Corporate & Investment Bank

2021 was another extraordinary year for our business.

Economies started to emerge from the shadow of the pandemic. Company order books began to fill up once more, and demand for energy, cars, travel and home improvements returned.

New virus outbreaks continued to appear, however, and supply chains remained disrupted. In addition, the tumultuous market environment of 2020 did not normalize as much as expected, and through the year, we raised nearly $1.5 trillion in capital and extended almost $700 billion in credit for clients around the world as they responded to the ongoing crisis. With the pandemic in its second year, thousands of companies had to make bold moves to survive and thrive, igniting a nearly $6 trillion deal boom and the busiest year on record for our M&A franchise.

The COVID-19 pandemic provided a rigorous test of our business model. It is a course we set 10 years ago when we combined our Investment Bank, Treasury & Securities Services business and Global Corporate Bank in a bid to create the strongest and most complete Corporate & Investment Bank (CIB) in the industry.

We set out to be global, diversified, complete and at scale and to provide a safe haven for clients in times of stress. We aimed for both league-topping performance and stable returns so we would be able to invest continuously and consistently, always with an eye to the future.

A decade later, we can reflect on the merits of that decision. Today, the CIB operates in 100+ countries and 100 currencies, serves more than 90% of the Fortune 500 and has leadership positions across every major business line.

