Asset & Wealth Management

When last year’s shareholder letter was published, the world and financial markets were just coming to grips with COVID-19. Since then, the global pandemic has affected all of us in unforgiving ways — with loss of life, strained healthcare systems and economic setbacks that will be felt for years to come.

Fortunately, governments and central banks acted swiftly and decisively to infuse capital and provide support for what could have been very fragile markets. If there is a silver lining to this horrible pandemic, it is how much the world acted in unison to try to do the right thing. We are hopeful that 2021 will be a better year for all.

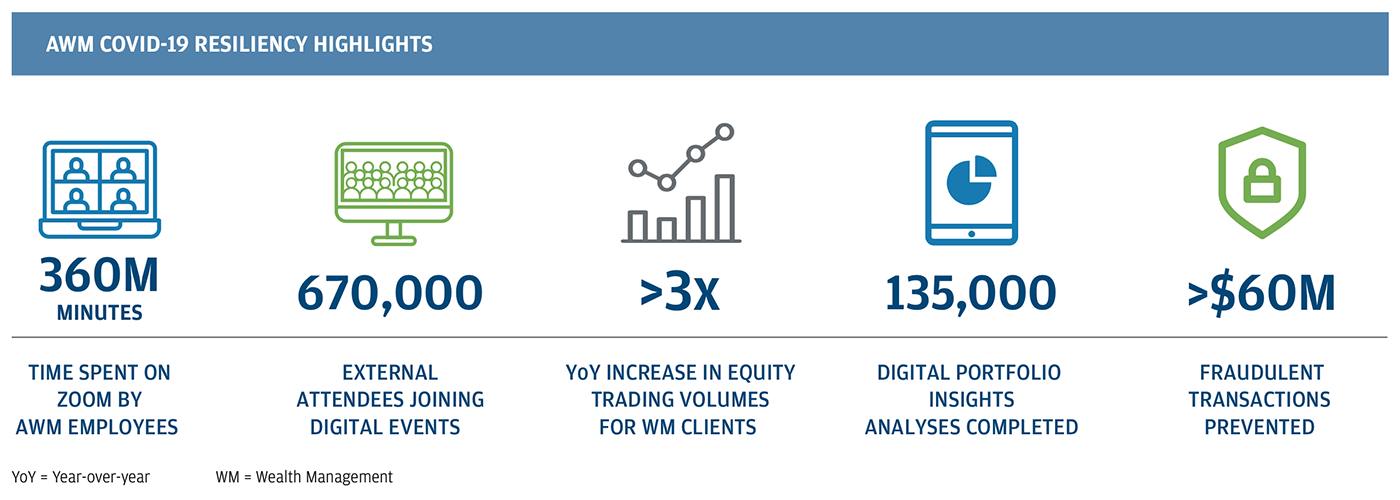

AWM COVID-19 Resiliency Highlights

360M minutes, time spent on Zoom by AWM employees

670,000 external attendees joining digital events

>3x YoY increase in equity trading volumes for WM clients

135,000 Digital Portfolio Insights analyses completed

>$60M fraudulent transactions prevented

YoY = Year-over-year

WM = Wealth Management

Rising to meet an unprecedented challenge

In March 2020, over the course of two weeks, we transitioned more than 90% of our global Asset & Wealth Management (AWM) team from on-site to remote work settings. In doing so, we proved that we can serve our clients under any and all circumstances, even without ever leaving our homes. We also showed that we can make sound and fast decisions under intense pressure and uncertainty.

As always, clients were our focus. Helping them as we all went through these challenges, together, was a source of great pride and drove us to be at our best.

Across AWM, our years of resiliency testing and preparation enabled us to pivot swiftly and seamlessly. As CEO, I have written annually about how proud I am of my colleagues and our firm. This was especially true in 2020, when we intensified our work on:

- Digital acceleration. Operating almost exclusively in a digital world, we were able to quickly identify manual or inefficient processes. As volumes surged and we overcame various work environment and personal challenges, we worked tirelessly to accelerate our digital engagement with clients, counterparties and one another. In 2021, we are focused on closing remaining process gaps and pulling forward multi-year plans.

