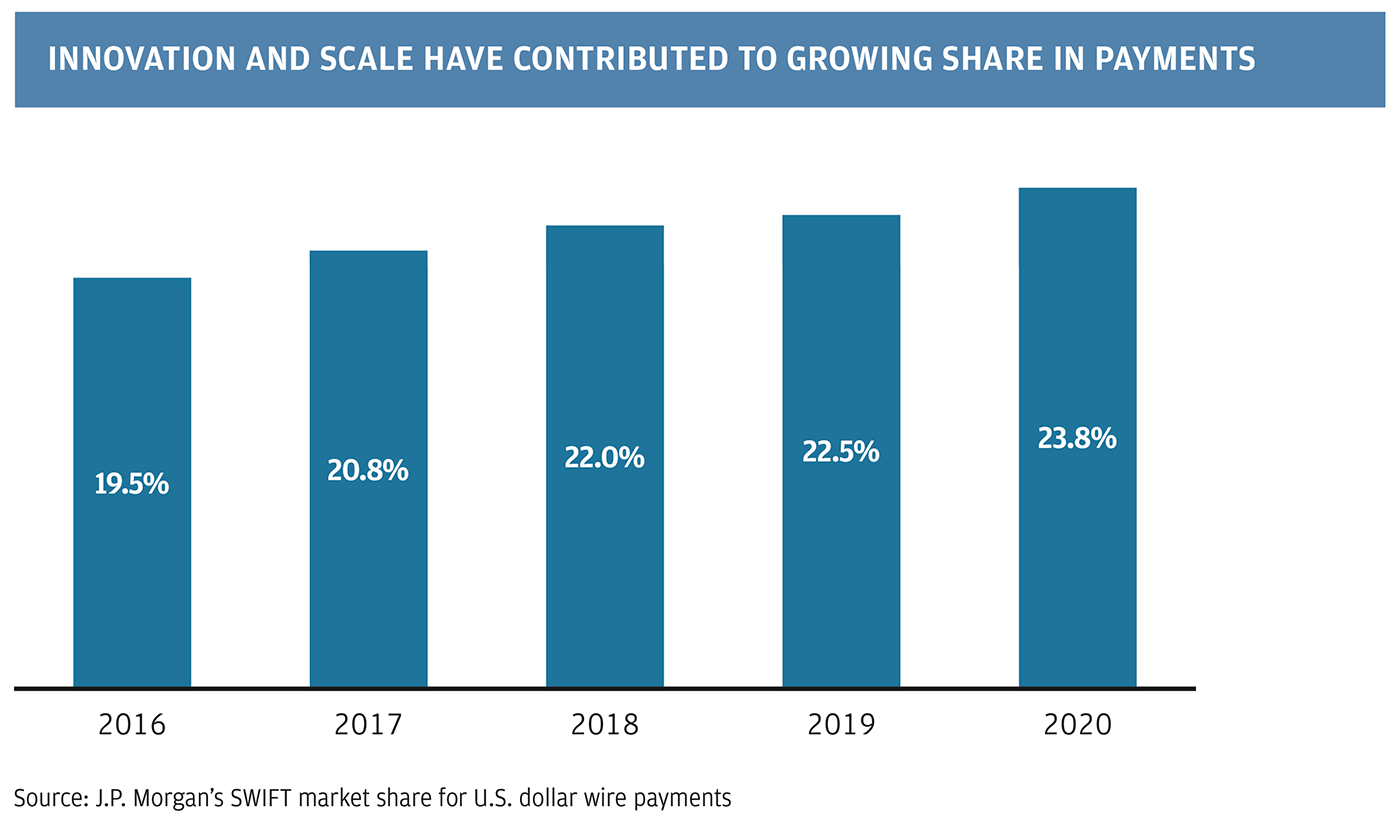

Our Wholesale Payments unit, which includes Treasury Services, Trade Finance and Merchant Services, also experienced strong growth in 2020. A decline in revenue, mostly attributable to low rates, was offset by notable deposit growth. Throughout the pandemic, Treasury Services has processed payments and facilitated the flow of essential funds to companies and governments. As the world’s largest transaction bank, the business moves trillions of dollars every day and remains #1 in U.S. dollar clearing by volume. Innovation in payments is exploding, driven by the growth in e-commerce and digital wallets. In 2020, we went live with Concourse, a highly configurable global platform that allows clients to send and receive payments in a more seamless way; J.P. Morgan also announced fintech partnerships in areas such as supply chain finance and corporate credit cards.

Legacy of a pandemic

The pandemic has accelerated the shift to digital platforms and has transformed the way we and our clients work. Last year showed us how quickly we can adapt; for the first time, many of the year’s biggest banking deals were conducted virtually or by phone – unthinkable before 2020.

As the crisis recedes, it is likely that we will adopt the best of these new virtual environments to complement what we miss most about working together in person. We are, at heart, a collaborative business – and working together is critical to innovation, creativity and a stronger culture.

After the pandemic, we will likely see some shift in working patterns. While some job functions will need to remain on-site full time, a different working model is starting to emerge in which employees rotate between working at home and in the office. This creates more flexibility for employees and also enables us to shrink our real estate footprint, operate buildings more efficiently with fewer empty seats and eliminate the need for costly recovery sites.