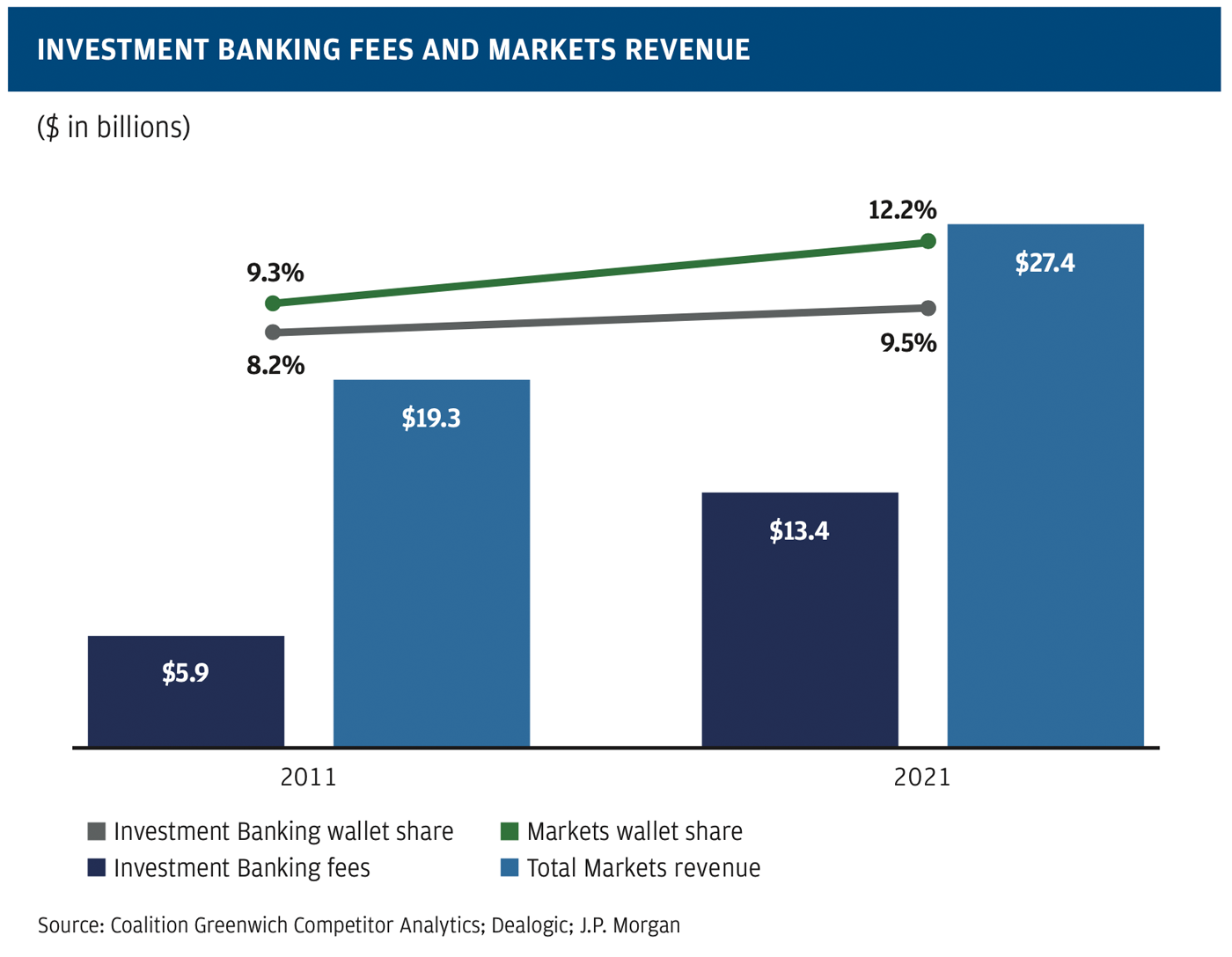

Investment banking fees and markets revenue

Revenue from our combined businesses has grown from $34 billion in 2011 to $52 billion in 2021; return on equity has risen from 17% to almost 25%; fees in Investment Banking have more than doubled; and in trading, revenue from our Equities desk has soared from $4.5 billion 10 years ago to $10.5 billion in 2021.

In 2011, we launched a securities joint venture in China to open up the country’s dynamic markets to investors and give domestic firms the chance to expand overseas. In 2021, we became the first foreign bank to fully own a securities company there. Meanwhile, we have nearly doubled the number of corporate bankers outside the United States to better serve major multinationals around the world. Helping midsized companies, too, has remained a priority, and Investment Banking revenue from our partnership with Commercial Banking has more than tripled in 10 years to $5.1 billion in 2021.

A decade of rock-steady support for our clients, along with disciplined and ongoing investment in our business, culminated in the CIB’s best-ever year in 2021.

The year in review

The CIB achieved a 25% return on equity in 2021 by generating record earnings of $21 billion on record revenue of $52 billion. For the 11th consecutive year, we retained our position as the world’s pre-eminent corporate and investment

bankfootnote1.

Our Investment Banking business ended 2021 with a record 9.5% market share, generating $13 billion in fees, nearly $4 billion more than 2020’s previous high.

Businesses flush with cash made decisive bets to address strategic gaps, driving the surge in M&A volumes. In a standout year, J.P. Morgan advised on more than 630 deals totaling $1.5 trillion, including the year’s biggest deal, Discovery's announced $96 billion combination with AT&T's WarnerMedia segment. M&A revenue increased by more than 80% compared with the last two years, and wallet share reached an all-time high of 10.2%.

In Debt Capital Markets, just as we have done over the last decade, J.P. Morgan finished the year with the top ranking in the debt and loan markets, completing more than 4,200 deals and retaining an approximate 10% share of the market. Activity was bolstered in large part by the M&A boom and deals to shore up companies affected by the evolving COVID-19 crisis.

In Equity Capital Markets, J.P. Morgan raised more than $435 billion across nearly 700 deals. In a year that saw initial public offering issuance jump over 85% to record levels, our team led seven of the 10 biggest listings of the year.

Another recent trend is the growth in private capital markets as investor demand grows and companies stay private for longer. In 2021, from offices in New York, San Francisco, Los Angeles, London and Hong Kong, our Global Private Capital Markets team set new records, raising approximately $50 billion for clients.

