Consumer & Community Banking

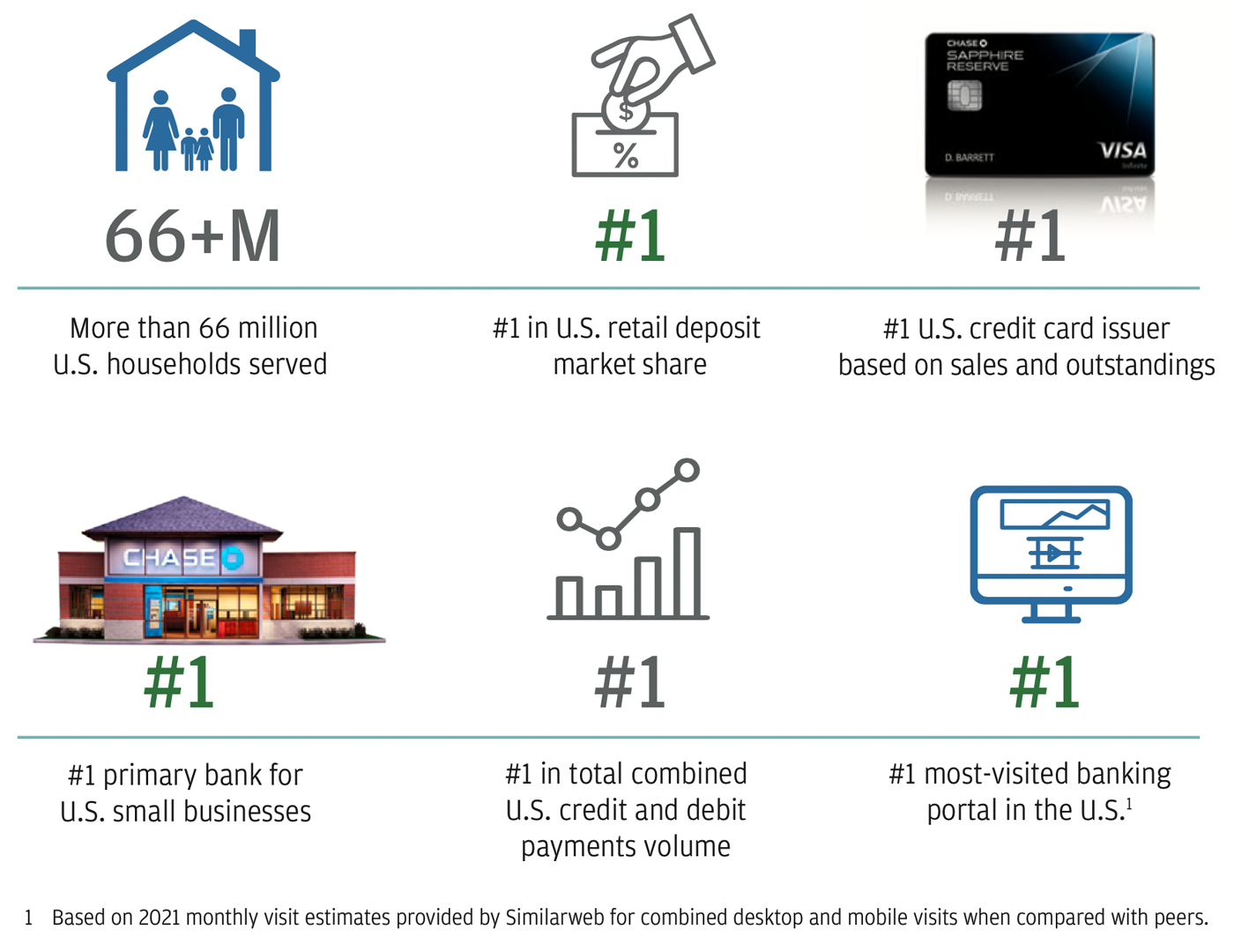

It is with great pride that we write our first shareholder letter together as co-CEOs of Consumer & Community Banking (CCB), and we are especially proud to work alongside nearly 130,000 talented CCB colleagues. We took the reins of this industry-leading franchise from Gordon Smith in May 2021 and are grateful for his vision, leadership and mentoring. Our business has grown to serve more than 66 million households, including over 5 million small businesses.