Meeting the needs of the future

From established rivals to tech giants and fast-moving fintechs adept at delivering a great client experience, competitors are crowding up across all fronts. The CIB is not immune to these competitive threats, which is why our focus on innovation and technology is at the heart of our investments.

Clients want to access the full breadth of our franchise from anywhere and at any time, and we are transforming to meet that future.

This transformation presents different opportunities across our businesses. For example, in Securities Services, we are evolving from a provider of back office services to a fully integrated platform that delivers scale and efficiency for clients across the entire investment life cycle.

In the U.S., the number of publicly listed companies has fallen by 24% since the mid-1990s as start-ups delay IPOs. To help those private companies through their extended life cycles, we are working to provide a platform that offers everything from primary issuance to secondary trading, as well as data and equity administration capabilities. In partnering with our Commercial Bank, which serves thousands of smaller, privately held companies, we see a wealth of untapped opportunities.

The trend in electronification continues in market trading, and we are expanding connectivity options for our clients, improving efficiency through automation and digitization, and more effectively participating in multi-dealer platforms. There is also an opportunity to act as the trading interface for smaller banks and to partner with the Commercial Bank and Treasury Services to manage the FX needs of smaller companies operating in international markets. Our ambition is to create a single payment and hedging platform for corporations that enables them to more efficiently reduce currency exposure and manage cross-border payments.

And in Wholesale Payments, where we now have the world's most complete payments network, our focus is on global e-commerce and online marketplaces. We want to help clients plug into a comprehensive payments and account administration service in one place and support more small businesses looking for FX expertise and working capital.

Innovation and scale have contributed to growing share in payments

19.5% in 2016

20.8% in 2017

22.0% in 2018

22.5% in 2019

23.8% in 2020

Source: J.P. Morgan's SWIFT market share for U.S. dollar wire payments

Central to all this change is a multi-year program to modernize our technology infrastructure. We are becoming a digital-first organization, able to harness – safely and smartly – the power of data and artificial intelligence across our firm in order to provide a more seamless client experience.

A sustainable future ...

Climate change is a defining issue of our age. Given our firm's scale and financing capabilities, we can play a leading role in helping companies and economies transition to a low-carbon world. As part of our efforts to limit global temperature rise by 2050, we are aligning our financing portfolio with the Paris Agreement. We will also establish intermediate emission targets for 2030, with a focus on the oil and gas, electric power and automotive manufacturing sectors.

In 2020, we achieved our goal of becoming carbon neutral in our operations, which includes sourcing renewable energy for 100% of our global power needs. The firm also launched the Center for Carbon Transition to provide clients with centralized access to sustainability-focused financing, research and advice.

Business and government must join forces to address the challenge of climate change. Meeting the target of the Paris Agreement requires massive restructuring in how the world produces and consumes energy. We are helping clients make the transition by financing technology to reduce emissions and by supporting investment in green energy. In industrialized sectors, we will continue to advocate for market-based policy solutions, including a price on carbon.

… and a diverse future

Stubborn structural challenges persist across our society, and in every industry human potential continues to go untapped as racial prejudice goes unchallenged.

The killing of George Floyd in May 2020 and the subsequent protests across the U.S. and around the world impelled us to seek new solutions to address the challenges Black and minority individuals face in the workplace – and in society.

Our efforts to close the racial wealth divide include a $30 billion injection of additional capital and other resources for Black and Latinx clients, employees and communities in the U.S. and globally over the next five years. As part of our investments, we will work to boost the flow of capital to minority-owned banks and businesses, expand support for minority-owned enterprises, improve financial health and broaden the diversity of our suppliers. Programs such as the Entrepreneurs of Color Fund and Advancing Black Pathways, for example, provide Black and other minority groups with access to capital, education and our technical expertise.

Our own success depends on hiring the best people, no matter where they grew up, how they were educated or what they look like. Internally, we have focused on inclusive recruiting, invested in new programs to advance Black talent and created a team dedicated to discovering recruits from more diverse communities.

Conclusion

In a year like no other, we did what we have always done: We supported our clients and employees through tough times.

The strategy we set years ago remains as relevant as ever. We are focused on running our business efficiently, managing risk prudently and delivering for clients. We are optimizing our business and closing any addressable gaps in our offering, and we are continuing to transform our business for the future.

From the pandemic crisis, we take forward some vivid lessons; namely, to preserve our ability to innovate and execute at speed, even as a large and complex organization. And we must do that in a way that enables our people, communities and planet to thrive over the long term.

The global vaccine rollout provides hope for our collective long-term health and economic well-being. As we emerge from this tumultuous time, one of the lingering concerns is whether the extreme infusion of liquidity and fiscal stimulus might ultimately create inflationary conditions in the medium term.

The performance of the CIB in 2020 is testament to the extraordinary commitment of our employees who supported clients while facing their own personal challenges. I am very proud of what they have accomplished.

Daniel E. Pinto

Co-President and Chief Operating Officer, JPMorgan Chase & Co., and CEO, Corporate & Investment Bank

- Return to footnote reference 1

- As reported for 2020 Investor Day.

- Return to footnote reference 2

- Assets under administration: Represents the market value of client assets for which administrative and other related services are performed.

- Return to footnote reference 3

- Assets under custody: Represents assets held directly or indirectly on behalf of clients under safekeeping, custody and servicing arrangements.