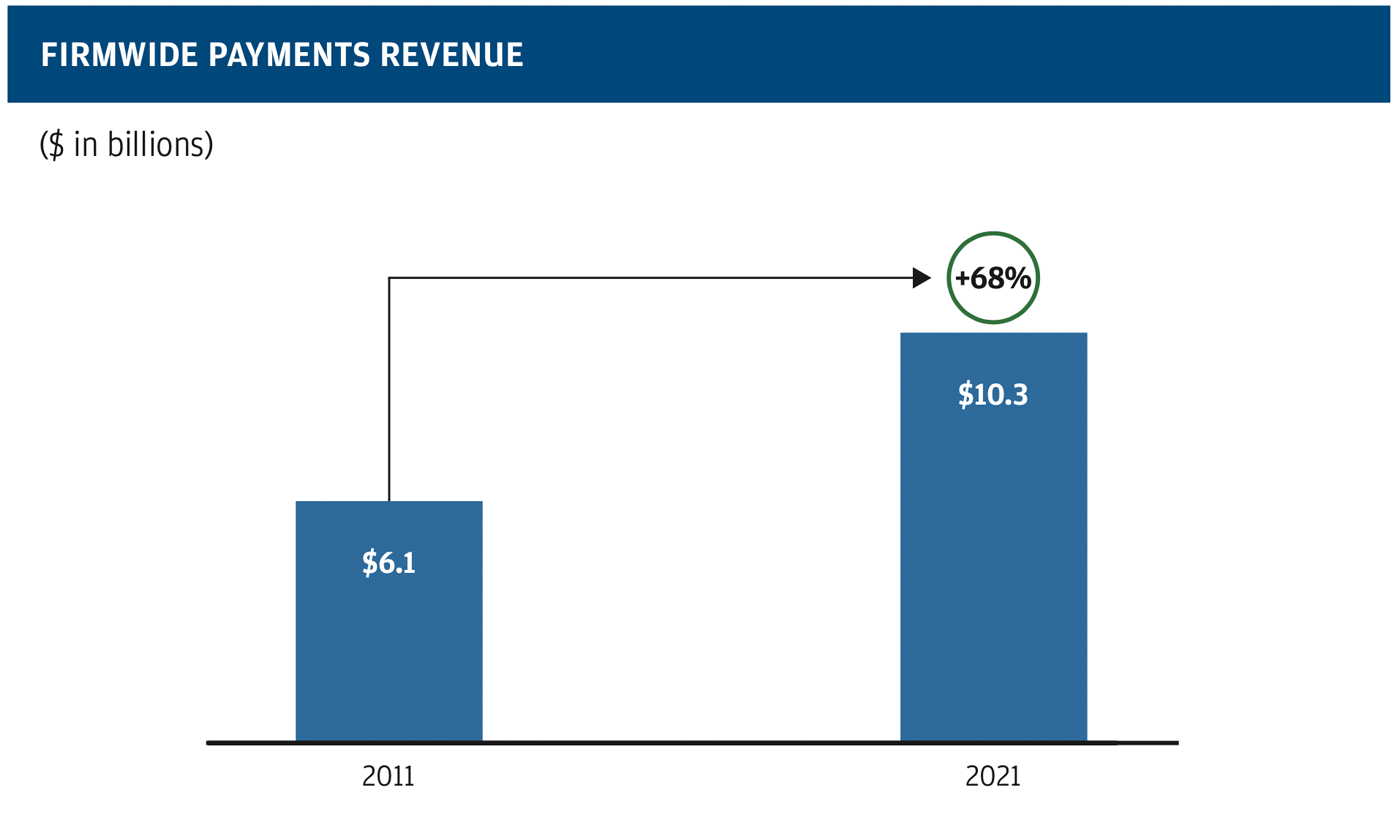

Firmwide payments revenues

In our Markets business, 2021 revenue of $27 billion was down from 2020’s highs as industry wallets started to normalize. Still, our trading businesses generated extremely strong results, particularly in Equities, which had its best-ever year, reporting $10.5 billion in revenue, up 22%, while our Fixed Income desk reported $17 billion in revenue and retained its #1 ranking for wallet share. Another notable success in 2021 was our Global Research team’s top ranking across all three of Institutional Investor’s annual global surveys, the first time any provider has achieved this accolade in the publication’s history.