Looking at the state of the CCB business today, we are operating from a position of strength on both an absolute and relative basis. However, we don’t take this position for granted. Competition is everywhere, including banks and fintechs that are formidable in every one of our businesses. We acknowledge that we must continue to match the simplicity that new entrants bring to the customer experience before they are able to match our distribution and scale.

We are intensely focused on where we can provide more customer value, gain share and expand our capabilities in high growth areas. As the past two years have reminded us, nothing is certain, and we will continue to prepare for all scenarios in order to be there for our customers.

Looking forward, we are focused on the following strategic priorities to drive shareholder value:

- Best-in-class financial performance

- Leveraging data and technology to drive productivity and agility

- Driving engagement with experiences that customers love

- Growing households and better serving customer needs to be the bank for all Americans

- Protecting our customers and the firm through a strong risk and controls environment

- Being the place everyone wants to work

More than 66 million U.S. households served

#1 in U.S. retail deposit market share

#1 U.S. credit card issuer based on sales and outstandings

#1 primary bank for U.S. small businesses.

#1 in total combined combined U.S. credit and debit payments online>

#1 most-visited banking portal in U.S.footnote1

Best-in-class financial performance

In 2021, CCB delivered a 41% return on equity on net income of $20.9 billion. Adjusting for $9.8 billion in credit reserve releases, our return on equity would have been 26%. Revenue of $50.1 billion was down 2% year-over-year, while our overhead ratio increased to 58% as we continued to invest heavily for future growth.

Our financial performance needs to be considered in the context of the rapidly evolving macro environment, which created both headwinds and tailwinds. Given the strength of our primary bank relationships, the impact of the extraordinary level of stimulus and relief programs on consumers and small businesses drove outsized growth in deposits. Average deposits of $1.1 trillion were up 24% over 2020.

Conversely, that same excess liquidity, coupled with a low rate environment, led to significant margin compression in deposits, deleveraging in credit card loans and accelerated levels of refinance activity in Home Lending. We ended 2021 with $434 billion in average loans, down 3%.

These factors, together with significant appreciation in home prices and used car values, drove exceptionally strong credit performance across our portfolios. Net charge-offs across portfolios were at historic lows, and we released $9.8 billion in credit reserves. Over the near term, we expect many of these macrodriven trends will start to normalize.