- Connectivity with our clients. As the world locked down, we were given the gift of redirecting time previously devoted to travel and other in-person activities to connect with tens of thousands of clients eager for our insights and thought leadership. The success of this shift is demonstrated by our results: record attraction and retention of assets and clients.

- Operational excellence. With an agile mindset, we accelerated the movement of reports to dashboards, simplified processes and strengthened the governance of our technology investments.

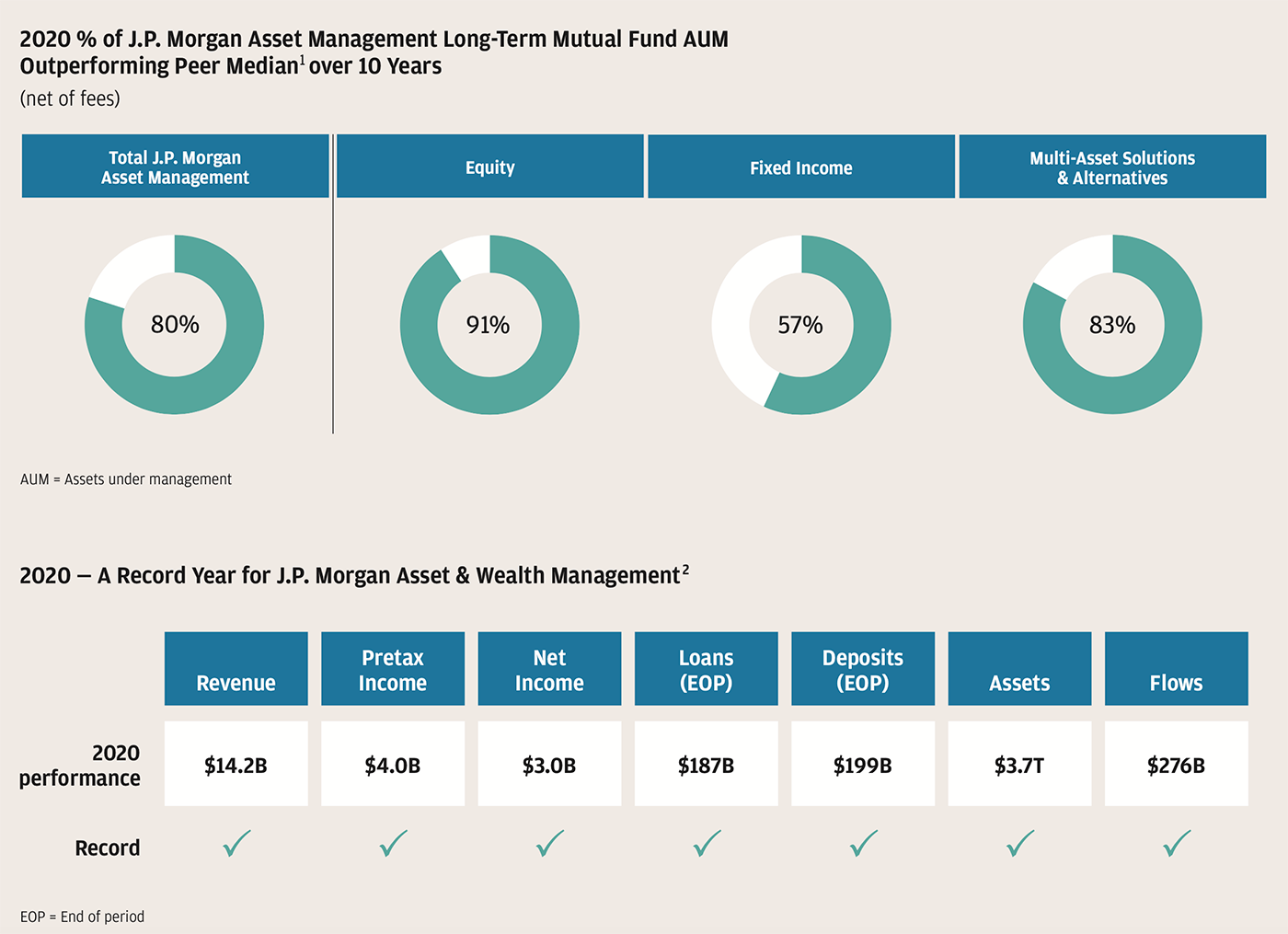

2020 % of J.P. Morgan Asset Management Long-Term Mutual Fund AUM Outperforming Peer Median1 over 10 Years