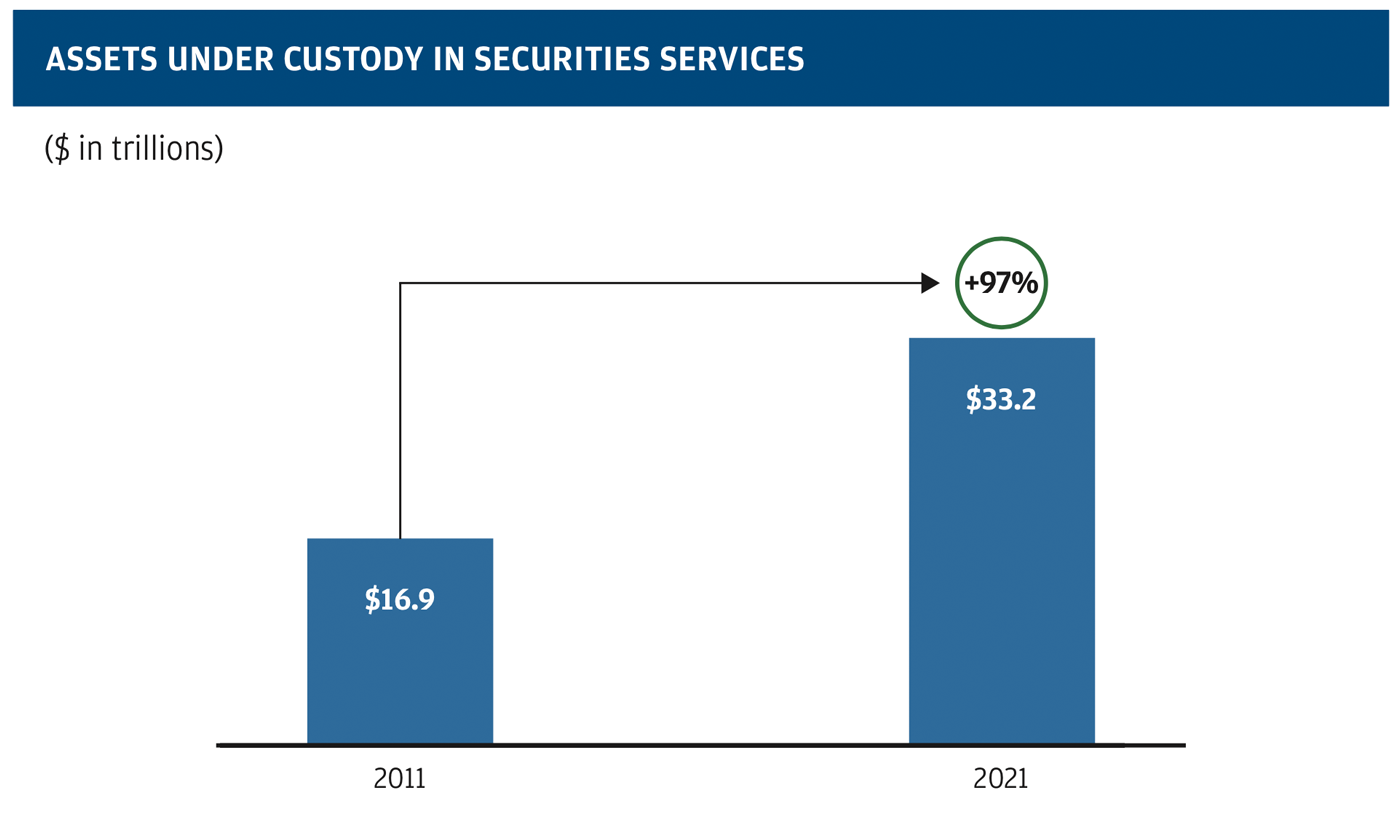

Our Securities Services business, which provides essential post-trade services to our institutional asset-manager and asset-owner clients, also had a strong year, reporting $4.3 billion in revenue. This is a business we have been investing — and winning — in for several years. In 2021, the team continued this momentum with more than $4 trillion in client assets onboarded and notable business wins, including a $700 billion share of BlackRock’s exchange-traded funds business. Assets under custodyfootnote2 in this unit have almost doubled since 2011, up from $17 trillion to $33 trillion in 2021.

Our rebranded J.P. Morgan Payments business, which includes Treasury Services, Trade Finance, Card and Merchant Services, continued its impressive record of growth, generating firmwide revenue of more than $10 billion, up 7% for the year. Over the last five years, the business has grown market share from 4.5% to 7.2% and, since the formation of the CIB, average deposits across the business have more than doubled, up from $319 billion to $715 billion. The business has also boosted its blockchain and automation capabilities so clients can move money around the world quickly, safely and easily. As the world’s largest transaction bank, the business moves, on average, more than $9 trillion every day and remains #1 in U.S. dollar clearing by volume. In other major developments during 2021, the business took a majority stake in Volkswagen’s payments platform, as competition in the connected car market accelerates.

Assets under custody in securities services

The competitive landscape

While we achieved all-time records in 2021 in a number of different areas, we cannot afford to be complacent. From long-established rivals to Big Tech and fintechs, the competitive threat is fierce and varied.

We are in a privileged position. Our consistent investment over the last 10 years lends us tremendous firepower for the future. Technology has always been a priority, and we have built some exceptional platforms that are high performing and resilient and work well at scale. In recent years, our focus has turned toward modernizing that infrastructure and using the cloud to increase our speed, output and agility so we can serve clients better and faster, particularly as we compete with fintech entrants.

Our greatest competitive advantage, however, is the talented people we have at J.P. Morgan. Their resilience and commitment throughout 2021 were remarkable. Even through the pandemic, we retained much of our top talent while taking opportunities to recruit diverse new talent with fresh perspectives. During 2021, more than 50% of CIB hires were diverse.

Helping more private companies

In Investment Banking, there remains significant opportunity related to the rapid growth of private capital markets. Over the past 20 years, the number of U.S. private companies has increased exponentially while the number of listed companies has declined, and capital raises for private companies have grown almost three times as fast as those for public ones. In 2021, J.P. Morgan bankers raised $50 billion for private companies. More investment capital is being allocated to this space — and more companies are staying private longer — than ever before.

Looking ahead, another opportunity exists in serving the thousands of smaller, earlier-stage private firms that are clients of our Commercial Banking business. And we want to expand our services to an even wider set of private companies, connecting them seamlessly with investors and providing benchmarking for future capital raises.