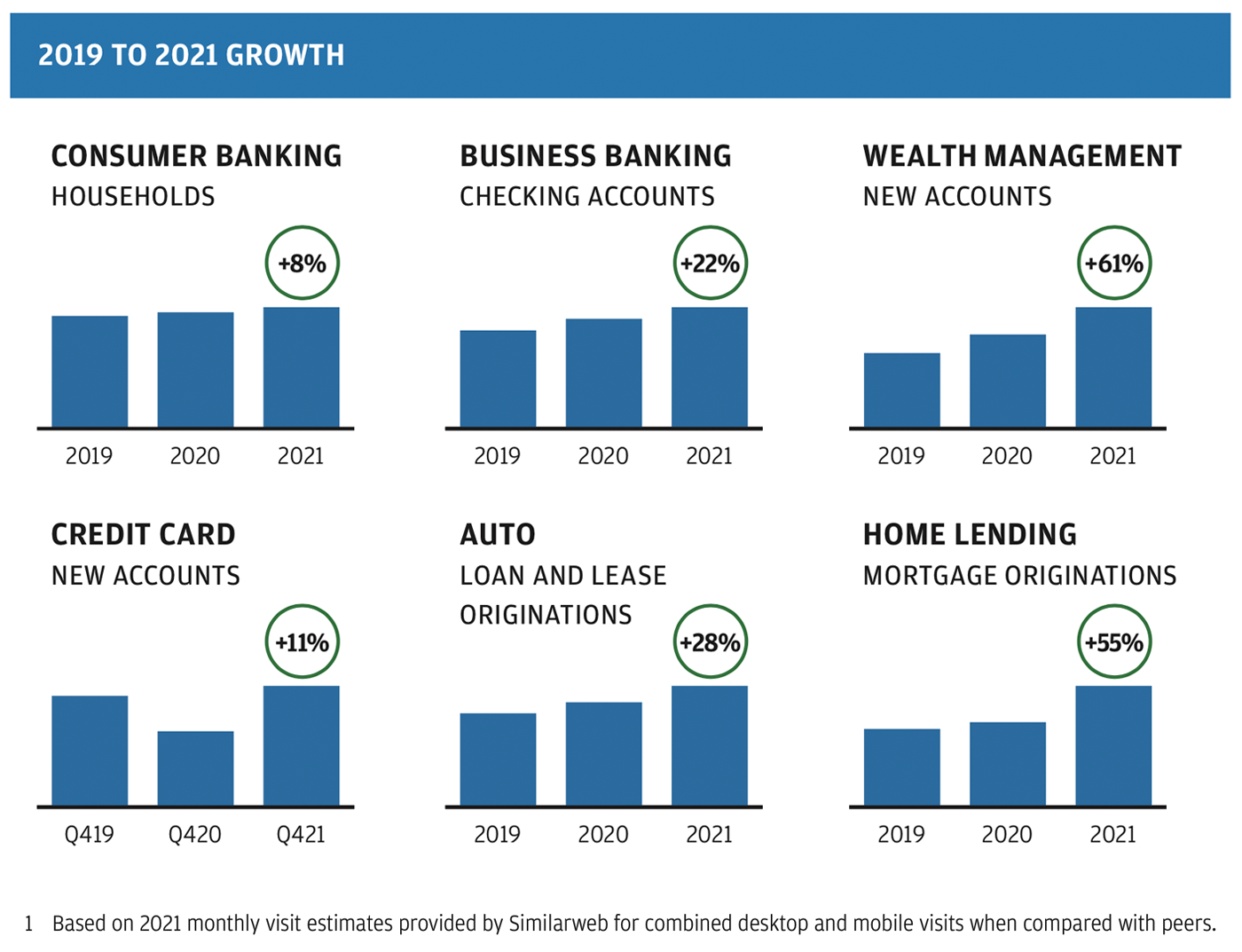

We invest with a long-term focus to drive sustainable growth and outperformance. Last year was no exception, and we identified opportunities to invest in technology, data, products and customer experience — with a particular focus on areas where we can deepen our relationships and gain share. The best evidence of that success is our growth over the last three years.