(net of fees)

Total J.P. Morgan Asset Management, 80%

Equity, 91%

Fixed Income, 57%

Multi-Asset Solutions & Alternatives, 83%

AUM = Asset under management

2020 - A Record Year for J.P. Morgan Asset & Wealth Managment2

2020 performance

Revenue, $14.2B

Pretax Income, $4.0B

Net Income, $3.0B

Loans (EOP), $187B

Deposits (EOP), $199B

Assets, $3.7T

Flows, $276B

EOP = End of period

1: For footnote, refer to page 67 footnote 32 in this Annual Report.

2: For footnote, refer to page 67 footnote 29 in this Annual Report.

Strong investment performance for clients

Year in and year out, we are focused on delivering outstanding investment performance. This is why maintaining a 95+% retention rate of our top-performing investment team heads, portfolio managers and research analysts is such a high priority. With the volatility that occurred in 2020, active management was never more important and its value never more apparent, and, accordingly, our long-term investment performance was strong across asset classes.

Clients vote with their feet, and they continue to entrust us with more of their assets every year. In 2020, our client assets grew to a record $3.7 trillion, and we received a record $276 billion in net client asset flows. Our record flows were the result of a diversified business that meets all of our clients’ needs – we had positive flows across all regions, segments and products. Having our breadth and depth of solutions was especially important during a very volatile market environment.

- Liquidity: $104 billion in flows, as more risk-averse clients looked to reduce their market exposure, particularly during the first half of the year when flows reached $170 billion. Two of our money market funds, U.S. Government and U.S. Treasury, each attracted over $25 billion in flows last yearfootnote3.

- Fixed Income: $48 billion in flows, as market volatility and the low interest rate environment caused clients to seek high-quality income sources. We had strong flows into our Income funds ($8 billion)footnote4, High Yield Bond funds ($6 billion)footnote5 and Ultra-Short Income ETF (JPST) ($5 billion)footnote6.

- Equity: $33 billion in flows, as markets rebounded and clients increased their exposure, particularly during the second half of the year. There was strong activity across our offering, including significant flows into our Emerging Markets Equity funds ($6 billion)footnote7, U.S. Large Cap Growth funds ($4 billion)footnote8 and China A-Share funds ($3 billion)footnote9.

- Multi-Asset: $5 billion in flows, as clients continued to seek actively managed, outcome-oriented strategies. Our SmartRetirement Blend Target Date funds were an example of this, with $4 billion in flowsfootnote3.

- Alternatives: $6 billion in flows across a range of income-oriented and higher-returning strategies, including Infrastructure, Private Credit and our Highbridge offering.

- Custody/Brokerage/Administration/Deposits: $80 billion in flows, as clients trusted us to support their trading and banking needs.

Having dedicated market experts to support our clients is almost as important as the breadth and depth of our offering. In addition to the nearly 2,500 Global Private Bankfootnote10 client advisors and more than 1,000 Asset Management investment professionals, we have over 120 market strategists, portfolio analysts and goals-based advisors whose sole job is to provide timely advice and insights to our clients.

When you bring these strengths together — the focus on investment performance, the breadth and depth of our offering, and the expertise and advice we offer our clients — it’s clear how, since 2010, we have averaged more than $100 billion per year in client flowsfootnote2 — quite rare in our industry.

Equally important, the acknowledgment from our clients has validated our strategy to be the leader in active management. Looking specifically at flows through this lens, I am very proud of the fact that Asset Management ranked #1 in global long-term active fund flows in 2020footnote11. And across all of AWM, we maintained our #2 ranking against publicly traded peers in five-year cumulative total client asset flowsfootnote12.

Record year for shareholders

As a result of our clients’ trust in us and the incredibly hard work of our employees, we delivered extraordinary results for our shareholders. This included record performance across nearly all financial metrics, including revenue, pretax income, net income, loans, deposits and assets.