Data is the differentiator

In Securities Services, data is a critical enabler for investor clients in driving efficiency, performance and growth. Asset managers use a variety of data sources to run their business, and the effort required to gather, cleanse and organize this data can be significant.

Data services has become a differentiator in the securities services business, and J.P. Morgan is in a unique position to address the challenge data management presents. We are developing solutions to provide our clients with seamless and efficient access to data, enabling them to unlock new insights and opportunities.

Serving online marketplaces

In Payments, we see major growth opportunities as online marketplaces — big and small — are experiencing explosive growth and looking to offer additional financial solutions to their customers.

Today, online marketplaces account for more than half of e-commerce sales globally, and the CIB’s Payments business wants to be the one-stop shop for all of their needs. From accepting payments to creating a seamless checkout experience, managing payments in multiple currencies and aggregating and analyzing data, J.P. Morgan has everything clients need to build and scale successful platforms.

Trading anywhere, anytime

More and more, participants in trading markets are using digital portals and electronic trading strategies. They want the ability to trade round the clock and round the globe, making multi-dealer platforms and nontraditional competitors more popular. In Markets, we are using our scale and strength to increase options for clients, building out our own proprietary channels that connect to others in order to streamline the experience from pre-trade to post-trade. Offering reliable liquidity in all market conditions, combined with our ability to harness data and deliver more intelligent, targeted services, will be key to serving clients now and in the future.

Behind all these innovations is our desire to improve the client experience. Across our firm, whether our clients are retail customers or multinationals, the quality of service we provide and how we deliver it will determine whether they choose to remain with us or take their business elsewhere.

Our approaches to private capital, data and marketplaces are ways to create a more holistic client experience. By harnessing capabilities across our firm, we are expanding our service “ecosystem” and addressing more of our clients' needs through the J.P. Morgan platform than we ever thought possible 10 years ago.

Climate action targets

We understand the urgency to combat change in our climate, and we are taking action.

In 2020, JPMorgan Chase achieved carbon neutrality in our own operations and spelled out how we will decarbonize our financing portfolio over the next decade. In 2021, we became the first U.S. bank to release sector-specific emission reduction targets as part of our commitment to align portions of our financing portfolio with the Paris Agreement.

In 2021, we also announced a new target to finance and facilitate $2.5 trillion over the next 10 years to further sustainable development, including $1 trillion to support green initiatives. And we are advising companies on how they can reduce their own carbon footprint in a practical, equitable way. Ensuring the consistent supply of reasonably priced energy to consumers during the transition is a huge focus.

Sustainable and low-carbon businesses are rushing to develop new technologies. While many of these companies and technologies are mature, many more are just getting started. They will need capital and advice to help them innovate and evolve. We intend to lend our considerable resources to the challenge.

Partnering through the pandemic

In 2021, COVID-19 continued to test us and our clients, and I am incredibly proud of how our teams rallied, serving companies and governments around the world. We adapted, were flexible and stayed connected.

In 2022, the combination of mass immunity, vaccinations and antiviral drugs should bring an end to the pandemic and make COVID-19 an endemic, manageable virus.

While there are still tight restrictions in certain parts of the world, many economies are opening up again, releasing pent-up consumer and corporate demand. Businesses and investors are hungry to put capital to work. Rising interest rates and their impact on expected loan growth will likely be tailwinds for our business.

There will be challenges for all of us in the near term as we continue to work through the pandemic's consequences and begin to wean global economies off the financial life support they have received over the past few years. As expected, the normalization of monetary and fiscal policies, coupled with rising inflation, has created more uncertainty in markets.

Of immediate and urgent concern, however, is what is taking place in Ukraine: devastation for its citizens and a massive humanitarian crisis in Europe. The situation has, without question, intensified anxiety in global markets, particularly commodity markets.

The full economic ramifications of the conflict, including the potential effects on global growth, can’t yet be measured. Of much greater importance, the human cost is also yet to be determined. Our firm has pledged support to the relief efforts and will continue to do so, hoping for peace in the region soon.

Confidence in the future

Ten years ago, we brought the Corporate & Investment Bank together in the belief that as a whole, we would be greater than the sum of our parts. And it has proved to be a lasting success.

Our unique combination of stability and innovation, coupled with our enduring culture of collaboration and of putting our clients first, gives me great confidence for the decades to come.

Daniel E. Pinto

President and Chief Operating Officer, JPMorgan Chase & Co., and CEO, Corporate & Investment Bank

- Return to footnote reference 1

- CIB revenue based on Coalition Greenwich Competitor Analytics. Investment Banking fees based on Dealogic.

- Return to footnote reference 2

- Represents assets held directly or indirectly on behalf of clients under safekeeping, custody and servicing arrangements.