2019 to 2021 Growth

Consumer Banking Households +8%

Business Banking Checking Accounts +22%

Wealth Management New Accounts +61%

Credit Card New Accounts +11%

Auto Loan and Lease Originations +28%

Leveraging data and technology to drive productivity and agility

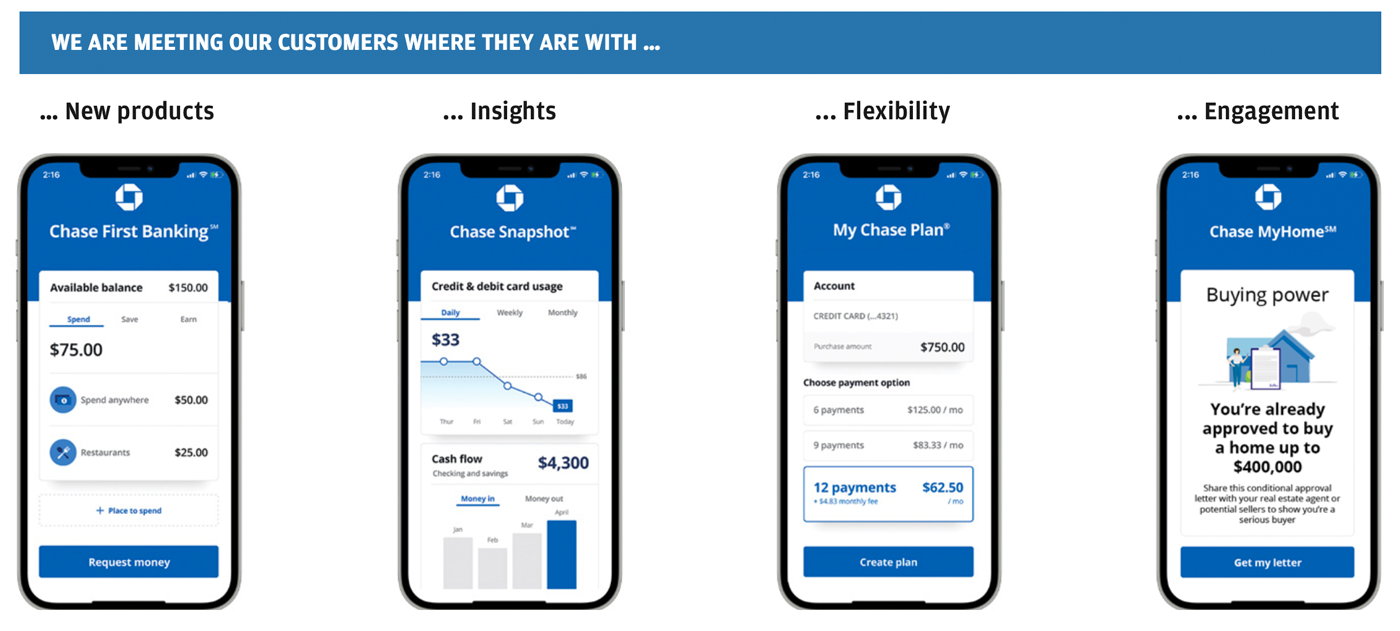

Consumer behavior changed at the onset of the pandemic, largely driven by necessity. Thanks to our investments in technology and digital product capabilities, we were in a strong position to rapidly pivot our operating model to support our customers’ needs. Many of these changes in consumer behavior represented an acceleration of secular trends for which we were already positioning the business, and we expedited our transformation to a design-led, agile product organization.

Now our goal is to mature this model. We are continuing to modernize our infrastructure and deepen our customer relationships by improving experiences. We’re delivering new products and features to customers more quickly (in many cases, half the time it took a year ago) with the flexibility to continuously release new features. These productivity gains are meaningful to our customers and to our business.

We are also using data to build a more comprehensive product continuum and engage with our customers in more personalized and relevant ways.

We are meeting our customers where they are with…

… New Products

… Insights

… Flexibility

… Engagement

Driving engagement with experiences that customers love

Our real engagement differentiator is the combination of our award-winning digital capabilities, our extensive physical network, and our nearly 50,000 local bankers, advisors, and relationship and branch managers. We are empowering our people with new tools and insights to advise our customers on their financial future and have delivered the highest satisfaction results in our history.

We think about our branches as a storefront — a place where digital engagement comes together with our bankers and advisors, who work every day to deliver the full capabilities of JPMorgan Chase. Thirty-six million unique customers walk into our almost 5,000 branches every year, generating about 85% of initial deposit balances. Our branch network is a powerful channel that most of our competitors don’t have and can’t easily replicate.

Our customer base of 59 million active digital users is the largest and fastest growing among major U.S. banks when comparing our growth in 2021. We have been simplifying the basics — things our customers do most often — such as opening an account, replacing a card, checking their credit score and making a payment.