Both of AWM’s lines of business also performed well. Asset Management reached record revenue of $7.7 billion and record pretax income of $2.2 billion. The Global Private Bank was an equally powerful story, with record revenue of $6.6 billion and pretax income of $1.8 billion, despite the headwind of $263 million in credit costs as we grew our franchisefootnote10.

Investing in our business

Our success would not be possible without constant reinvestment in our business – to accelerate our growth, expand our offering, and maintain a strong risk and control framework. As a result of our long-term focus, increased scale and business momentum, our investment budget for 2021 is the largest in AWM’s history. Our most significant investments are aligned with the following areas:

- Hiring: Grow market share domestically and internationally by hiring advisors and investment professionals.

- Digital and Data: Digitize everything, and leverage data to deliver insights to our clients, investors and advisors.

- Environmental, Social and Governance: Rank among the top three in active sustainable funds.

- China: Become the #1 foreign asset manager onshore in China.

100 Years of J.P. Morgan in China

In 2021, J.P. Morgan will celebrate its 100th year in China. Today, the country represents one of the largest opportunities for our clients and the firm. For AWM, 2021 is especially important because we have agreed on terms with our joint venture partner to purchase China International Fund Management (CIFM), the culmination of a successful 17-year partnership. Given our firm’s heritage in China, established brand, and current on-the-ground investment teams and distribution channels, we are very excited about the possibilities that full ownership of CIFM will bring to our business and clients — and we look forward to our next 100 years in China.

Optimism for our future

Over a century ago, we launched one of our first investment funds, Mercantile Investment Trust. That fund, with a 136-year track record, thrives today as a great example of our consistent and steadfast management of assets. Clients choose J.P. Morgan as a long-term partner because we have withstood the test of time and are well-positioned for centuries to come.

As our business helps governments, central banks, individuals, corporations and pensions all around the world, we have a global perspective that few others enjoy. This, coupled with top-ranked performance in successfully managing client assets directly and in choosing third-party managers who we believe can do the same, gives us a unique understanding of the ever-changing investment landscape. That is why clients turn to us in uncertain times just as much as they do in more optimistic times. In 2020, we experienced both extremes.

Simply put, delivering performance and doing first-class business in a first-class way, decade after decade, is the core of what we do in AWM.

While new challenges undoubtedly lie ahead, I have never been more proud of the resiliency of our people, more grateful for our clients’ trust and confidence or more optimistic about our business’s future.

Mary Callahan Erdoes

CEO, Asset & Wealth Management

- Return to footnote reference 1

- For footnote, refer to page 67 footnote 32 in this Annual Report.

- Return to footnote reference 2

- For footnote, refer to page 67 footnote 29 in this Annual Report.

- Return to footnote reference 3

- Source: ISS Market Intelligence Simfund

- Return to footnote reference 4

- Source: ISS Market Intelligence Simfund. Total flows into U.S.- and Luxembourg-domiciled funds

- Return to footnote reference 5

- Source: ISS Market Intelligence Simfund. Total flows into High Yield Fund (U.S.-domiciled) and Global High Yield Bond Funds (Luxembourg- and U.K.-domiciled)

- Return to footnote reference 6

- Source: ISS Market Intelligence Simfund. U.S.-domiciled ETF

- Return to footnote reference 7

- Source: ISS Market Intelligence Simfund. Total flows into Emerging Markets Equity Funds (U.S.- and Luxembourg-domiciled) and Emerging Markets Fund (U.K.-domiciled)

- Return to footnote reference 8

- Source: ISS Market Intelligence Simfund. Total flows into Large Cap Growth Fund (U.S.-domiciled) and U.S. Growth Fund (Luxembourg-domiciled)

- Return to footnote reference 9

- Source: ISS Market Intelligence Simfund. Total flows into China A-Share Opportunities Funds (Luxembourg- and Hong Kong-domiciled), China Pioneer A-Share Fund (Hong Kong-domiciled) and China A Share Equity Fund (Taiwan-domiciled)

- Return to footnote reference 10

- For footnote, refer to page 67 footnotes 29 and 30 in this Annual Report.

- Return to footnote reference 11

- Source: ISS Market Intelligence Simfund retrieved March 17, 2021. Excludes index, fund of funds and money market funds

- Return to footnote reference 12

- For footnote, refer to page 67 footnote 26 in this Annual Report.