Last year alone, our customers:

- Opened about 50% of consumer deposit accounts digitally

- Submitted nearly three-quarters of consumer mortgage applications digitally

- Safely and seamlessly moved more than $3 trillion in digital payments

- Processed more than 5 million card replacements digitally

- Initiated nearly 60% of their card transaction disputes through digital channels

- Took steps to improve their financial health, with 8 million customers engaging with Credit Journey monthly and 28 million in the program

We are intensely focused on building trust with customers in every community we serve by making investments that will have a lasting impact for families, small businesses and neighborhoods. And we’re achieving this by having products, services and solutions that are relevant and valuable for all customer segments — so every customer believes we are the bank for them. Where we have gaps, we need to fill them, and we are.

For example, since our October 2020 Racial Equity Commitment, we have:

- Opened 10 additional Community Center branches and hired more than 100 Community Managers

- Hired more than 150 Community Home Lending Advisors focused on sustainable homeownership

- Expanded our homebuyer grant program, which includes $5,000 to help a customer cover a down payment and closing costs in 6,700 minority neighborhoods nationwide

- Provided free one-on-one coaching for business owners in 14 U.S. cities through dedicated consultants

Growing households and better serving customer needs to be the bank for all Americans

We are focused on three major growth areas across CCB: optimizing our distribution network; expanding our U.S. Wealth Management business; and advancing our leadership in payments, lending and commerce.

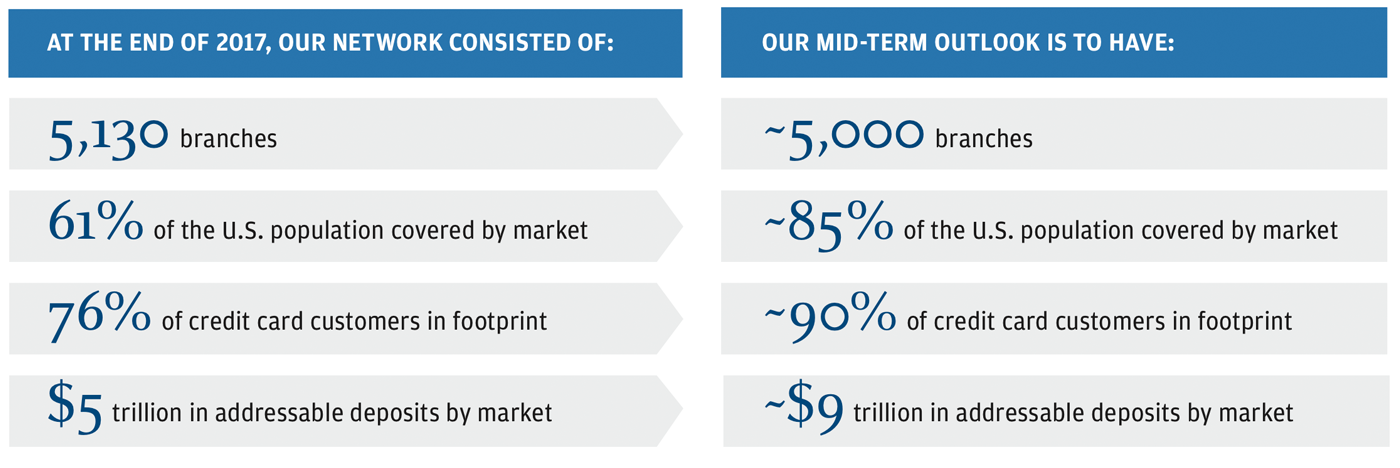

Our distribution network

In 2021, we became the first bank to have branches in all the lower 48 states, and we are on track to deliver on our previous commitment, which was to open 400 new branches in 25 states and the District of Columbia. Over time, we will continue to optimize our distribution network as customer needs evolve. Our goal is not to have the most branches — but to have the right branches, in more communities, serving the financial needs of our customers.

At the end of 2017, our network consisted of:

5,130 Branches

61% of U.S. population covered by market

76% of credit card customers in footprint

$5 trillion in addressable deposits by market

Our mid-term outlook is to have:

~5,000 branches

~85% of U.S. population covered by market

~90% of credit card customers in footprint

~$9 trillion in addressable deposits by market

As we expand our product offerings and earn deeper customer relationships and engagement, we have areas of opportunity to gain meaningful share.

U.S. Wealth Management

We are investing significantly in our U.S. Wealth Management business, which represents one of our biggest growth opportunities. We already have relationships with about half of affluent households in the United States, but we don't have a proportionate share of their investments. There are an estimated 13 million affluent Chase households who have a total deposit and investment wallet of approximately $17 trillion, and we are making progress in winning their investment relationships.

We had a record 2021:

- Increased investment assets by 22%

- Grew the number of investment households we serve by 12%

- Increased the number of advisors by 7%

We are going to continue to invest in our advisors, launch a new remote advice model and expand our self-directed capabilities. In addition, we will launch a new digital wealth planning tool available free to all Chase clients. These investments will position us well to earn a greater share of our clients’ wallets.

Payments, lending and commerce

Payments are still the center of gravity for consumer financial relationships. We are a leading consumer payments franchise in the United States, enabling our customers to move $5 trillion each year across payment methods. Looking forward, we’re obsessing over simple and seamless experiences to maintain that leadership position and give our customers more choice, flexibility and value.

We are the nation’s #1 credit card provider, with leading airline and hotel co-brand cards. We are innovating to deliver more flexible borrowing options, partner benefits and more. Our leading programs already in the market produced meaningful results in 2021:

- Chase Ultimate Rewards® loyalty redemptions: 16 million customers redeemed points earned for travel, gift cards, cash back and other experiences

- Chase Offers: 15 million customers engaged with valuable discounts for shopping at specific merchants

- My Chase Plan®: Nearly 625,000 credit card customers used this buy-now-pay-later option

One in every four dollars spent on travel in the United States is on a Chase card, so travel is a natural place for us to offer shopping, payment and borrowing experiences at scale. With our acquisition of cxLoyalty, we now have a wholly owned proprietary travel platform, currently ranked among the top travel agencies in the United States. Our card and platform assets will enable us to deliver premium, personalized travel-booking experiences, fully integrated payments features and lending flexibility.

Over time, we will expand our payments, lending and loyalty experiences. With data from more than 66 million households and over 11 billion impressions through our own channels, we are in a great position to understand where our customers search, shop and build loyalty. Our goals are to meet our customers where they are, deliver ease and value in shopping experiences, and capture incremental spend-and-lend share.

Protecting our customers and the firm through a strong risk and controls environment

Our risk and controls environment is essential to a healthy, thriving business. Therefore, protecting our customers and the firm is job number one for everyone in CCB. It is only by getting this right that we are able to innovate and make financial services seamless and easy for our customers.

We continue to focus on having the proper governance and processes in place to ensure that our business is sustainable and resilient in order to meet our regulatory and customer expectations. We’re using enhanced capabilities in data and analytics to be more surgical in extending credit and managing risk. We’re also using our data in a leadership role to develop an industry utility to responsibly expand access to credit to many of the nearly 50 million people in the United States who have no usable credit scorefootnote2.

Being the place everyone wants to work

We believe delivering a great customer experience is inextricably linked to providing a great employee experience. We know having a strong culture with diverse talent is the only way we are going to achieve everything we have just mentioned. And we acknowledge that competition for talent — especially ours — has never been more fierce. We approach talent management as we do any aspect of the business: We maintain high standards, set goals, and honestly measure progress by analyzing our data, listening constantly and recognizing success.

We are proud of our efforts but are never satisfied. In 2021, we continued to improve representation of Asian, Black and Hispanic talent among our employees. Our commitment to diversity goes beyond hiring and includes a focus on development and inclusion. Our promotion rates of ethnically diverse people are also on the rise, which has had a positive effect on representation across many levels.

In conclusion

We approach our opportunities and challenges with great humility, yet we have tremendous confidence about our future and wouldn’t trade our hand with anyone. Our scale, our assets and — most important — our people position us well to be the bank for all Americans.

Marianne LakeCo-CEO, Consumer & Community Banking

Jennifer PiepszakCo-CEO, Consumer & Community Banking